FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Complete the Adjusted

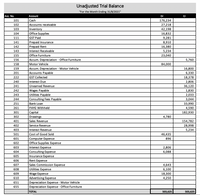

Transcribed Image Text:Unadjusted Trial Balance

"For the Month Ending 31/8/2021"

Acc. No.

Account

Dr

Cr

101

Cash

176,234

102

Accounts receivable

27,218

103

Inventory

Office Supplies

42,198

104

16,832

111

GST Paid

9,281

Prepaid Insurance

Prepaid Rent

141

8,910

142

16,380

143

Interest Receivable

5,234

155

Office Furniture

23,040

156

Accum. Depreciation - Office Furniture

5,760

158

Motor Vehicle

84,000

159

Accum. Depreciation - Motor Vehicle

16,800

201

Accounts Payable

6,330

222

GST Collected

18,378

240

Interest Due

2,806

241

Unearned Revenue

36,120

Wages Payable

Utilities Payable

Consulting Fees Payable

242

1,830

243

2,033

244

3,044

251

Bank Loan

33,990

261

PAYG Withheld

4,590

301

Capital

182,930

302

Drawings

4,780

401

Sales Revenue

154,782

402

Service Revenue

28,998

403

Interest Revenue

5,234

501

Cost of Good Sold

46,435

Computer Expense

Office Supplies Expense

601

896

602

603

Interest Expense

2,806

604

Consulting Expense

6,088

605

Insurance Expense

Rent Expense

Sales Commission Expense

Utilities Expense

606

607

4,643

608

6,100

Wage Expense

Advertising Expense

Depreciation Expense - Motor Vehicle

Depreciation Expense - Office Furniture

ТOTAL

609

18,300

610

4,250

651

655

503,625

503,625

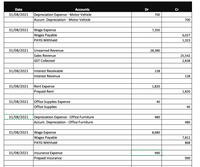

Transcribed Image Text:Date

Accounts

Dr

Cr

Depreciation Expense - Motor Vehicle

Accum. Depreciation - Motor Vehicle

31/08/2021

700

700

Wage Expense

Wages Payable

PAYG Withheld

31/08/2021

7,350

6,027

1,323

31/08/2021

Unearned Revenue

28,380

Sales Revenue

25,542

GST Collected

2,838

31/08/2021

Interest Receivable

128

Interest Revenue

128

31/08/2021

Rent Expense

1,820

Prepaid Rent

1,820

Office Supplies Expense

Office Supplies

31/08/2021

40

40

Depreciation Expense - Office Furniture

Accum. Depreciation - Office Furniture

31/08/2021

480

480

Wage Expense

Wages Payable

31/08/2021

8,680

7,812

PAYG Withheld

868

31/08/2021

Insurance Expense

990

Prepaid Insurance

990

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education