Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

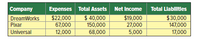

a. Compute the debt ratio for each of the three companies. b. Which company has the most financial leverage?

Transcribed Image Text:Company

Expenses Total Assets

Net Income Total Llablitles

$22,000

67,000

12,000

$ 40,000

150,000

$19,000

$30,000

147,000

17,000

DreamWorks

Pixar

27,000

Universal

68,000

5,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the below statements holds based on the empirical evidence? A.Leverage ratios are generally identical across countries B. Return on equity is on average greater than return on debt C.Return on equity is generally the same as the return on debt D.Leverage ratios are generally identical across companiesarrow_forwarda) Define financial leverage.b) What is the effect on earnings?c) When is the use of financial leverage advantageous and disadvantageous?arrow_forwardWhat is the overall purpose of financial ratios? What is their use relative to the economy, the firm’s industry, the firm’s main competitors, and the firm’s past relative ratios.arrow_forward

- Which of the following statements are true about the interest-burden ratio? Check all that apply: It can be expressed as EBIT/Interest Expense. If the company has no financial leverage, the interest-burden ratio will be equal to 0. A company with higher financial leverage will have a lower interest-burden ratio. If the company has no financial leverage, the interest-burden ratio will be equal to 1. It can be expressed as Net profits/Pretax profits.arrow_forwardSuppose a firm wants to maintain a specific TIE ratio. It knows the amount of its debt, the interest rate on that debt, the applicable tax rate, and its operating costs. With this information, the firm can calculate the amount of sales required to achieve its target TIE ratio. a. True b. Falsearrow_forward1. Discuss how using debt ratios applies to a business.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education