ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

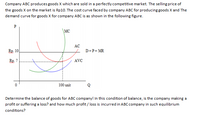

Transcribed Image Text:Company ABC produces goods X which are sold in a perfectly competitive market. The selling price of

the goods X on the market is Rp10. The cost curve faced by company ABC for producing goods X and The

demand curve for goods X for company ABC is as shown in the following figure.

P

\MC

AC

Rp. 10

D=P= MR

Rp. 7

AVC

100 unit

Determine the balance of goods for ABC company! In this condition of balance, is the company making a

profit or suffering a loss? and how much profit / loss is incurred in ABC company in such equilibrium

conditions?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Imagine a perfectly competitive wood industry composed of 240 identical firms. The production output, q for each firm is determined by the function 9 = K1/2* L¹1/2, where K represents capital and L stands for labor. The $25 and PL prices for capital and labor are PK = $4, respectively. With labor fixed at 25 units, and the market demand described by Qd = 260 2P, what would be the economic profit or loss at equilibrium for these firms? -98 -99 99 98 = =arrow_forward6. Short-run perfectly competitive equilibrium Consider a perfectly competitive market for wheat in New York City. There are 90 firms in the industry, each of which has the cost curves shown on the following graph: COST (Cents per bushel) 100 90 80 70 60 50 40 30 20 10 0 ATC 0 5 AVC 10 15 20 25 30 35 40 QUANTITY OF OUTPUT (Thousands of bushels) MC The following graph shows the market demand for wheat. 45 50 ?arrow_forwardAfter serving as President of the United States for eight years, Dena has retired from politics and has decided to become a wheat farmer. The market for wheat is perfectly competitive and the current market price for wheat is $10 per bushel. Dena is currently producing 8 bushels (Dena can only produce this good in whole units). Her total cost at 8 units of output is $88 and her variable cost at 8 units of output is $64. Dena knows that if she produces a 9th unit her total cost will become $97, and if she produces a 10th unit her total cost will become $110. Dena’s goal is to maximize her profits. Based on this information, identify whether each of the following would be true or false and briefly explain your reasoning. Dena is currently losing money in the short-run and she would be better off if she shutdown and produced zero. Dena is not currently profit maximizing at 8 units of output and she could increase her profits if she expanded output by one unit. Dena would increase her…arrow_forward

- A firm's technology is characterized by a Cobb - Douglas production function of the form 1 1 y = f(K,L) = 2K² + 1² a. The output price is p, and the input prices are r and w for K and L, respectively. Set up the problem for a profit - maximizing firm and solve for the factor demand functions for K and L. b. Find the firm's supply function. c. Find the firm's profit function. d. Assume now that p = 2, r = 1, and w = 1. Using the functions you have found in parts (a), (b) and (c), calculate the profit - maximizing levels of the factors and (K* and L*), the profit - maximizing output level (v) and the maximum profit of the firm (). Please solve it by explaining and explaining.arrow_forwardThe question is in the attached imagearrow_forwardThe marginal costs (MC), average variable costs (AVC), and average total costs (ATC) for a firm are shown in the figure below. The market price is $26. Instructions: Use the tool provided (Pt. A) to identify the profit-maximizing output. Then use the tool "Profit" to draw the area of profit (or loss) that occurs at this level of output. Position this rectangle by dragging on the vertices. Price/Cost ($) 50 r Tools MC 40 Pt. A Profit ATC 30 AVC 20 10 10 20 30 40 50 Quantity Instructions: Round your answer to the nearest whole number. Use a negative sign if necessary. At the profit-maximizing level of output, average total cost is $ and profit is $arrow_forward

- Please Answer according to the picture. What are the parameters of the problem? Find the conditional factor demand functions. Label them l(w,r,y) and k(w,r,y).Find the cost function: c(w,r,y). What is its interpretation?arrow_forwardTwo months ago, on July 1, 2019, the State of Illinois raised gasoline taxes by $.19 (19 cents) per gallon of gas Question 3: For this question, please model the short-run impact of this tax on a typical Illinois gas station. The horizontal axis will be qgas (the output of this particular producer) and the vertical axis will measure price in dollars, $. This firm is subject to the Law of Diminishing Marginal Product. Begin by graphically depicting the “Family of Short Run Cost Curves” (AFC, AVC, ATC, MC) for this producer in late June, prior to the implementation of the new gasoline tax (you must submit a graph).arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education