FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

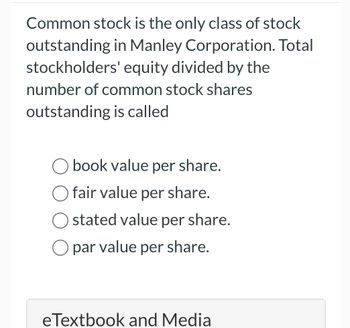

Transcribed Image Text:Common stock is the only class of stock

outstanding in Manley Corporation. Total

stockholders' equity divided by the

number of common stock shares

outstanding is called

book value per share.

fair value per share.

stated value per share.

☐ par value per share.

eTextbook and Media

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Beacon Corporation issued a 5 percent stock dividend on 39,500 shares of its $7 par common stock. At the time of the dividend, the market value of the stock was $27 per share. Required: a. Compute the amount of the stock dividend. b. Show the effects of the stock dividend on the financial statements using a horizontal statements model. Complete this question by entering your answers in the tabs below. Required A Required B Compute the amount of the stock dividend. Stock dividendarrow_forwardMatch the following terms with their definitions (not every letter is used) 1. Outstanding stock 2. Issued stock Authorized stock 4. Paid-in Capital Retained earnings a. The earnings not paid out in dividends. b. Shareholders can lose no more than the amount they invested in the company. c. The corporation's own stock that is reacquired. d. The amount invested by stockholders. e. Total number of shares available to sell. f. Shares can be returned to the corporation at a predetermined price. g. Shares held by investors. h. Shares receive priority for future dividends if dividends are not paid in a given year. i. Shares actually sold.arrow_forwardThe charter of a corporation provides for the issuance of 93,872 shares of common stock. Assume that 44,236 shares were originally issued and 3,223 were subsequently reacquired. What is the amount of cash dividends to be paid if a $2-per-share dividend is declared? Oa. $3,223 Ob. $93,872 Oc. $44,236 Od. $82,026arrow_forward

- The charter of a corporation provides for the issuance of 106,898 shares of common stock. Assume that 42,395 shares were originally issued and 4,642 were subsequently reacquired. What is the amount of cash dividends to be paid if a $2-per-share dividend is declared? a.$42,395 b.$106,898 c.$4,642 d.$75,506arrow_forwardCompanies can issue different classes of common stock. Which of the following statements concerning stock classes is correct? a. All common stock fall into one of three classes: A, B, and C. b. Most firms have several classes of common stock outstanding. c. All common stock, regardless of class, must have voting rights. d. All common stock, regardless of class, must have the same dividend privileges. e. None of the above statements is necessarily true.arrow_forwardA corporation has the following account balances: Common stock, $1 par value, $42000; Paid-in Capital in Excess of Par, $730000. Based on this information, the O number of shares outstanding is 772000. O legal capital is $772000. O number of shares issued is 42000. O average price per share issued is $6.96.arrow_forward

- The charter of a corporation provides for the issuance of 94,560 shares of common stock. Assume that 42,608 shares were originally issued and 3,393 were subsequently reacquired. What is the amount of cash dividends to be paid if a $2-per-share dividend is declared? a.$42,608 b.$94,560 c.$3,393 d.$78,430arrow_forwardDescribe the types of shares held by the company. What can you say about the history of company share issues, retained earnings and payment of dividends? Are they following any specific policies for these? (Please correct answer)arrow_forwardWhich of the following statements is true?a. The outstanding number of shares is the maximum number of shares that can beissued by a corporation.b. The shares that are in the hands of the stockholders are said to be outstanding.c. It is very unlikely that corporations will have more than one class of stock outstanding.d. Preferred stock is stock that has been retired.arrow_forward

- Ashkenazi Companies has the following stockholders' equity account: Common stock (425,901 shares at $3 par) Paid-in capital in excess of par Retained earnings Total stockholders' equity $1,277,703 3,383,532 938,765 $5,600,000 Assuming that state laws define legal capital solely as the par value of common stock, how much of a per-share dividend can Ashkenazi pay? If legal capital were more broadly defined to include all paid-in capital, how much of a per-share dividend can Ashkenazi pay? Assuming that state laws define legal capital solely as the par value of common stock, the per-share dividend Ashkenazi can pay is $ (Round to the nearest cent.)arrow_forwardIf a company issues only one class of stock, what is this kind of stock called? Group of answer choices outstanding stock preferred stock common stock authorized stockarrow_forwardA corporation has the following account balances: Common Stock. $1 par value, $80000; Paid-in Capital in Excess of Par Value, $2710000. Based on this information, the O average price per share issued is $3.49. O number of shares issued is 80000 O number of shares outstanding is 2790000. O legal capital is $2790000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education