Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

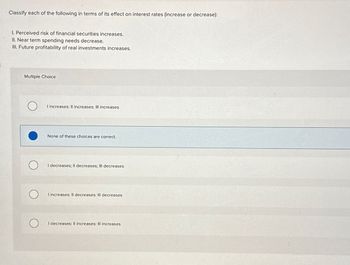

Transcribed Image Text:Classify each of the following in terms of its effect on interest rates (increase or decrease):

1. Perceived risk of financial securities increases.

II. Near term spending needs decrease.

III. Future profitability of real investments increases.

Multiple Choice

I increases: Il increases: III increases

None of these choices are correct.

I decreases; Il decreases; III decreases

I increases: Il decreases: Ill decreases

I decreases: Il increases: Ill increases

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is TRUE? O An American call option on a stock should never be exercised early O An American call option on a stock should be exercised early when dividends are expected O It can sometimes be optimal to exercise early an American call option on a stock even when no dividends are expected and there is no liquidity or portfolio rebalancing need. O An American call option on a stock should never be exercised early when no dividends are expected << Previous Next ▸arrow_forwardWhen the quantity of a financial security supplied or demanded changes at every given interest rate in response to a change in a factor, this causes a shift in the supply or demand curve true or false ?arrow_forwardThe pure time value of money is known as the: Multiple Choice liquidity effect. inflation factor. Fisher effect. term structure of interest rates. interest rate factor.arrow_forward

- INTEREST RATE RISK In the context of the repricing gap model, what is the spread effect? How does it affect the change in net interest income?arrow_forwardA normal yield curve a.has an upward slope b.is a sign of a coming recession c.indicates that the interest rate will decrease in the future d.All of the above.arrow_forwardIf net present values are used to evaluate two investments that have equal costs and equal total cash flows, the one with more cash flows in the latter years has the higher net present value. OTrue O Falsearrow_forward

- Leverage is gained when which of the following exists? O Return on assets is greater than the interest on borrowed funds O Interest coverage ration is greater than 1 O Interest coverage ratio is less than 1% O Interest on borrowed funds is greater than the return on assetsarrow_forwardAn investment requires a total return that comprises: O a real rate of return and compensation for inflation. a real rate of return, compensation for inflation, and a risk premium. compensation for inflation and a risk premium. a real rate of return, compensation for inflation, a risk premium, and compensation for time and effort devoted to researching alternative investments. None of the abovearrow_forwardof stion According to MM Case II, if the expected return on assets decreases, what happens to the expected return on equity? Select one: Oa increases O b. remains constant Oc decreases O d. depends on the firm's capital structure Time learrow_forward

- When calculating present value, the the interest rate, the smaller the present value amount. smaller largerarrow_forwardof stion According to MM Case II, if the expected return on assets decreases, what happens to the expected return on equity? Select one: Oa increases O b. remains constant Oc decreases O d. depends on the firm's capital structure Time learrow_forwardWhich of the following are the key factors when determining asset allocation for an investment? I. Time an investor has until he needs to use the money from the investment (time horizon) II. Risk preferences (tolerance for risk) III. Current financial situation a. I., II., & III. b. I. & III. c. II. & III. d. I. & II.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education