FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

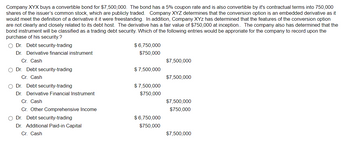

Transcribed Image Text:Company XYX buys a convertible bond for $7,500,000. The bond has a 5% coupon rate and is also convertible by it's contractual terms into 750,000

shares of the issuer's common stock, which are publicly traded. Company XYZ determines that the conversion option is an embedded derivative as it

would meet the definition of a derivative it it were freestanding. In addition, Company XYZ has determined that the features of the conversion option

are not clearly and closely related to its debt host. The derivative has a fair value of $750,000 at inception.. The company also has determined that the

bond instrument will be classified as a trading debt security. Which of the following entries would be approriate for the company to record upon the

purchase of his security.?

Dr. Debt security-trading

Dr. Derivative financial instrument

Cr. Cash

Dr. Debt security-trading

Cr. Cash

Dr. Debt security-trading

Dr. Derivative Financial Instrument

Cr. Cash

Cr. Other Comprehensive Income

Dr. Debt security-trading

Dr. Additional Paid-in Capital

Cr. Cash

$6,750,000

$750,000

$7,500,000

$ 7,500,000

$7,500,000

$7,500,000

$750,000

$7,500,000

$750,000

$6,750,000

$750,000

$7,500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Rupar Financial has an investment in 33,000 bonds of Anand Company that Rupar accounts for as a security available-for-sale. Anand bonds are publicly traded, and The Wall Street Journal quotes a price for those bonds of $14 per bond, but Rupar believes the market does not appreciate the full value of the Anand bonds and that a more accurate price is $24 per bond. Rupar should carry the Anand investment on its balance sheet at: Multiple Choice $627,000, the midpoint of Nichols's range of reasonably likely valuations of Elliott. $792,000. $462,000. Either $462,000 or $792,000, as either are defensible valuations.arrow_forwardMaple Aircraft has issued a 4¾% convertible subordinated debenture due 3 years from now. The conversion price is $47 and the debenture is callable at 102.75% of face value. The market price of the convertible is 91% of face value, and the price of the common is $41.50. Assume that the value of the bond in the absence of a conversion feature is about 65% of face value. 7. By how much does the common have to rise after three years to justify conversion? This is the third part of my first submitted questions. please explain in full detail. Thank you.arrow_forwardBreuer Investment's convertible bonds have a $1,000 par value and a conversion price of $45 a share. What is the convertible issue's conversion ratio? Round your answer to two decimal places.arrow_forward

- 1. (7 marks) A stock XYZ is quoted 1015. Two counterparties agree to enter into a forward contract maturing at T = 6 months. Here are the possible values of XYZ, at maturity. XYZ at T=6 months XYZ Forward Long Short 1000 1015 1020 1030 1080 (A) Find the possible values of the payoff for the buyer and for the seller of the forward and sketch a graph of the payoffs. (3.5 marks) (B) We know that spot price at expiration can be duplicated according to Forward + Zero Coupon bond = Spot Price at Maturity. Find the possible values of the zero coupon bond. What can you say about the risk associated with this bond? (3.5 marks)arrow_forwardes Vital Silence Corporation has just issued a 30-year callable, convertible bond with a coupon rate of 6.3 percent and annual coupon payments. The bond has a conversion price of $93.30. The company's stock is selling for $27.70 per share. The owner of the bond will be forced to convert if the bond's conversion value is ever greater than or equal to $1,130. The required return on an otherwise identical nonconvertible bond is 7.3 percent. Assume a par value of $1,000. a. What is the minimum value of the bond? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the stock price were to grow by 10.5 percent per year forever, how long would it take for the bond's conversion value to exceed $1,130? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Minimum price b. Number of yearsarrow_forwardWhich type of security does it refer to? “First pay two times the Original Purchase Price on each share of Series A Preferred. The balance of any proceeds shall be distributed pro rata to holders of Common Stock.”arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education