FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

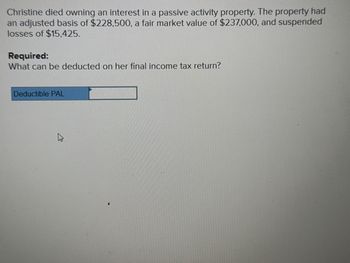

Christine died owning an interest in a passive activity property. The property had an adjusted basis of $228,500, a fair market value of $237,000, and suspended losses of $15,425 .

What can be deducted on her final income tax return?

Transcribed Image Text:Christine died owning an interest in a passive activity property. The property had

an adjusted basis of $228,500, a fair market value of $237,000, and suspended

losses of $15,425.

Required:

What can be deducted on her final income tax return?

Deductible PAL

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rachel, a single taxpayer, operates a construction business as a sole proprietor. This year, Rachel earned $225,000 of qualified business income after paying $40,000 of wages to her employees. The unadjusted basis of her business property totals $10,000. Rachel's taxable income before the deduction for qualified business income is $212,300. What is the amount of her QBI deduction? Group of answer choices $25,000 $15, 100 $29,900 $42,460 $45,000arrow_forwardEva received $60,000 in compensation payments from JAZZ Corp. during 2020. Eva incurred $5,000 in business expenses relating to her work for JAZZ Corp. JAZZ did not reimburse Eva for any of these expenses. Eva is single and she deducts a standard deduction of $12,400. Based on these facts, answer the following questions: Use Tax Rate Schedule for reference. (Leave no answer blank. Enter zero if applicable.) c. Assume that Eva is considered to be a self-employed contractor. What is her self-employment tax liability and additional Medicare tax liability for the yeararrow_forwardIn 2006, Douglas purchased an office building for $500,000 to be used in his business. He sells the building in the current tax year. Explain whether his recognized gain or loss for regular income tax purposes will be different from his recognized gain or loss for AMT purposes.arrow_forward

- Yancy's personal residence is condemned as part of an urban renewal project. His adjusted basis for the residence is $572,600. He receives condemnation proceeds of $543,970 and invests the proceeds in stocks and bonds. If an amount is zero, enter "0". a. Calculate Yancy's realized and recognized gain or loss. Yancy's realized loss is $________________, and Yancy's recognized loss is $_________________. b. If the condemnation proceeds are $598,367, what are Yancy's realized and recognized gain or loss? Yancy's realized gain is $_______________, and Yancy's recognized gain is $_______________. c. Assume the house is rental property. Yancy's adjusted basis is $572,600 and he receives condemnation proceeds of $543,970 and invests the proceeds in stock. What are Yancy's realized and recognized gain or loss? Yancy's realized loss is $______________, and Yancy's recognized loss is $________________arrow_forwardCandace is claimed as a dependent on her parent's tax return. In 2020, Candace received $5,000 of interest income from corporate bonds she obtained several years ago. This is her only source of income. She is 15 years old at year-end. What is her gross tax liability? (Use Tax Rate Schedule, Standard deduction, Estates and Trusts.arrow_forwardMartha has a net capital loss of $17,000 and other ordinary taxable income of $45,000 for the current year. What is the amout of Marth's capital loss carryover?arrow_forward

- Lena is a sole proprietor. In April of this year, she sold equipment purchased four years ago for $42,000 with an adjusted basis of $25,200 for $27,720. Later in the year, Lena sold another piece of equipment purchased two years ago with an adjusted basis of $12,600 for $8,190. What are the tax consequences of these tax transactions? Lena has an ordinary gain Lena has a § 1231 loss of $ ✔ of $ X from the sale of the first equipment. X from the sale of the second equipment.arrow_forwardMarilyn owns land that she acquired three years ago as an investment for $250,000. She sells the land two years later for $300,000. How does the "recovery of capital doctrine" apply in computing Marylyn's gain or loss from the sales transaction? What is the correlation between "adjusted basis" and the "recovery of capital doctrine? Give an example how this doctrine prevents income from being taxes more than once.arrow_forwardJackie qualified as Head of Household for 2020 tax purposes. Jackie's 2020 taxable income was $100,000, exclusive of capital gains and losses. Quinn had a net long-term capital loss of $8,000 and a net short-term capital gain of $6,000 in 2020. What amount can she offset against 2021 ordinary income?arrow_forward

- Julia has invested her profits from the last several years with BF Dutton, Inc. and has provided the Forms 1099 INT and 1099DIV for 2022 for her investment income. She has no other income for 2022 and did not receive any Forms 1099 B. Julia's Taxable Income for 2022 is: $216, 736 $267,848 $270,442 $218, 811arrow_forwardAram's taxable income before considering capital gains and losses is $82,000. Determine Aram's taxable income and how much of the income will be taxed at ordinary rates in each of the following alternative scenarios (assume Aram files as a single taxpayer) Required: a. Aram sold a capital asset that he owned for more than one year for a $5,440 gain, a capital asset that he owned for more than one year for a $720 loss, a capital asset that he owned for six months for a $1,640 gain, and a capital asset he owned for two months for a $1,120 loss. b. Aram sold a capital asset that he owned for more than one year for a $2.220 gain, a capital asset that he owned for more than one year for a $2,940 loss, a capital asset that he owned for six months for a $420 gain, and a capital asset he owned for two months for a $2.340 loss c. Aram sold a capital asset that he owned for more than one year for a $2.720 loss, a capital asset that he owned for six months for a $4,640 gain, and a capital asset…arrow_forwardNicole purchased new equipment for her business on February 1, 2022. The equipment cost $32,925. She did not place any other property in service. What amount may Nicole deduct under Section 179 in in the current tax year and what is the basis of her equipment on January 1 of the following tax year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education