FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

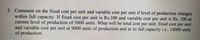

Transcribed Image Text:5. Comment on the fixed cost per unit and variable cost per unit if level of production changes

within full capacity. If fixed cost per unit is Rs.100 and variable cost per unit is Rs. 100 at

current level of production of 5000 units. What will be total cost per unit, fixed cos unit

and variable cost per unit at 9000 units of production and at its full capacity ie., 14000 units

of production.

per

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Total Variable cost is 560,000 OMR total units sold is 7000 units, total fixed cost is 160000 OMR,describe the production costs in the equation form Y = f + vX. Select one: a. Y = 160000 + 100X b. Y = 160000 + 70X c. Y = 160000 + 80X d. Y = 160000 + 40X Clear my choicearrow_forwardIf fixed costs are $235,000, the unit selling price is $125, and the unit variable costs are $75, what is the break-even sales (units)?arrow_forwardCompany D is planning to perform an ABC analysis for its products. An information table is given below. Item Annual Demand Unit Cost 180 $100 130 $140 C 600 $220 D. 60 $70 50 $80 Assuming that class A items represent about 75% of the total dollar usage, class B about 20%, class C less than 5%, what is the annual dollar volume of Item D? a. 132000 b. 4200 C. 18200 d. 4000 e. 18000arrow_forward

- If sales are $30,000, fixed costs are $10,000, and variable costs are $7,000 what is the contribution margin ratio? O 0.594 O 0.767 O 0.612 0.659arrow_forwardSuppose that a company has fixed costs of $22 per unit and variable costs $9 per unit when 15,000 units are produced. What are the fixed costs per unit when 12,000 units are produced? Round your answer to the nearest cent. Fixed costs per unit $fill in the blank 1arrow_forwardIf fixed costs are $332,000, the unit selling price is $72, and the unit variable costs are $45, the old and new break-even sales (units), respectively, if the unit selling price increases by $8 arearrow_forward

- Hixson Company manufactures and sells one product for $34 per unit. The company maintains no beginning or ending inventories and its relevant range of production is 20,000 units to 30,000 units. When Hixson produces and sells 25,000 units, its unit costs are as follows: Amount Per Unit Direct materials $8.00 $5.00 $1.00 $6.00 $3.50 $2.50 $ 4.00 $1.00 Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expensearrow_forwardManufacturing costs for product X include direct materials $18 per unit, direct labor $4 per unit, variable overhead $2 per unit, and fixed overhead $3 per unit, for a total of $27 per unit. If production volume is increased by 10 units, how much will total manufacturing costs change in the short term? Assume that the new production volume is in the relevant range. (hint: the total cost equation might be useful here) increase by $240 not enough information need to know the original volume increase by $220 increase by $250 O increase by $270arrow_forwardFor a certain product, the linear demand curve is described by the equation, Quantity = 15,449 - 405 * Price. Variable cost to manufacture this product is $8 per unit. Calculate optimal price for this product. Rounding: penny.arrow_forward

- For Waterway Industries at a sales volume of 5000 units, sales revenue is $67000, variable costs total $ 44000, and fixed expenses are $21000. What is the unit contribution margin? Select answer from the options below $4.20 $8.80 $9.20 $4.60arrow_forwardSuppose that a company has fixed costs of $22 per unit and variable costs $9 per unit when 18,000 units are produced. What are the fixed costs per unit when 14,400 units are produced? Round your answer to the nearest cent. Fixed costs per unit _____arrow_forwardThe following information is related to product A: in 2015, variable cost was Rs 200 per unit and fixed cost was Rs 40 per unit. Production was 1,20,000 units. It is expected that production in 2016 will increase to 1,60,000 units. The variable cost will increase by 25% and fixed cost by 10% in 2016. The amount of fixed cost in 2016 will be- a. Rs 52,80,000 b. Rs 70,40,000 c. Rs 64,00,000 d. Rs 48,00,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education