Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Complete rows (14a)-(14c) of the table, filling in the amount of Singapore dollars remitted in year 4 for each of the cash flows from years 1–3. Then, complete row (14d), filling in the total S$ accumulated from investing these blocked funds. Next, complete row (15), filling in the amount of Singapore dollars withheld for taxes and the total after-tax Singapore dollars to be remitted to the parent in row (16). Then, calculate and enter the resulting U.S. dollar cash flows to the parent in row (19).

Note: Do not forget to account for the salvage value in row (19).

|

______________________________________________

|

Year 0

|

Year 1

|

Year 2

|

Year 3

|

Year 4

|

|---|---|---|---|---|---|

| 14. S$ to be Remitted by Subsidiary | S$6,000,000 | S$6,000,000 | S$7,600,000 | S$8,400,000 | |

| 14a Year 1 Cash Flow Remitted in Year 4 @ 5.00% | S$

|

||||

| 14b. Year 2 Cash Flow Remitted in Year 4 @ 5.00% | S$

|

||||

| 14c. Year 3 Cash Flow Remitted in Year 4 @ 5.00% | S$

|

||||

| 14d. Total Accumulated Funds over 4 years | S$

|

||||

| 15. Tax Withholding of Remitted Funds @ 10.00% | S$

|

||||

| 16. S$ Remitted After Tax Withholdings | S$

|

||||

| 17. Salvage Value | S$12,000,000 | ||||

| 18. Exchange Rate of S$ | $0.50 | ||||

| 19. Cash Flows to Parent [(16) +(17)] X (18) | $ |

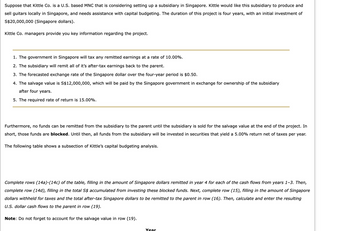

Transcribed Image Text:Suppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and

sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with an initial investment of

S$20,000,000 (Singapore dollars).

Kittle Co. managers provide you key information regarding the project.

1. The government in Singapore will tax any remitted earnings at a rate of 10.00%.

2. The subsidiary will remit all of it's after-tax earnings back to the parent.

3. The forecasted exchange rate of the Singapore dollar over the four-year period is $0.50.

4. The salvage value is S$12,000,000, which will be paid by the Singapore government in exchange for ownership of the subsidiary

after four years.

5. The required rate of return is 15.00%.

Furthermore, no funds can be remitted from the subsidiary to the parent until the subsidiary is sold for the salvage value at the end of the project. In

short, those funds are blocked. Until then, all funds from the subsidiary will be invested in securities that yield a 5.00% return net of taxes per year.

The following table shows a subsection Kittle's capital budgeting analysis.

Complete rows (14a)-(14c) of the table, filling in the amount of Singapore dollars remitted in year 4 for each of the cash flows from years 1-3. Then,

complete row (14d), filling in the total S$ accumulated from investing these blocked funds. Next, complete row (15), filling in the amount of Singapore

dollars withheld for taxes and the total after-tax Singapore dollars to be remitted to the parent in row (16). Then, calculate and enter the resulting

U.S. dollar cash flows to the parent in row (19).

Note: Do not forget to account for the salvage value in row (19).

Year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Which of these is reported on Schedule M-1, Reconciliation of Income (Loss) per Books With Income (Loss) per Return? $347 of royalties reported on the books this year and included on Schedule K. $673 of foreign taxes paid reported on the books this year and included on Schedule K. $1,234 of ordinary dividend income included on Schedule K and recorded on the books this year. $1,679 of capital gain from the sale of collectibles included on Schedule K and not recorded on the books this year.arrow_forwardBeginning balances were: Cash, $91,000; Taxes Receivable, $186,500; Accounts Payable, $50,750; and Fund Balance, $226,750. Note: Enter debits before credits. Transaction General Journal Debit Credit 01 .arrow_forwardDetermine the amount of cash received from customers for each of the three independent situations below. All dollars are in millions. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Situation Sales Revenue Accounts Receivable Increase (Decrease) Cash Received from Customers 1 140 0.0 2 140 11.0 3 140 (11.0)arrow_forward

- Assume that it is a domestic corporation using itemized deduction, compute the net taxable incomearrow_forwardplease answer in text form and in proper format answer with must explanation , calculation for each part and steps clearlyarrow_forwardProblem 1- Tax on interest income Lebron James, an American basketball player received P500,000 interest income on his 4-year term deposits on Bank of the Philippines Island (BI) in the Philippines. Compute for the final withholding income tax.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education