Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 14, Question 6

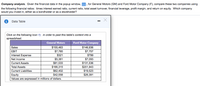

Transcribed Image Text:### Company Analysis

Given the financial data displayed in the popup window, compare General Motors (GM) and Ford Motor Company (F) using specific financial ratios: times interest earned ratio, current ratio, total asset turnover, financial leverage, profit margin, and return on equity. Decide which company you would invest in, either as a bondholder or as a stockholder.

#### Data Table

| | General Motors | Ford Motor Company |

|----------------------|----------------|--------------------|

| **Sales** | $155,463 | $146,936 |

| **EBIT** | $7,785 | $7,757 |

| **Interest Expense** | $321 | $799 |

| **Net Income** | $5,381 | $7,093 |

| **Current Assets** | $81,533 | $131,536 |

| **Total Assets** | $166,315 | $201,943 |

| **Current Liabilities** | $62,402 | $19,523 |

| **Equity** | $42,558 | $26,391 |

*Values are expressed in millions of dollars.*

### Analysis Steps

1. **Times Interest Earned Ratio**:

- Calculate by dividing EBIT by Interest Expense.

- GM: \( \frac{7,785}{321} \)

- Ford: \( \frac{7,757}{799} \)

2. **Current Ratio**:

- Determine by dividing Current Assets by Current Liabilities.

- GM: \( \frac{81,533}{62,402} \)

- Ford: \( \frac{131,536}{19,523} \)

3. **Total Asset Turnover**:

- Evaluate by dividing Sales by Total Assets.

- GM: \( \frac{155,463}{166,315} \)

- Ford: \( \frac{146,936}{201,943} \)

4. **Financial Leverage**:

- Assess by dividing Total Assets by Equity.

- GM: \( \frac{166,315}{42,558} \)

- Ford: \( \frac{201,943}{26,391} \)

5. **Profit Margin**:

- Calculate by dividing Net Income by Sales.

- GM: \( \frac{5,381

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 18 pts Multiple Functions 88 MULTIPLE CHOICE Question 2 ◄ Listen When f(x)=-3x-6 and g(x) = x²-x-6, what is ? A B C f 54 g = 3 fg = -3 x-3x=3 f 51 g = -2x+2; x=1arrow_forwardC B A Question 2 Listen What is tane for the given triangle? 13 53 12 25 55 13 12 13 earrow_forwardZina Manufacturing Company started and completed Job 501 in December with the following Job Cost Sheet and transferred it to the warehouse. Direct Materials Date Dec 17 Dec 30 Total Direct Labor Amount Date Amount $2,000 Dec 20 $4,000 8,000 Dec 30 3,800 Total Job Cost Sheet - Job No. 501 Total Cost The journal entry to record the transaction is A) WIP Inventory FG Inventory B) Cost of Goods Sold WIP Inventory C) FG Inventory WIP Inventory D) FG Inventory WIP Inventory Debit Credit 35,800 17,800 17,800 Manufacturing Overhead Date Amount Dec 24 $10,000 Dec 30 8,000 Total 35,800 35,800 17,800 17,800 35,800arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education