FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Complete accrued interest payable and

1-record the accrued interest expense

2-record the payment of note at maturity on February 5th

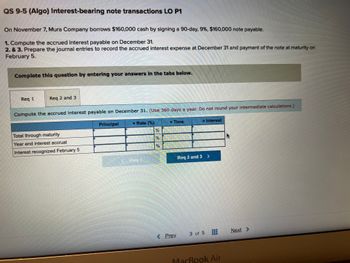

Transcribed Image Text:**Interest-bearing Note Transactions**

In this example, Mura Company borrows $160,000 in cash by signing a 90-day, 9%, $160,000 note payable on November 7.

### Requirements

1. **Compute the Accrued Interest Payable on December 31.**

Use a 360-day year for calculations. Do not round your intermediate calculations.

2. & 3. **Prepare Journal Entries:**

- To record the accrued interest expense at December 31.

- For payment of the note at maturity on February 5.

### Table: Interest Calculation

**Columns:**

- **Principal**

- **Rate (%)**

- **Time**

- **Interest**

**Rows:**

- **Total Through Maturity:** Computes full interest from issuance to maturity.

- **Year End Interest Accrual:** Calculates interest accrued by December 31.

- **Interest Recognized February 5:** Determines remaining interest until note maturity.

Complete these calculations by entering the appropriate values in each section, considering the given rate and timeframe. This exercise provides practice in calculating interest accruals and preparing corresponding journal entries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please only answer the amount fields. Thank youarrow_forwardces Required information [The following information applies to the questions displayed below.] Following are transactions of Danica Company. December 13 Accepted a $20,000, 45-day, 4% note in granting Miranda Lee a time extension on her past-due account receivable. December 31 Prepared an adjusting entry to record the accrued interest on the Lee note. Complete the table to calculate the interest amounts at December 31st and use the calculated value to prepare your journal entries. Note: Do not round your intermediate calculations. Use 360 days a year. Complete this question by entering your answers in the tabs below. Interest Amounts General Journal Complete the table to calculate the interest amounts at December 31st, Interest Recognized December 31 20,000 4% 18/360 Principal Rate (%) Time Total interest Total Through Maturity $ 20,000 $ 4% 45/360 Check my workarrow_forwardeBook Show Me How Proceeds from Notes Payable On January 26, Vibrant Co. borrowed cash from Conrad Bank by issuing a 60-day note with a face amount of $39,600. Assume a 360-day year. a. Determine the proceeds of the note, assuming the note carries an interest rate of 6%. b. Determine the proceeds of the note, assuming the note is discounted at 6%. Check My Work Email Instructor Save and Exit Previous Submit Assignmearrow_forward

- Please help mearrow_forward! Required information [The following information applies to the questions displayed below.] Claire Corporation is planning to issue bonds with a face value of $160,000 and a coupon rate of 8 percent. The bonds mature in two years and pay interest quarterly every March 31, June 30, September 30, and December 31. All of the bonds were sold on January 1 of this year. Claire uses the effective-interest amortization method and also uses a discount account. Assume an annual market rate of interest of 12 percent.(FV of $1. PV of $1, FVA of $1, and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Show Transcribed Text < Journal entry worksheet Note: Enter debits before credits. Record the issuance of the bonds on January 1. Date January 01 Record entry J General Journal Clear entry c Debit Credit View general journalarrow_forwardDetermine Due Date and Interest on Notes Determine the due date and the amount of interest due at maturity on the following notes. When calculating interest amounts, assume there are 360 days in a year. Round intermediate calculations to 4 decimal places, and round your final answers to the nearest whole dollar. Date of Note a. January 15 April 1 b. C. d. e. a. b. C. d. e. June 22 August 30 October 16 Due Date Feb. 14 Jun. 38 Aug. 6 Dec. 28 Dec. 5 Face Amount $44,175 $ 12,350 19,800 20,535 10,935 Interest Due at Maturity Interest Rate 9% 9 13 13 8 Term of Note 30 days 90 days 45 days 120 days 50 daysarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education