FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

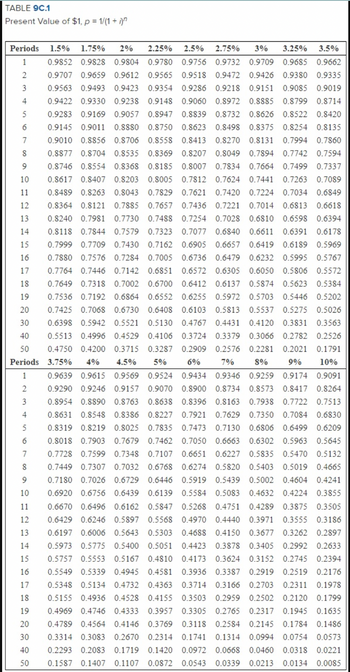

Imai Company issued a $1.185 million bond that matures in five years. The bond has a 6 percent coupon rate. When the bond was issued, the market rate was 4 percent. The bond pays interest twice per year, on June 30 and December 31. Use Table 9C.1, Table 9C.2.

Required:

1. Record the issuance of the bond on June 30. (Round time value factor to 4 decimal places. Enter your answers in dollars not in millions. Round intermediate and final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No

General Entry

Debit - Cash

Credit- Bond payable

What are the amounts for the general entry?

Transcribed Image Text:TABLE 9C.1

Present Value of $1, p = 1/(1+i)n

Periods 1.5% 1.75% 2% 2.25% 2.5% 2.75% 3% 3.25% 3.5%

1

0.9662

0.9732 0.9709 0.9685

0.9472

0.9472 0.9426 0.9380

2

0.9335

0.9852 0.9828 0.9804 0.9780 0.9756

0.9707 0.9659 0.9612 0.9565 0.9518

3 0.9563 0.9493 0.9423 0.9354 0.9286

0.9422 0.9330 0.9238 0.9148

0.9218 0.9151

0.9151 0.9085

0.9019

4

0.9060

0.8972 0.8885 0.8799

0.8714

5

0.9283 0.9169

0.9057 0.8947

0.8839

0.8839

6

0.9145 0.9011 0.8880

0.8880

0.8750

0.8750

0.8623 0.8498

0.8623

0.8498 0.8375 0.8254 0.8135

7

0.9010 0.8856

0.8706

0.8558

0.8413 0.8270 0.8131

0.8131 0.7994

0.7994 0.7860

8

0.8877 0.8704 0.8535

0.8369 0.8207

0.8049

0.7894 0.7742 0.7594

9

0.8746 0.8554

0.8368

0.8185

0.7834

0.8007 0.7834

0.8007

0.7664 0.7499

0.7664 0.7499

0.7337

10

0.8617 0.8407

0.8203

0.8005

0.7812

0.7624 0.7441 0.7263 0.7089

11

12

13

14

15

0.8732

0.8732 0.8626

1

2

3

4

5

6

7

0.8522

0.8626 0.8522 0.8420

0.8489 0.8263

0.8043 0.7829 0.7621

0.8043 0.7829 0.7621

0.7420

0.7420 0.7224 0.7034 0.6849

0.8364 0.8121

0.7885

0.7657

0.7436

0.7221 0.7014 0.6813 0.6618

0.6810 0.6598 0.6394

0.7488 0.7254

0.6611

0.6611 0.6391

0.6178

0.8240 0.7981 0.7730

0.7028

0.8118 0.7844 0.7579 0.7323 0.7077 0.6840

0.7999 0.7709 0.7430

0.6905 0.6657

0.7880 0.7576 0.7284 0.7005

0.7162

0.6419 0.6189 0.5969

16

0.6736

0.6479

0.6232 0.5995 0.5767

17

0.6572

0.6305 0.6050 0.5806 0.5572

0.7764 0.7446 0.7142 0.6851

0.6700 0.6412

18

0.6137

0.5874 0.5623 0.5384

19

0.7649 0.7318 0.7002

0.7536 0.7192 0.6864 0.6552

0.7425 0.7068 0.6730 0.6408

0.6255

0.5972 0.5703

0.5703 0.5446

0.5202

20

30

40

0.6103 0.5813 0.5537 0.5275 0.5026

0.6398 0.5942 0.5521 0.5130 0.4767 0.4431

0.5130 0.4767 0.4431 0.4120 0.3831 0.3563

0.5513 0.4996 0.4529 0.4106 0.3724 0.3379 0.3066 0.2782 0.2526

50 0.4750 0.4200 0.3715 0.3287 0.2909 0.2576 0.2281 0.2021 0.1791

Periods 3.75% 4% 4.5% 5%

6%

7%

8% 9% 10%

0.9639 0.9615 0.9569 0.9524 0.9434 0.9346

0.9524 0.9434 0.9346 0.9259 0.9174 0.9091

0.9290 0.9246 0.9157 0.9070 0.8900

0.8954 0.8890 0.8763 0.8638 0.8396

0.8386 0.8227 0.7921

0.8025 0.7835 0.7473

0.8734 0.8573 0.8417 0.8264

0.8163 0.7938 0.7722 0.7513

0.7629

0.8631 0.8548

0.7350 0.7084 0.6830

0.8319 0.8219

0.7130

0.6806 0.6499 0.6209

0.7462 0.7050 0.6663 0.6302 0.5963 0.5645

0.8018 0.7903

0.7679

0.7728 0.7599 0.7348

0.7107

0.6651

0.6227

0.5835 0.5470 0.5132

8

0.6768

0.6274

0.5820

0.5403

0.5403 0.5019

0.5019

0.4665

0.7449 0.7307 0.7032

0.7180 0.7026 0.6729 0.6446

9

0.5919 0.5439

0.5002 0.4604 0.4241

10

0.5083 0.4632 0.4224 0.3855

11

0.4751 0.4289 0.3875 0.3505

12

0.3971 0.3555 0.3186

13

0.6197 0.6006 0.5643 0.5303

14

0.5973 0.5775 0.5400 0.5051

15

0.6920 0.6756 0.6439 0.6139 0.5584

0.6670 0.6496 0.6162 0.5847 0.5268

0.6429 0.6246 0.5897 0.5568 0.4970 0.4440

0.4688 0.4150 0.3677

0.3677 0.3262 0.2897

0.4423 0.3878

0.4423 0.3878 0.3405 0.2992 0.2633

0.5757 0.5553 0.5167 0.4810 0.4173 0.3624 0.3152 0.2745 0.2394

0.5549 0.5339 0.4945 0.4581 0.3936 0.3387 0.2919 0.2519 0.2176

0.5348 0.5134 0.4732 0.4363 0.3714 0.3166 0.2703 0.2311 0.1978

0.5155 0.4936 0.4528 0.4155 0.3503 0.2959

0.4969 0.4746 0.4333 0.3957 0.3305

0.4789 0.4564 0.4146 0.3769 0.3118 0.2584

0.3118

0.3314 0.3083 0.2670 0.2314

16

17

18

0.2959 0.2502 0.2120 0.1799

19

0.2765 0.2317 0.1945 0.1635

0.2765

20

0.2584 0.2145 0.1784 0.1486

0.1741

0.1314 0.0994 0.0754 0.0573

30

40 0.2293 0.2083 0.1719 0.1420

0.0972 0.0668

0.0972 0.0668

0.0460 0.0318 0.0221

50

0.1587 0.1407 0.1107 0.0872

0.0213 0.0134 0.0085

0.0543 0.0339

0.0543 0.0339

![TABLE 9C.2

Present Value of Annuity of $1, p = [1-1/(1+]/i

3.25%

3.5%

1

2

3

4

5

6

7

6.5982

6.5346

8

7.4859

7.4051

7.4051

7.3255 7.2472

9

8.3605 8.2605 8.1622 8.0657

9.2222 9.1012 8.9826 8.8662

10

11

12

13

14

15

Periods 1.5% 1.75% 2% 2.25% 2.5% 2.75% 3%

0.9852 0.9828 0.9804 0.9780 0.9756 0.9732 0.9709 0.9685 0.9662

1.9559 1.9487 1.9416 1.9345 1.9274 1.9204 1.9135 1.9066 1.8997

2.9122 2.8980 2.8839 2.8699 2.8560 2.8423 2.8286 2.8151 2.8016

3.8544 3.8309 3.8077 3.7847 3.7620 3.7394 3.7171 3.6950 3.6731

4.7826 4.7479 4.7135 4.6795 4.6458 4.6126 4.5797 4.5472 4.5151

5.6972 5.6490 5.6014 5.5545 5.5081 5.4624 5.4172 5.3726 5.3286

6.4720 6.4102 6.3494 6.2894 6.2303 6.1720 6.1145

7.1701 7.0943 7.0197 6.9462 6.8740

7.9709 7.8777 7.7861 7.6961 7.6077

8.7521 8.6401 8.5302 8.4224 8.3166

10.0711 9.9275 9.7868 9.6491 9.5142 9.3821 9.2526 9.1258 9.0016

10.9075 10.7395 10.5753 10.4148 10.2578 10.1042 9.9540 9.8071 9.6633

11.7315 11.5376 11.3484 11.1636 10.9832 10.8070 10.6350 10.4669 10.3027

12.5434 12.3220 12.1062 11.8959 11.6909 11.4910 11.2961 11.1060 10.9205

13.3432 13.0929 12.8493 12.6122 12.3814 12.1567 11.9379 11.7249 11.5174

14.1313 13.8505 13.5777 13.3126 13.0550 12.8046 12.5611 12.3244 12.0941

14.9076 14.5951 14.2919 13.9977 13.7122 13.4351 13.1661 12.9049 12.6513

15.6726 15.3269 14.9920 14.6677 14.3534 14.0488 13.7535 13.4673 13.1897

16.4262 16.0461 15.6785 15.3229 14.9789 14.6460 14.3238 14.0119 13.7098

17.1686 16.7529 16.3514 15.9637 15.5892 15.2273 14.8775 14.5393 14.2124

24.0158 23.1858 22.3965 21.6453 20.9303 20.2493 19.6004 18.9819 18.3920

29.9158 28.5942 27.3555 26.1935 25.1028 24.0781 23.1148 22.2084 21.3551

34.9997 33.1412 31.4236 29.8344 28.3623 26.9972 25.7298 24.5518 23.4556

3.75% 4% 4.5% 5%

0.9639 0.9615 0.9569 0.9524

1.8929 1.8861 1.8727 1.8594

2.7883 2.7751 2.7490 2.7232

3.6514 3.6299 3.5875 3.5460 3.4651 3.3872

4.4833 4.4518 4.3900 4.3295 4.2124

5.2851 5.2421 5.1579

5.8927

6.5959 6.4632

16

17

18

19

20

30

40

50

Periods

6% 7% 8% 9% 10%

0.9434 0.9346 0.9259 0.9174 0.9091

1

2

1.8334 1.8080 1.7833 1.7591 1.7355

2.6730 2.6243 2.5771 2.5313 2.4869

3

4

3.3121 3.2397 3.1699

5

4.1002 3.9927 3.8897 3.7908

6

5.0757 4.9173 4.7665

4.6229 4.4859 4.3553

7

6.0579 6.0021

5.7864

5.2064 5.0330 4.8684

5.5824 5.3893

6.2098 5.9713 5.7466 5.5348 5.3349

8

6.8028 6.7327

9

7.5208 7.4353

7.2688

7.1078

6.8017 6.5152

6.2469 5.9952 5.7590

10

8.2128 8.1109

7.9127

7.7217

7.0236 6.7101 6.4177 6.1446

11

7.1390 6.8052 6.4951

7.3601

8.8798 8.7605 8.5289 8.3064 7.8869 7.4987

9.5227 9.3851 9.1186 8.8633

10.1424 9.9856 9.6829 9.3936

12

7.5361 7.1607 6.8137

13

14

15

16

17

8.3838 7.9427

8.8527 8.3577 7.9038 7.4869 7.1034

10.7396 10.5631 10.2228 9.8986 9.2950 8.7455 8.2442 7.7862 7.3667

11.3153 11.1184 10.7395 10.3797 9.7122 9.1079 8.5595 8.0607 7.6061

11.8702 11.6523 11.2340 10.8378 10.1059 9.4466 8.8514 8.3126 7.8237

12.4050 12.1657 11.7072 11.2741 10.4773 9.7632 9.1216 8.5436 8.0216

12.9205 12.6593 12.1600 11.6896 10.8276 10.0591 9.3719 8.7556 8.2014

13.4173 13.1339 12.5933 12.0853 11.1581 10.3356 9.6036 8.9501 8.3649

13.8962 13.5903 13.0079 12.4622 11.4699 10.5940 9.8181 9.1285 8.5136

17.8292 17.2920 16.2889 15.3725 13.7648 12.4090 11.2578 10.2737 9.4269

20.5510 19.7928 18.4016 17.1591 15.0463 13.3317 11.9246 10.7574 9.7791

22.4345 21.4822 19.7620 18.2559 15.7619 13.8007 12.2335 10.9617 9.9148

18

19

20

30

40

50

*There is one payment each period.](https://content.bartleby.com/qna-images/question/2b705b43-f340-437c-8aa2-d0e605827dee/a48a484b-066f-4653-8135-50a7a7cb6a38/f0rafv_thumbnail.png)

Transcribed Image Text:TABLE 9C.2

Present Value of Annuity of $1, p = [1-1/(1+]/i

3.25%

3.5%

1

2

3

4

5

6

7

6.5982

6.5346

8

7.4859

7.4051

7.4051

7.3255 7.2472

9

8.3605 8.2605 8.1622 8.0657

9.2222 9.1012 8.9826 8.8662

10

11

12

13

14

15

Periods 1.5% 1.75% 2% 2.25% 2.5% 2.75% 3%

0.9852 0.9828 0.9804 0.9780 0.9756 0.9732 0.9709 0.9685 0.9662

1.9559 1.9487 1.9416 1.9345 1.9274 1.9204 1.9135 1.9066 1.8997

2.9122 2.8980 2.8839 2.8699 2.8560 2.8423 2.8286 2.8151 2.8016

3.8544 3.8309 3.8077 3.7847 3.7620 3.7394 3.7171 3.6950 3.6731

4.7826 4.7479 4.7135 4.6795 4.6458 4.6126 4.5797 4.5472 4.5151

5.6972 5.6490 5.6014 5.5545 5.5081 5.4624 5.4172 5.3726 5.3286

6.4720 6.4102 6.3494 6.2894 6.2303 6.1720 6.1145

7.1701 7.0943 7.0197 6.9462 6.8740

7.9709 7.8777 7.7861 7.6961 7.6077

8.7521 8.6401 8.5302 8.4224 8.3166

10.0711 9.9275 9.7868 9.6491 9.5142 9.3821 9.2526 9.1258 9.0016

10.9075 10.7395 10.5753 10.4148 10.2578 10.1042 9.9540 9.8071 9.6633

11.7315 11.5376 11.3484 11.1636 10.9832 10.8070 10.6350 10.4669 10.3027

12.5434 12.3220 12.1062 11.8959 11.6909 11.4910 11.2961 11.1060 10.9205

13.3432 13.0929 12.8493 12.6122 12.3814 12.1567 11.9379 11.7249 11.5174

14.1313 13.8505 13.5777 13.3126 13.0550 12.8046 12.5611 12.3244 12.0941

14.9076 14.5951 14.2919 13.9977 13.7122 13.4351 13.1661 12.9049 12.6513

15.6726 15.3269 14.9920 14.6677 14.3534 14.0488 13.7535 13.4673 13.1897

16.4262 16.0461 15.6785 15.3229 14.9789 14.6460 14.3238 14.0119 13.7098

17.1686 16.7529 16.3514 15.9637 15.5892 15.2273 14.8775 14.5393 14.2124

24.0158 23.1858 22.3965 21.6453 20.9303 20.2493 19.6004 18.9819 18.3920

29.9158 28.5942 27.3555 26.1935 25.1028 24.0781 23.1148 22.2084 21.3551

34.9997 33.1412 31.4236 29.8344 28.3623 26.9972 25.7298 24.5518 23.4556

3.75% 4% 4.5% 5%

0.9639 0.9615 0.9569 0.9524

1.8929 1.8861 1.8727 1.8594

2.7883 2.7751 2.7490 2.7232

3.6514 3.6299 3.5875 3.5460 3.4651 3.3872

4.4833 4.4518 4.3900 4.3295 4.2124

5.2851 5.2421 5.1579

5.8927

6.5959 6.4632

16

17

18

19

20

30

40

50

Periods

6% 7% 8% 9% 10%

0.9434 0.9346 0.9259 0.9174 0.9091

1

2

1.8334 1.8080 1.7833 1.7591 1.7355

2.6730 2.6243 2.5771 2.5313 2.4869

3

4

3.3121 3.2397 3.1699

5

4.1002 3.9927 3.8897 3.7908

6

5.0757 4.9173 4.7665

4.6229 4.4859 4.3553

7

6.0579 6.0021

5.7864

5.2064 5.0330 4.8684

5.5824 5.3893

6.2098 5.9713 5.7466 5.5348 5.3349

8

6.8028 6.7327

9

7.5208 7.4353

7.2688

7.1078

6.8017 6.5152

6.2469 5.9952 5.7590

10

8.2128 8.1109

7.9127

7.7217

7.0236 6.7101 6.4177 6.1446

11

7.1390 6.8052 6.4951

7.3601

8.8798 8.7605 8.5289 8.3064 7.8869 7.4987

9.5227 9.3851 9.1186 8.8633

10.1424 9.9856 9.6829 9.3936

12

7.5361 7.1607 6.8137

13

14

15

16

17

8.3838 7.9427

8.8527 8.3577 7.9038 7.4869 7.1034

10.7396 10.5631 10.2228 9.8986 9.2950 8.7455 8.2442 7.7862 7.3667

11.3153 11.1184 10.7395 10.3797 9.7122 9.1079 8.5595 8.0607 7.6061

11.8702 11.6523 11.2340 10.8378 10.1059 9.4466 8.8514 8.3126 7.8237

12.4050 12.1657 11.7072 11.2741 10.4773 9.7632 9.1216 8.5436 8.0216

12.9205 12.6593 12.1600 11.6896 10.8276 10.0591 9.3719 8.7556 8.2014

13.4173 13.1339 12.5933 12.0853 11.1581 10.3356 9.6036 8.9501 8.3649

13.8962 13.5903 13.0079 12.4622 11.4699 10.5940 9.8181 9.1285 8.5136

17.8292 17.2920 16.2889 15.3725 13.7648 12.4090 11.2578 10.2737 9.4269

20.5510 19.7928 18.4016 17.1591 15.0463 13.3317 11.9246 10.7574 9.7791

22.4345 21.4822 19.7620 18.2559 15.7619 13.8007 12.2335 10.9617 9.9148

18

19

20

30

40

50

*There is one payment each period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A bond with a 7% coupon rate makes payments on January 15 and July 15 of each year (182-day coupon period). On January 30, the ask price for the bond was reported as 100:02. On April 15, it was selling at an ask price of 101:04. What is the bond's invoice price on January 30? If you purchased the bond from a dealer on April 15, what price would you have to pay for it? (Note: Bond quotes are always at a percentage of the face value. Therefore, 103:05 must be read as 103.05% of face value, so the quoted price is $1,030.5.)arrow_forwardOn March 1, Wayne Michaels bought 10 bonds from a particular company with a coupon rate of 9.625%. The purchase price was 89.875, and the commission was $8 per bond. Bonds from this particular company pay interest on February 1 and August 1. (a) What is the current yield (as a %) of the bond as of the purchase date? (Round your answer to one decimal place.) % (b) What is the total purchase price (in $) of the bonds? (Round your answer to the nearest cent.) $ (c) If Wayne sold the bonds on November 1 for 94.875, what are the proceeds (in $) from the sale? (Round your answer to the nearest cent.) $ Need Help? Read Itarrow_forwardSubject - account Please help me. Thankyou.arrow_forward

- On March 1, Wayne Michaels bought 10 bonds from a particular company with a coupon rate of 9.625%. The purchase price was 89.875, and the commission was $8 per bond. Bonds from this particular company pay interest on February 1 and August 1. (a)What is the current yield (as a %) of the bond as of the purchase date? (Round your answer to one decimal place.) 10.7 % (b)What is the total purchase price (in $) of the bonds? (Round your answer to the nearest cent.) $ (c)If Wayne sold the bonds on November 1 for 94.875, what are the proceeds (in $) from the sale? (Round your answer to the nearest cent.) $arrow_forwardDetermine the interest payment for the following three bonds. (Assume a $1,000 par value.) Note: Round your answers to 2 decimal places. 3.60 percent coupon corporate bond (paid semiannually) 4.35 percent coupon Treasury note Corporate zero-coupon bond maturing in 10 yearsarrow_forwardOn March 1, Wayne Michaels bought 10 bonds from a particular company with a coupon rate of 9.325%. The purchase price was 89.875, and the commission was $7 per bond. Bonds from this particular company pay interest on February 1 and August 1. (a) What is the current yield (as a %) of the bond as of the purchase date? (Round your answer to one decimal place.) % (b) What is the total purchase price (in $) of the bonds? (Round your answer to the nearest cent.) $ (c) If Wayne sold the bonds on November 1 for 94.875, what are the proceeds (in $) from the sale? (Round your answer to the nearest cent.) $arrow_forward

- On January 1 of this year, Ikuta Company issued a bond with a face value of $115,000 and a coupon rate of 4 percent. The bond matures in 3 years and pays interest every December 31. When the bond was issued, the annual market rate of interest was 5 percent. Ikuta uses the effective-interest amortization method. (FV of $1, PV of $1, FVA of $1, and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Required: 1. Complete a bond amortization schedule for all three years of the bond's life. 2. What amounts will be reported on the income statement and balance sheet at the end of Year 1 and Year 2? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete a bond amortization schedule for all three years of the bond's life. Note: Round your intermediate calculations and final answers to whole dollars. Date January 01, Year 1 December 31, Year 1 December 31, Year 2 December 31, Year 3 Cash Interest Interest Expense Amortization Book…arrow_forwardOn March 1, Wayne, Michaels bought 10 bonds from a particular company with a coupon rate of nine. 7 to 5% the purchase price was 87.875 and the commission was $7 per bond. Bonds from this particular company pay interest on February 1 and August 1. A-what is the current year as a percent of the bottom of the purchase date round your answer to one decimal place? 11.07 is correct B-what is the total purchase price in dollars of the bonds round your answer to the nearest cent? I put 893.85 it’s wrong C-if Wayne sold the bonds on November 1 for 92.875 what are the proceeds in dollars from the sale round your answer to the nearest cent?  I put 110.1875 it’s wrongarrow_forwardA bond issue of 4%, 8-year bonds with a face value of $43,000 with interest payable annually on January 1. Market interest rate is 6%. What is the present value of the bonds? (For calculation purposes, use five decimal places as displayed in the factor table provided. Round your answers to O decimal places (e.g., 5,275).) Click here to view the factor table. Present value of interest payments $ Present value of principal $ Present value of the bonds $ 69arrow_forward

- On April 30, Year 6, Tuesday Ltd. issued $1,000,000 of 20-year bonds paying interest twice a year on October 31 and April 30. The coupon rate is 5%, and the market rate was 7%. The bonds were issued at 78.6449. Required a. Calculate the issue price. Round your numbers to the nearest dollar. b. Prepare a bond amortization table for the initial issue of the bonds and the first four interest periods. c. Using the net method, prepare journal entries for the issue of the bonds and the following: • Interest payment on October 31, Year 6⚫ Interest accrual, rounded to 2 months, on December 31, Year 6 ⚫ Interest payment on April 30, Year 7⚫ Interest payment on October 31, Year 7 • Interest accrual on December 31, Year 7arrow_forwardOn March 1, Wayne Michaels bought 10 bonds from a particular company with a coupon rate of 9.325%. The purchase price was 87.875, and the commission was $9 per bond. Bonds from this particular company pay interest on February 1 and August 1. (a)What is the current yield (as a %) of the bond as of the purchase date? (Round your answer to one decimal place.) (b) What is the total purchase price (in $) of the bonds? (Round your answer to the nearest cent.) (c) If Wayne sold the bonds on November 1 for 92.875, what are the proceeds (in $) from the sale? (Round your answer to the nearest cent.)arrow_forwardGive answer for the questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education