FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

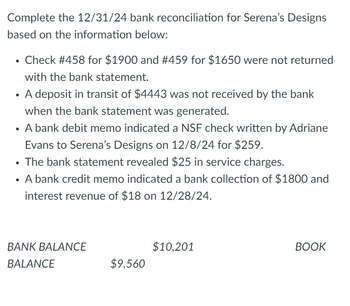

Transcribed Image Text:Complete the 12/31/24 bank reconciliation for Serena's Designs

based on the information below:

• Check #458 for $1900 and # 459 for $1650 were not returned

with the bank statement.

• A deposit in transit of $4443 was not received by the bank

when the bank statement was generated.

• A bank debit memo indicated a NSF check written by Adriane

Evans to Serena's Designs on 12/8/24 for $259.

• The bank statement revealed $25 in service charges.

A bank credit memo indicated a bank collection of $1800 and

interest revenue of $18 on 12/28/24.

BANK BALANCE

BALANCE

$9,560

$10,201

BOOK

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please include explanationarrow_forwardCheyenne Corporation is preparing a bank reconciliation and has identified the following potential reconciling items. (a) Deposit in transit $6,590. (b) Bank service charges $27. (Use Office Expense account.) (c) Interest credited to Cheyenne's account $41. (d) Outstanding checks $7,670. (e) NSF check returned $480. Prepare entries necessary to make Cheyenne's accounting records correct and complete. (If no entry is required, selec Do not indent manually.)arrow_forwardNonearrow_forward

- In preparing its August 31 bank reconciliation, Apex Corp. has available the following balance per bank and reconciling items: Balance per bank Deposit in transit Erroneous charge (deduction) made by bank Outstanding checks Collection from customer by bank The 8/31 unadjusted cash balance per books is: Select one: a. $19,250 b. $18,550 c. $18,050 d. $19,050 e. $17,850 $ 18,050 3,250 100 2,750 600arrow_forwardIdentify where each of the following transactions would be found on the bank reconciliation.arrow_forwardIf deposits per the cash ledger are $2,200, deposits per the bank ledger are $1,800, and the bank erroneously recorded a $400 deposit as $40, an adjustment of $360 for deposits in transit will be recorded on the bank reconciliation. O True O Falsearrow_forward

- The bookkeeper at Jefferson Company has not reconciled the bank statement with the Cash account, saying, "I don't have time." You have been asked to prepare a reconciliation and review the procedures with the bookkeeper. The April 30, Current Year, bank statement and the April ledger account for cash showed the following (summarized): Balance, April 1, Current Year Deposits during April Interest collected Checks cleared during April NSF check-A. B. Wright Bank service charges BANK STATEMENT Checks Deposits Balance $32,200 $36,500 68,700 1,280 69,980 $46,400 23,580 250 23,330 170 23,160 23,160 Balance, April 30, Current Year Cash (A) April 1 Debit Balance April Deposits Credit 24,000 April Checks written 42,200 44,600 A comparison of checks written before and during April with the checks cleared through the bank showed outstanding checks at the end of April of $6,400 (including $4,600 written before and $1,800 written during April). No deposits in transit were carried over from March,…arrow_forward! Required information [The following information applies to the questions displayed below.] The bookkeeper at Washington Company has not reconciled the bank statement with the Cash account, saying, "I don't have time." You have been asked to prepare a reconciliation and review the procedures with the bookkeeper. The May 31, Current Year, bank statement and the May ledger account for cash showed the following (summarized): BANK STATEMENT Balance, May 1, Current Year Deposits during May Interest collected Checks cleared during May NSF check-B. C. Wong Bank service charges Balance, May 31, Current Year May 1 Debit Balance May Deposits Cash (A) Checks * Required: 1. Complete the following bank reconciliation. $ 47,400 360 110 Deposits $ 38,800 1,840 Credit 26,700 May Checks written 44,400 Balance $ 33,800 72,600 74,440 27,040 26,680 26,570 26,570 43,700 A comparison of checks written before and during May with the checks cleared through the bank showed outstanding checks at the end of May…arrow_forwardThe bank mistakenly recorded the collection of $385 on a customer account as $358 in the bank statement. The cheque was written in the correct amount and was correctly recorded in the company’s accounting system. The journal entry required to correct this error would be: Select one: a. debit Accounts Receivable, $385; credit Cash, $385 b. debit Cash, $27; credit Accounts Receivable, $27 c. debit Cash, $385; credit Accounts Receivable, $385 d. debit Accounts Receivable, $27; credit Cash, $27 e. no journal entry is requiredarrow_forward

- For which of the following errors would the appropriate amount be added to the balance per books on a bank reconciliation? Deposit of $770 recorded by the bank as $77. O Check written for $73, but recorded by the company as $37. O A returned $470 check recorded by the bank as $47. Check written for $57, but recorded by the company as $75.arrow_forwardA-7arrow_forwardCurrent Attempt in Progress Identify whether each of the following items would be (a) added to the book balance, or (b) deducted from the book balance in a bank reconciliation. 1. 2 3. 4. 5. EFT transfer to a supplier. Bank service charge. Check printing charge. Error recording check # 214 which was written for $260 but recorded for $620. Collection of note and interest by the bank on the company's behalf.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education