FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

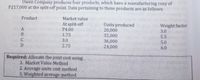

Transcribed Image Text:Owen Company produces four products, which have a manufacturing cosy of

P217,000 at the split-off point. Data pertaining to these products are as follows:

ob

Product

Market value

g At split-off

Units produced

Weight factor

3.0

A

P4.00

Ioleyiq 20,000

bod 32,000

36,000

24,000

1.75

5.5

C

3.0

5.0

2.75

6.0

Required: Allocate the joint cost using

1. Market Value Method

2. Average units cost method

3. Weighted average method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- X Corp produces 200 units of A and 100 units of B products. Final sales amount of A is 9,000. Joint cost is 6,600. Cost beyond the split off point is 3,000 each for both A and B. Using NRV or adjusted sale value method, the computed unit cost of A is 22 per unit. What is the Final sales amount of product B?arrow_forwardRings company has three product lines A, B and C. The following financial information is available:arrow_forwardAfter allocating the joint process costs to its two joint products, Allomar Co. reports gross margin percentages of 30% for Product A and 40% for Product B. Sales reported for each product were $25,000 for Product A and $60,000 for Product B. Neither of the two products were processed beyond the split-off point. Calculate the total amount of joint costs assigned between the two products. Allocated joint costs Product A Product B Assuming Allomar used the physical quantities method to allocate the joint costs, what percentage of the total production volume did Product B represent? (Round answer to 2 decimal places, e.g. 15.25%.) Proportion of joint costs assigned to product B %arrow_forward

- The following information is for Bullwinkle Industries Inc.: Line Item Description East West Sales volume (units): Product Alpha 45,000 38,000 Product Omega 60,000 50,000 Sales price: Product Alpha $500 $600 Product Omega $250 $225 Variable cost per unit: Product Alpha $275 $275 Product Omega $140 $140 a. Determine the contribution margin for the East Region and West Region.East Region: fill in the blank 1 of 2$West Region: fill in the blank 2 of 2$ b. Determine the contribution margin ratio for the East Region and West Region. Round the contribution margin ratio to one-tenth of a percent.East Region: fill in the blank 1 of 2%West Region: fill in the blank 2 of 2%arrow_forwardEdgewater Enterprises manufactures two products. Information follows: Product A Product B Sales price $ 12.00 $ 15.25 Variable cost per unit $ 6.20 $ 6.90 Product mix 30% 70% M6-17 [LO 6-6] es Required: Calculate Edgewater's weighted-average contribution margin per unit. Note: Round your intermediate calculations and final answer to 2 decimal places. Weighted average CM per unitarrow_forwardRequired information [The following information applies to the questions displayed below] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): $ 10,000 5,500 4,500 2,250 Sales Variable expenses Contribution margin Fixed expenses Net operating income 2,250 2. What is the contribution margin ratio? Contribution margin ratioarrow_forward

- Peter Company produces four solvents from the same process: A,B,C and D. Joint product costs are P9,000 ( Round to the nearest peso) Product Barrels SP @ Split-Off Pt. Cost to sell @ Split-off Separable Cost Final sales price A 750 P10.00 P6.50 P2.00 P13.50 B 1,000 8.00 4.00 2.50 10.00 C 1,400 11.00 7.00 4.00 15.50 D 2,000 15.00 9.50 4.50 19.50 If Peter Company sells the products after further processing, the following costs to sell will be incurred: A-P2.50 B-P1.00 C-P3.50 D- P6.00 Using a…arrow_forwardSunland Inc. produces three separate products from a common process costing $100,100. Each of the products can be sold at the split- off point or can be processed further and then sold for a higher price. Shown below are cost and selling price data for a recent period. Product 10 Product 12 Product 14 (c) Product Your answer is partially correct. Product 10 Product 12 Product 14 $ Sales Value at Split-Off Point $59,700 $ 15,800 $ 55,400 Calculate incremental profit/(loss) and determine which products should be sold at the split-off point and which should be processed further. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Incremental profit (loss) Cost to Process Further eTextbook and Media $100,100 30,800 149,700 Sales Value after Further Processing $191,000 34,700 Decision 214,000 Should be processed further Should be sold at the split-off point Should be processed further Assistance Usedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education