Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

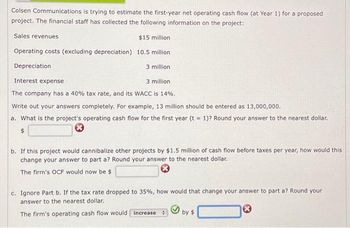

Transcribed Image Text:Colsen Communications is trying to estimate the first-year net operating cash flow (at Year 1) for a proposed

project. The financial staff has collected the following information on the project:

Sales revenues

$15 million.

Operating costs (excluding depreciation) 10.5 million

Depreciation

3 million.

Interest expense

3 million.

The company has a 40% tax rate, and its WACC is 14%.

Write out your answers completely. For example, 13 million should be entered as 13,000,000.

a. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar.

$

b. If this project would cannibalize other projects by $1.5 million of cash flow before taxes per year, how would this.

change your answer to part a? Round your answer to the nearest dollar.

The firm's OCF would now be $

c. Ignore Part b. If the tax rate dropped to 35%, how would that change your answer to part a? Round your

answer to the nearest dollar.

The firm's operating cash flow would increase :

by $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Hughes Corporation is considering a project that would require an investment of $343,000 and would last for 8 years. The incremental annual revenues and expenses generated by the project during those 8 years would be as follows (Ignore income taxes.): Sales Variable expenses Contribution margin Fixed expenses: Salaries Rents Depreciation Total fixed expenses Net operating income $ 227,000 52,000 175,000 O 3.0 years O 5.1 years O 3.2 years O 4.8 years 27,000 41,000 40,000 108,000 $ 67,000 The scrap value of the project's assets at the end of the project would be $23,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:arrow_forwardA project with a life of 6 years is expected to provide annual sales of $380,000 and costs of $269,000. The project will require an investment in equipment of $670,000, which will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/−15 percent. The tax rate is 21 percent. What is the annual operating cash flow for the best-case scenarioarrow_forwardBennett Company has a potential new project that is expected to generate annual revenues of $261,200, with variable costs of $143,600, and fixed costs of $61,000. To finance the new project, the company will need to issue new debt that will have an annual interest expense of $24,000. The annual depreciation is $25,000 and the tax rate is 21 percent. What is the annual operating cash flow? Multiple Choice $42,600 $127,600 $81,600 $178,616 $49,964arrow_forward

- Salsa Company is considering an investment in technology to improve its operations. The investment costs $241,000 and will yield the following net cash flows. Management requires a 10% return on investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Year Net cash Flow 1 $ 48, 200 2 53,900 3 76, 400 4 95,500 5 126,500 Required: Determine the payback period for this investment. Determine the break - even time for this investment. Determine the net present value for this investment. Should management invest in this project based on net present value?arrow_forwardBennett Company has a potential new project that is expected to generate annual revenues of $263,000, with variable costs of $144, 400, and fixed costs of $61,600. To finance the new project, the company will need to issue new debt that will have an annual interest expense of $25,000. The annual depreciation is $25,400 and the tax rate is 35 percent. What is the annual operating cash flow? Multiple Choice $127,490 $82,400 $180,212 $45,940 $40,890arrow_forwardWildhorse Industries management is planning to replace some existing machinery in its plant. The cost of the new equipment and the resulting cash flows are shown in the accompanying table. The firm uses an 18 percent discount rate for projects like this. Should management go ahead with the project? Year 0 1 2 3 4 5 Cash Flow -$3,485,400 871,710 896,700 1,104,400 1,340,360 1,450,600 What is the NPV of this project? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to O decimal places, e.g. 1,525.) The NPV is $arrow_forward

- The financial staff of Cairn Communications has identified the following information for the first year of the roll-out of its new proposed service: Projected sales $22 million Operating costs (not including depreciation) $11 million Depreciation $5 million Interest expense $3 million The company faces a 25% tax rate. What is the project's operating cash flow for the first year (t = 1)? Enter your answer in dollars. For example, an answer of $1.2 million should be entered as $1,200,000. Round your answer to the nearest dollar. $arrow_forwardThe financial staff of Cairn Communications has identified the following information for the first year of the roll-out of its new proposed service: Projected sales $22 million Operating costs (not including depreciation) $9 million Depreciation $5 million Interest expense $3 million The company faces a 25% tax rate. What is the project's operating cash flow for the first year (t = 1)? Enter your answer in dollars. For example, an answer of $1.2 million should be entered as $1,200,000. Round your answer to the nearest dollar.arrow_forwardThe Whilst Co. is analyzing a project that has projected sales of $189,400 and costs of $102,300. The project requires an investment in inventory of $15,000 plus another $28,000 in accounts receivable. Fixed assets of $80,000 are needed and will be depreciated straight-line over 5 years. Accounts payable will increase by $36,000. An interest expense of $11,000 will be incurred annually. The project has a life of 3 years. At the end of the three years, the equipment has an estimated market value of $26,000. The company requires a 14% rate of return and is in the 34% marginal tax bracket. What is the net present value of this project? $65,887 $68,023 $88,671 $91,425 None of the above.arrow_forward

- Ivanhoe Industries management is planning to replace some existing machinery in its plant. The cost of the new equipment and the resulting cash flows are shown in the accompanying table. The firm uses an 18 percent discount rate for projects like this. Should management go ahead with the project? Year Cash Flow 0 -$3,046,900 1 803,710 2 889,200 3 1,247,600 4 1,285,160 5 1,576,500 What is the NPV of this project? - NPV $?arrow_forwardOriole Corporation is considering adding a new product line. The cost of the factory and equipment to produce this product is $1,700,000. Company management expects net cash flows from the sale of this product to be $630,000 in each of the next eight years. If Oriole uses a discount rate of 11 percent for projects like this, what is the net present value of this project? (Round intermediate calculations to 5 decimal places, e.g. 0.42354. Round answer to O decimal places, e.g. 52.25. Enter negative amounts using negative sign e.g. -45.25.) NPV $ 36695.55 What is the internal rate of return? (Round answer to 2 decimal places, e.g. 52.50.) Internal rate of return %arrow_forwardalbot Industries is considering launching a new product. The new manufacturing equipment will cost $18 million, and production and sales will require an initial $5 million investment in net operating working capital. The company's tax rate is 25%. Enter your answers as a positive values. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answers to two decimal places. What is the initial investment outlay? $ million The company spent and expensed $150,000 on research related to the new project last year. What is the initial investment outlay? $ million Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for $1.8 million after taxes and real estate commissions. What is the initial investment outlay? $ millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education