FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

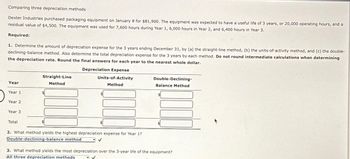

Transcribed Image Text:Comparing three depreciation methods

Dexter Industries purchased packaging equipment on January 8 for $81,900. The equipment was expected to have a useful life of 3 years, or 20,000 operating hours, and a

residual value of $4,500. The equipment was used for 7,600 hours during Year 1, 6,000 hours in Year 2, and 6,400 hours in Year 3.

Required:

1. Determine the amount of depreciation expense for the 3 years ending December 31, by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-

declining-balance method. Also determine the total depreciation expense for the 3 years by each method. Do not round intermediate calculations when determining

the depreciation rate. Round the final answers for each year to the nearest whole dollar.

Depreciation Expense

Units-of-Activity

Method

Year

Year 1

Year 2

Year 3

Total

Straight-Line

Method

$

2. What method yields the highest depreciation expense for Year 1?

Double-declining-balance method

Double-Declining-

Balance Method

3. What method yields the most depreciation over the 3-year life of the equipment?

All three depreciation methods

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduce to Depreciation Expense

VIEW Step 2: Working for annual depreciation expense using straight line method

VIEW Step 3: Working for Depreciation Expense using units of activity Method

VIEW Step 4: Working for depreciation expense using double declining balance method

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Revision of depreciation Equipment with a cost of $354,400 has an estimated residual value of $40,800, has an estimated useful life of 32 years, and is depreciated by the straight-line method. a. Determine the amount of the annual depreciation. 9,800 ✔ b. Determine the book value after 18 full years of use. $ 178,000 ✓ c. Assuming that at the start of the year 19 the remaining life is estimated to be 18 years and the residual value is estimated to be $34,000, determine the depreciation expense for each of the remaining 18 years.arrow_forwardComparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $667,000. The equipment was expected to have a useful life of four years, or 6,800 operating hours, and a residual value of $55,000. The equipment was used for 2,380 hours during Year 1, 1,428 hours in Year 2, 1,904 hours in Year 3, and 1,088 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method. Round the answer for each year to the nearest whole dollar. Depreciation Expense Year Straight-Line Method Units-of-Activity Method Double-Declining-Balance Method Year 1 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Year 2 $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 Year 3 $fill in…arrow_forwardComparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $302,200. The equipment was expected to have a useful life of four years, or 8,400 operating hours, and a residual value of $25,000. The equipment was used for 2,940 hours during Year 1, 1,764 hours in Year 2, 2,352 hours in Year 3, and 1,344 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the straight-line method, (b) the units- of-activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method. Round the answer for each year to the nearest whole dollar. Depreciation Expense Year Year 1 Year 2 Year 3 Year 4 Total Straight-Line Method $ $ $ $ Units-of-Activity Method $ $ $ 2. What method yields the highest depreciation expense for Year 1? Double-Declining- Balance Method $ $ $ $ 3. What method yields the most depreciation over the…arrow_forward

- Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $416,000. The equipment was expected to have a useful life of four years, or 7,200 operating hours, and a residual value of $34,400. The equipment was used for 2,520 hours during Year 1, 1,512 hours in Year 2, 2,016 hours in Year 3, and 1,152 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method. Round the answer for each year to the nearest whole dollar. Depreciation Expense Year Year 1 Year 2 Year 3 Year 4 Total Straight-Line Method $ Units-of-Activity Method $ $ 2. What method yields the highest depreciation expense for Year 1? Double-Declining- Balance Method 3. What method yields the most depreciation over the four-year life of the…arrow_forwardComparing Three Depreciation Methods Waylander Coatings Company purchased waterproofing equipment on January 6 for $501,400. The equipment was expected to have a useful life of four years, or 10,000 operating hours, and a residual value of $41,400. The equipment was used for 3,800 hours during Year 1, 3,100 hours in Year 2, 1,800 hours in Year 3, and 1,300 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-output method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method.Note: FOR DECLINING BALANCE ONLY, round the multiplier to four decimal places. Then round the answer for each year to the nearest whole dollar. 2. What method yields the highest depreciation expense for Year 1? 3. What method yields the most depreciation over the four-year life of the equipment?arrow_forwardinformation and question attached with imagearrow_forward

- Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $282,600. The equipment was expected to have a useful life of four years, or 4,800 operating hours, and a residual value of $23,400. The equipment was used for 1,680 hours during Year 1, 1,008 hours in Year 2, 1,344 hours in Year 3, and 768 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method. Round the answer for each year to the nearest whole dollar. Depreciation Expense Year Straight-Line Method Units-of-Activity Method Double-Declining-Balance Method Year 1 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Year 2 $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 Year 3 $fill in the…arrow_forwardRequired information [The following information applies to the questions displayed below] On January 1, Year 1, a company purchased equipment for $148,000. The estimated service life of the equipment is 10 years and the estimated residual value is $16,000. The equipment is expected to produce 400.000 units during its life. Required: Calculate depreciation for Year 1 and Year 2 using each of the following methods. 3. Units of production (units produced in Year 1, 48,000; units produced in Year 2, 43,000). Note: Round "Depreciation per unit rate" answers to 2 decimal places. Select formula for Units of Production Depreciation: Calculato Year 1 depreciation expense Depreciation per unit rate Units produced in Year 1 Depreciation in Year 1 Calculate Year 2 depreciation expense: Depreciation per unit rate. Units produced in Year 2 Depreciation in Year 2arrow_forwardDexter Industries purchased packaging equipment on January 8 for $314,600. The equipment was expected to have a useful life of three years, or 7,800 operating hours, and a residual value of $26,000. The equipment was used for 3,120 hours during Year 1, 2,418 hours in Year 2, and 2,262 hours in Year 3. Required: 1. Determine the amount of depreciation expense for the three years ending December 31, Year 1, Year 2, Year 3, by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the three years by each method. Note: For all methods, round the answer for each year to the nearest whole dollar. Depreciation Expense Year Straight-Line Method Units-of-Activity Method Double-Declining-Balance Method Year 1 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Year 2 $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 Year 3 $fill in the blank 7…arrow_forward

- Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $479,600. The equipment was expected to have a useful life of four years, or 8,000 operating hours, and a residual value of $39,600. The equipment was used for 2,800 hours during Year 1, 1,680 hours in Year 2, 2,240 hours in Year 3, and 1,280 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the straight-line method, (b) the units-of- activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method. Round the answer for each year to the nearest whole dollar. Depreciation Expense Year Year 1 Year 2 Year 3 Year 4 Total Straight-Line Method Units-of-Activity Method 2. What method yields the highest depreciation expense for Year 1? Double-declining-balance method Double-Declining- Balance Method 3. What method yields the most depreciation over…arrow_forwardComparing Three Depreciation Methods Waylander Coatings Company purchased waterproofing equipment on January 6 for $248,600. The equipment was expected to have a useful life of four years, or 7,600 operating hours, and a residual value of $20,600. The equipment was used for 2,900 hours during Year 1, 2,400 hours in Year 2, 1,400 hours in Year 3, and 900 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-output method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method.Note: FOR DECLINING BALANCE ONLY, round the multiplier to four decimal places. Then round the answer for each year to the nearest whole dollar. Depreciation Expense Year Straight-Line Method Units-of-Output Method Double-Declining-Balance Method Year 1 $fill in the blank 1 $fill in the blank 2 $fill…arrow_forwardPerdue Company purchased equipment on April 1 for $59,940. The equipment was expected to have a useful life of three years, or 4,320 operating hours, and a residual value of $1,620. The equipment was used for 800 hours during Year 1, 1,500 hours in Year 2, 1,300 hours in Year 3, and 720 hours in Year 4. Required: Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) units-of-activity method, and (c) the double-declining-balance method. Note: FOR DECLINING BALANCE ONLY, round the multiplier to four decimal places. Then round the answer for each year to the nearest whole dollar. a. Straight-line method Year Amount Year 1 $fill in the blank 1 Year 2 $fill in the blank 2 Year 3 $fill in the blank 3 Year 4 $fill in the blank 4 b. Units-of-activity method Year Amount Year 1 $fill in the blank 5 Year 2 $fill in the blank 6 Year 3 $fill in the blank 7 Year 4 $fill in the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education