Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

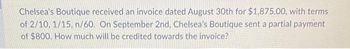

Transcribed Image Text:Chelsea's Boutique received an invoice dated August 30th for $1,875.00, with terms

of 2/10, 1/15, n/60. On September 2nd, Chelsea's Boutique sent a partial payment

of $800. How much will be credited towards the invoice?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- n March 1, Terrell & Associates provides legal services to Whole Grain Bakery regarding some recent food poisoning complaints. Legal services total $11,000. In payment for the services, Whole Grain Bakery signs a 9% note requiring the payment of the face amount and interest to Terrell & Associates on September 1. Required: For Terrell & Associates, record the acceptance of the note receivable on March 1 and the cash collection on September 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardAn invoice for $12,000 arrived on Sept. 26, w/ terms 3/7, 2/30, n/60. A second invoice for $93,000 arrived on Sept. 29, w/ terms 5/7, 1/30, n/60. You paid $10,000 on Oct. 1. How much do you have to pay today to settle the invoices?arrow_forwardI need to know how to record this transaction in a general journal. 1/18 Received $8,000 the January telephone bill from At&t for $375, due Feb.15. 1/20 Received utility bills for January due Feb 16, from Swepco for $360 and Tx Water Utilities for $280.arrow_forward

- Paper Company receives a $6,000, 3-month, 6% promissory note from Dame Company in settlement of an open accounts receivable. What entry will Paper Company make upon receiving the note?arrow_forwardA local company received an invoice for $3,647.00 dated March 8 with terms 2/10, n/30. The company paid the bill March 15. What amount should be paid?arrow_forwardLone Star Company received a 90-day, 6% note for $80,000, dated March 12 from a customer on account. (Assume a 360-day year when calculating interest.) a. Determine the due date of the note. b. Determine the maturity value of the note. c. Journalize the entry to record the receipt of the payment of the note at maturity. If an amount box does not require an entry, leave it blank. June 10arrow_forward

- On March 1, Terrell & Associates provides legal services to Whole Grain Bakery regarding some recent food poisoning complaints. Legal services total $11,000. In payment for the services, Whole Grain Bakery signs a 9% note requiring the payment of the face amount and interest to Terrell & Associates on September 1. Required: For Terrell & Associates, record the acceptance of the note receivable on March 1 and the cash collection on September 1.arrow_forwardPlease see below. I need help with the part a2.arrow_forwardAn invoice for a laptop computer that costs $625.68 is dated September 15, with sales terms of 3/10 EOM. When must the invoice be paid to take advantage of the discount?arrow_forward

- You received an invoice dated April 20th in the amount of $14,200 with terms 5/15, 1/30, n/40, 2.8% penalty per month for late payments. The merchandise is received on May 9th. You sent in a partial payment of $7,100 on May 15th with the intention to pay the remaining balance before the credit period expired. However, you forgot about the invoice and realized your mistake on June 29th, when you submit payment in full for the invoice. What amount is the final payment?arrow_forwardA furniture store received an invoice from a supplier for $12282 dated July 13, 2022 with terms 5/10, 2/20, n/60. A partial payment, in the amount of $5373 is made on July 20. What amount is credited to the account? Boyd Industries received an invoice dated September 4, 2021 with terms 2.5/10, n/30. The amount stated on the invoice was $6386. What is the amount due on September 10 if the invoice is to be paid in full? A set of weights has a list price of $97. If discounts of 14%, 10% and 3% are offered, what is the single equivalent discount rate (SEDR) that was given? Write your final answer as a percent rounded to 2 decimal places. A microwave oven has a list price of $93 less discounts of 16%, 5% and 2%. What is the net price of the microwave oven? Beatles Office Products bought a desk for $735 and plans a mark up of $626. During a clearance sale, they decided to mark down the regular selling price of the desk by 16%. What was the clearance sale price of the desk?…arrow_forwardSunshine Service Center received a 120-day, 6% note for $40,000, dated April 12 from a customer on account. Assume 360 days per year. a. Determine the due date of the note. b. Determine the maturity value of the note. When required, round your answers to the nearest dollar.$fill in the blank df5724f79f8d02f_2 c. Journalize the entry to record the receipt of the payment of the note at maturity. If an amount box does not require an entry, leave it blank. Aug. 10 Cash Cash Note Receivable Note Receivable Interest Revenue Interest Revenuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education