FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format thanku

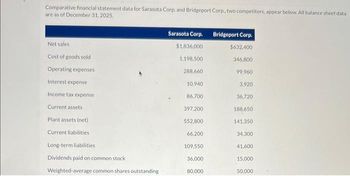

Transcribed Image Text:Comparative financial statement data for Sarasota Corp. and Bridgeport Corp. two competitors, appear below. All balance sheet data

are as of December 31, 2025.

Net sales

Cost of goods sold

Operating expenses

Interest expense

Income tax expense

Current assets

Plant assets (net)

Current liabilities

Long-term liabilities

Dividends paid on common stock

Weighted-average common shares outstanding

Sarasota Corp.

$1,836,000

1,198,500

288,660

10,940

86,700

397,200

552,800

66,200

109,550

36,000

80,000

Bridgeport Corp.

$632,400

346,800

99,960

3,920

36,720

188,650

141,350

34,300

41,600

15,000

50,000

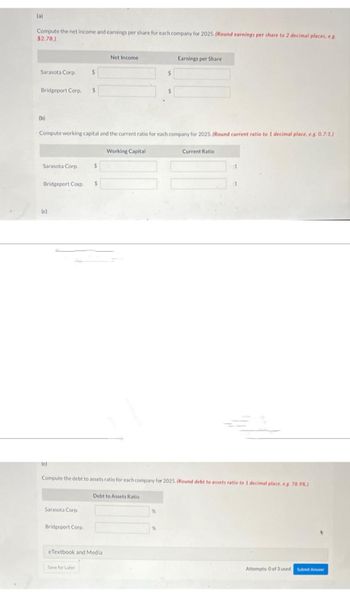

Transcribed Image Text:(a)

Compute the net income and earnings per share for each company for 2025. (Round earnings per share to 2 decimal places, e.g.

$2.78.)

Sarasota Corp,

Bridgeport Corp. $

(b)

Sarasota Corp.

Bridgeport Corp.

Compute working capital and the current ratio for each company for 2025. (Round current ratio to 1 decimal place, e.g. 0.7:1.)

(c)

(c)

$

Sarasota Corp.

Bridgeport Corp.

$

Save for Later

$

Net Income

eTextbook and Media

Working Capital

Compute the debt to assets ratio for each company for 2025. (Round debt to assets ratio to 1 decimal place, e.g. 78.9%)

Debt to Assets Ratio

Earnings per Share

%

Current Ratio

:1

:1

Attempts: 0 of 3 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide me the solution with explanation of d,e,f and Garrow_forwardWhat is meant by Authorized and issued captial?arrow_forwardChoose the term that best describes static data? O Static data does not change once it is created. O Static data may change after it is recorded. O Static data is like a website. O Static data is very difficult to record.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education