Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

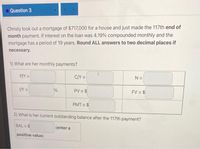

Transcribed Image Text:Question 3

Christy took out a mortgage of $717,000 for a house and just made the 117th end of

month payment. If interest on the loan was 4.19% compounded monthly and the

mortgage has a period of 19 years. Round ALL answers to two decimal places if

necessary.

1) What are her monthly payments?

P/Y =

C/Y =

N =

VY =

PV = $

FV = $

PMT = $

2) What is her current outstanding balance after the 117th payment?

BAL = $

(enter a

positive value)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Tim Huston purchased a wall unit for $2,200. He made a $600.00 down payment and financed the balance with an installment loan for 48 months. If Tim’s payments are $42.59 per month, use the APR formula to calculate what annual percentage rate he is paying on the loan. (Round your answer to two decimal places)arrow_forwardOn October 5, Tristan Sandino borrowed $3,050 to buy an English bulldog. The loan carried a rate of 4% and Tristan agreed to pay a maximum of $105 in interest. What is the maturity date of this loan? Assume a 365-day year. Express your answer as month and day.arrow_forwardElijah took out a mortgage of $672,000 for a house and just made the 113th end of month payment. Interest on the loan was 3.88% compounded monthly and the mortgage has a period of 20 years. Round ALL answers to two decimal places if necessary. 1) What are his monthly payments? P/Y = I/Y = % BAL= $ positive value) C/Y = (enter a PV = $ PMT = $ N = 2) What is his current outstanding balance after the 113th payment? FV = $arrow_forward

- A family has a $105,613, 30-year mortgage at 6.3% compounded monthly. Find the monthly payment. Also find the unpaid balance after the following periods of time. (A) 10 years (B) 20 years (C) 25 yearsarrow_forwardMarcel Thiessen purchased a home for $205, 700 and obtained a 15-year, fixed - rate mortgage at 10% after paying a down payment of 10%. Of the first month's mortgage payment, how much is interest and how much is applied to the principal? (Round your answer to the nearest cent.)arrow_forwardTim Houston purchased a wall unit for $2,200. He made a $800 down payment and financed the balance with an installment loan for 48 months. If Tim's payments are $43.50 per month, use the APR formula to calculate what annual percentage rate he is paying on the loan. (Round your answer to two decimal places.)arrow_forward

- Tim Houston purchased a wall unit for $2,400. He made a $800 down payment and financed the balance with an installment loan for 48 months. If Tim's payments are $43.50 per month, use the APR formula to calculate what annual percentage rate he is paying on the loan. (Round your answer to two decimal places.)arrow_forwardOn September 1, the home mortgage balance was $262,000 for the home owned by Kim Thompson. The interest rate for the loan is 8 percent. Assuming that Kim makes the September monthly mortgage payment of $2620 , calculate the following: (a) The amount of interest included in the September payment (round your answer to the nearest cent). (b) The amount of the monthly mortgage payment that will be used to reduce the principal balance. (c) The new balance after Kim makes this monthly mortgage payment.arrow_forwardBilbo Baggins has just purchased a home and taken out a $400,000 mortgage. The mortgage has a 30-year term with monthly payments and has an APR of 5.4%. Compute Bilbo's monthly payments.arrow_forward

- Ivan is looking to purchase a home that costs $ 160,000. The interest rate is currently at 3.7%. Use the monthly payment formula below to find Ivan's monthly mortgage payment for the next 30 years. M = P)(1+)¹²t (1+)12t_1 Emilio's savings account had a balance of $621.96 at the end of July. During August, he made three savings account deposits of $83.11, $52.89, and $307.84 and one withdrawal of $129.00. At the end of August his account earned $11.50 in interest. Will Emilio meet his savings account goal of $1,000 by September 1st?arrow_forwardJohn Mayer Inc. purchases a house for $500,000. On January 1, He makes a 20 percent down-payment and gets a 30 year fixed mortgage with a 3.6 percent annual interest rate (i.e., he borrows 400,000). What are his monthly mortgage payments on the house if the first mortgage payment happens on January 31? Hint, this means interest compounds monthly.arrow_forwardLoretta bought a home for $210,000 with a down payment of $30,000. Her rate of interest is 5 5/8% for 15 years. Calculate Loretta's payment per $1000 and her monthly mortgage payment. Round "payment per $1,000" to five decimal places. Round "monthly mortgage payment " to the nearest cent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education