FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

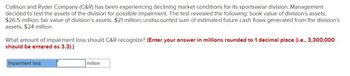

Transcribed Image Text:Collison and Ryder Company (C&R) has been experiencing declining market conditions for its sportswear division. Management

decided to test the assets of the division for possible impairment. The test revealed the following: book value of division's assets,

$26.5 million; fair value of division's assets, $21 million; undiscounted sum of estimated future cash flows generated from the division's

assets, $24 million.

What amount of impairment loss should C&R recognize? (Enter your answer in millions rounded to 1 decimal place (i.e., 3,300,000

should be entered as 3.3).)

Impairment loss

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2017, Flint Corporation discontinued its retail store operations to focus on its online opportunities. The elimination of these retail operations is properly considered a discontinued operation. During the current year, its store operations lost $ 670,000 (net of tax) while its online operations reported a profit of $ 3,320,000 (net of tax). Flint sold the store operations at the end of the year at a loss of $ 1,340,000 (net of tax). Prepare an income statement for 2017 beginning with line item "Income from continuing operations." FLINT CORPORATION Partial Income Statement $ %24 %24 > > >arrow_forwardIn relation to evaluating non-current assets, indicate which of the following statements is TRUE? 1. The higher the asset turnover, the more effective a company is in using its resources to generate sales. 2. Too high a depreciation rate will result in increased reported profits for the period. 3. All non-current assets must be depreciated. 4. The older the assets are, the better the company is performing.arrow_forwardSarasota Corporation and Marigold Corporation, two companies of roughly the same size, are both involved in the manufacture of shoe-tracing devices. Each company depreciates its plant assets using the straight-line approach. An investigation of their financial statements reveals the following information. Net income Sales revenue Total assets (average) Plant assets (average) Intangible assets (goodwill) (a) (1) (2) (3) Return on assets Profit margin Asset turnover Sarasota Corp. $ 237,540 Save for Later 1,187,700 3,210,000 2,430,000 387,100 For each company, calculate these values: (Round answers to 2 decimal places, e.g. 6.25% or 17.54.) Marigold Corp. $316,050 Sarasota Corp. 1,264,200 3,010,000 1,828,000 do % do % 0 times Marigold Corp. % do % times Attempts: 0 of 3 used Submit Answerarrow_forward

- In 2017, Bramble Corporation discontinued its retail store operations to focus on its online opportunities. The elimination of these retail operations is properly considered a discontinued operation. During the current year, its store operations lost $ 750,000 (net of tax) while its online operations reported a profit of $ 3,210,000 (net of tax). Bramble sold the store operations at the end of the year at a loss of $ 1,360,000 (net of tax). Prepare an income statement for 2017 beginning with line item "Income from continuing operations." BRAMBLE CORPORATION Partial Income Statement %24 %24 > > >arrow_forwardAfter many years of success, Kaputnik Co. recorded net operating losses for the years year 13 through year 16, totaling $250 million, resulting in the recording of large deferred tax assets based on the assumption of a rapid return to profitability. However, attempts by management to revamp its outmoded business model have so far failed. A radical final attempt to save the company will be implemented in year 18. It will entail selling off the vast majority of Kaputnik's asset groups while maintaining a small but promising segment. The projected outlook for the near term is a modest net profit of $5 million over the next three years, beyond which it is impossible to determine if Kaputnik Co. will even still be in existence. The enacted tax rate has been 35% for the last several years and is expected to be 21% in year 17 and future years. No addition to the deferred tax asset balance will be recorded for year 17, during which Kaputnik recorded a $70 million net operating loss, nor has…arrow_forwardA copy machine costs $41,000 when new and has accumulated depreciation of $35,000. Suppose Hilton Copy Center discards this machine and receives nothing. What is the result of the disposal transaction? A. No gain or loss B. Gain of $6,000 C. Loss of $40,000 D. Loss of $6,000arrow_forward

- XYZ Ltd. is a manufacturing company that produces specialized machinery. The company has been in business for the last 10 years and has always used the straight-line method of depreciation to calculate the depreciation expense for its machinery. However, the company's financial controller has recently proposed that they switch to the double- declining balance method instead. The financial controller argues that this method would result in a more accurate depreciation expense calculation and better reflect the actual usage of the machinery over time. Questions: 1. What is the straight-line method of depreciation? 2. What is the double-declining balance method of depreciation? 3. What are the advantages and disadvantages of using the straight-line method? 4. What are the advantages and disadvantages of using the double-declining balance method? 5. Should XYZ Ltd. switch to the double-declining balance method of depreciation? Why or why not?arrow_forwardThe net assets of Fragrance, a cash generating unit (CGU), are: $ Property, plant and equipment 200,000 Allocated goodwill 50,000 Product patent 20,000 Net current assets (at net realizable value) 30,000 Total 300,000 As a result of adverse publicity, Fragrance has a recoverable amount of only $200,000. What would be the value of Fragrance's property, plant, and equipment after the allocation of the impairment loss? $154,545 $170,000 $160,000 $133,333arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education