FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

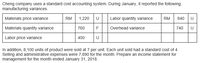

Transcribed Image Text:Cheng company uses a standard cost accounting system. During January, it reported the following

manufacturing variances.

Materials price variance

RM

1,220

U

Labor quantity variance

RM

840

U

Materials quantity variance

760

Overhead variance

740

U

Labor price variance

450

U

In addition, 8,100 units of product were sold at 7 per unit. Each unit sold had a standard cost of 4.

Selling and administrative expenses were 7,890 for the month. Prepare an income statement for

management for the month ended January 31, 2018.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following labor standards have been established for a particular product: Standard labor-hours per unit of output Standard labor rate 9.1 hours $ 17.10 per hour The following data pertain to operations concerning the product for the last month: Actual hours worked Actual total labor cost Actual output 10,100 hours $ 169,680 What is the labor rate variance for the month? 1,000 unitsarrow_forwardThe following data were taken from the records of Griggs Company for December: Cost Category Dollar Amount Administrative expenses $110,000 Cost of goods sold at standard 540,000 Direct materials price variance (unfavorable) 1,650 Direct materials quantity variance (favorable) (540) Direct labor rate variance (favorable) (1,120) Direct labor time variance (unfavorable) 420 Variable factory overhead controllable variance (favorable) (210) Fixed factory overhead volume variance (unfavorable) 3,080 Interest expense 2,070 Sales 869,000 Selling expenses 125,000 Prepare an income statement for presentation to management.arrow_forwardSubject:arrow_forward

- Lewis Company's standard labor cost of producing one unit of Product DD is 3.20 hours at the rate of $12.50 per hour. During August, 42,600 hours of labor are incurred at a cost of $12.65 per hour to produce 13,200 units of Product DD. (a) Compute the total labor variance. Total labor variance (b) Compute the labor price and quantity variances. Labor price variance Labor quantity variance (c) $ Labor price variance $ Compute the labor price and quantity variances, assuming the standard is 3.50 hours of direct labor at $12.85 per hour. $ > Labor quantity variance $ <arrow_forwardThe following data were taken from the records of Griggs Company for December: Administrative expenses $100,800 Cost of goods sold (at standard) 550,000 Direct materials price variance—unfavorable 1,680 Direct materials quantity variance—favorable (560) Direct labor rate variance—favorable (1,120) Direct labor time variance—unfavorable 490 Variable factory overhead controllable variance—favorable (210) Fixed factory overhead volume variance—unfavorable 3,080 Interest expense 2,940 Sales 868,000 Selling expenses 125,000 Prepare an income statement for presentation to management. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. If an amount box does not require an entry leave it blank. Griggs Company Income Statement For the Month Ended December 31 $ $ Unfavorable Favorable Variances from standard cost: $ $…arrow_forwardThe standard cost of product 2525 includes 4.10 hours of direct labour at $14.40 per hour. The predetermined overhead rate is $21.60 per direct labour hour. During July, the company incurred 11,170 hours of direct labour at an average rate of $14.80 per hour and $237,012 of manufacturing overhead costs. It produced 2,700 units. (a) Calculate the total, price, and quantity variances for labour. (Round per unit calculations to 2 decimal places, e.g. 1.25 and final answers to O decimal places, e.g. 125.) Total labour variance Labour price variance Labour quantity variance eTextbook and Media Save for Later tA $ $ +A ta $ Favourable Unfavourable Neither favourable nor unfavourable Attempts: 0 of 3 used Submit Answerarrow_forward

- Chulak Company uses a standard costing system. The following data are available for the month: Actual quantity of direct materials purchased 25,000 pounds Standard price of direct materials $2 per pound Material price variance $2,500 unfavorable The actual price per pound of direct materials purchased during the month isarrow_forwardIn October, Pine Company reports 21,000 actual direct labor hours, and it incurs $118,000 of manufacturing overhead costs. Standard hours allowed for the work done is 20,600 hours. The predetermined overhead rate is $6.00 per direct labor hour. In addition, the flexible manufacturing overhead budget shows that budgeted costs are $4 variable per direct labor hour and $50,000 fixed. Compute the overhead controllable variance. Overhead Controllable Variance $ 5600 Favorable 23arrow_forwardThe following materials standards have been established for a particular product: Standard quantity per unit of output Standard price 4.9 pounds $13.70 per pound The following data pertain to operations concerning the product for the last month: Actual materials purchased Actual cost of materials purchased Actual materials used in production Actual output 5,550 pounds $63,380 5,050 pounds 750 units The direct materials purchases variance is computed when the materials are purchased. What is the materials quantity variance for the month? Multiple Choice $5,710 U $15,702 U $18,838 U $6,850 Uarrow_forward

- Douglas Inc. has provided the following data concerning one of the products in its standard cost system. Standard Quantity or Hours per Unit of Output 0.70 hours Inputs Direct labor Standard Price or Rate $20.40 per hour The company has reported the following actual results for the product for January: Actual output 5,100 units 3,380 hours. Actual direct labor-hours Actual direct labor cost The labor efficiency variance for the month is closest to: O $3,876 U O $4.199 F O $4,199 U O $3,876 F $ 74,698arrow_forwardSheridan Company's standard labor cost per unit of output is $22.00 (2.00 hours x $11 per hour). During August, the company incurs 2.420 hours of direct labor at an hourly cost of $12.10 per hour in making 1,100 units of finished product. Compute the total, price, and quantity labor variances. (Round answers to 2 decimal places, e.g. 52.75.) Total labor variance Labor price variance $ $ Labor quantity variance $ Unfavorable Unfavorable Unfavorable Varrow_forwardPlease help me with show all calculation thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education