Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

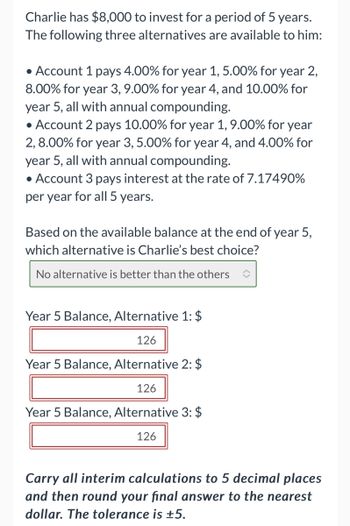

Transcribed Image Text:Charlie has $8,000 to invest for a period of 5 years.

The following three alternatives are available to him:

• Account 1 pays 4.00% for year 1, 5.00% for year 2,

8.00% for year 3, 9.00% for year 4, and 10.00% for

year 5, all with annual compounding.

• Account 2 pays 10.00% for year 1, 9.00% for year

2, 8.00% for year 3, 5.00% for year 4, and 4.00% for

year 5, all with annual compounding.

• Account 3 pays interest at the rate of 7.17490%

per year for all 5 years.

Based on the available balance at the end of year 5,

which alternative is Charlie's best choice?

No alternative is better than the others

Year 5 Balance, Alternative 1: $

126

Year 5 Balance, Alternative 2: $

126

Year 5 Balance, Alternative 3: $

126

Carry all interim calculations to 5 decimal places

and then round your final answer to the nearest

dollar. The tolerance is ±5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Andy borrowed P9000 from Randy today and P12000 two years after and made a partial payment of P7000 one year after. It was agreed that the balance of the loan would be amortized by two payments on the 4th and 5th year from the start of transaction, the second being 50% larger than the first, if the interest rate is 12%, what is the amount of each payment?arrow_forwardMichael needs an investment loan. He gets a simple interest amortized loan for $12,000 at 9 % for four years. Find the total interest that will be paid over the life of the loan.arrow_forwardAndy invested a certain amount of money which he saves in account that earns 4% per year, compounded annually over a 15-year period. Starting in year 16, he begins making equal annual withdrawals $3500 for thenext 10 years. Assuming Andy's account is fully depleted after making these withdrawals, what is the amount invested in the account initially?arrow_forward

- A.Jenevive who is in the 36 percent tax bracket can earn 9 percent annually on her investments in a tax-exempt IRA account (Individual Retirement). What will be the value of a one-time ₱10,000 investment in 5 years? 10 years? 20 years? (assume annual compounding interest) Please answer immediately thank you :)arrow_forwardOmar was given $1,000,000 on his 2nd birthday. The money is put into an account that pays 4% compounded annually. If he takes the money in 50 equal annual payments with the first when he turns 30 years old, then what is the size of each?arrow_forwardVanessa was supposed to make a payment of $3,500 in 2 years and another payment for $1,800 in 5 years to Loon Company as part of a payment plan. Instead, he is trying to reach an agreement with the company where he would pay an upfront amount now, and an amount of $1,600 in 4 years. Assume that money is worth 8.40% compounded quarterly. a. Calculate the equivalent value of the $3,500 payment and the $1,800 payment today. Round to the nearest cent b. Calculate the upfront amount that he should pay under the alternative payment agreement so that the payments are equivalent. Round to the nearest cent.arrow_forward

- Abel wants to determine the amount of money he would obtain from the interest of PHP 2,000 at 16% compounded quarterly for 5 years. How much will she receive?arrow_forwardAli deposits BD 2,500 in a savings account that pays interest at the rate of 5.5% per year, compounded annually. If all of the money is allowed to accumulate, how much money will the student have after 14 years?arrow_forwardKarl borrows P200,000 and agrees to pay the principal and interest by making equal payments at the end of every 6 months for 4 years. Find his semi annual payments if the lender charges 12% compounded semi annually.arrow_forward

- Jeffery Johnson is saving $1,450,000 per year in a savings account that is paying annual compound interest of 6%. He intends to continue this for three years after which he will move it to JMMB’s long term fund which pays interest of 8% per annum compounded semi-annually. i. How much would he be able to transfer to JMMB after 3 years? ii. How much money will he have at the end of 8 years from today?arrow_forwardHui deposits $800 at the end of every 3 months in an RRSP that is earning 5.10% compounded semi-annually. For the RRSP to accumulate to $33,000, calculate the following: a. How many deposits will he have to make? b. How long will he have to make these deposits? (Years & Months)arrow_forwardJim has an annual income of $240,000. Jim is looking to buy a house with monthly property taxes of $140 and monthly homeowner’s insurance of $70. Jim has $178 in monthly student loan payments. Apple bank has a maximum front end DTI limit of 28% and a maximum back end DTI limit of 36%. Both limits must be satisfied. Apple bank is offering a fully amortizing 30 year FRM at an annual rate of 4.5%, with monthly payments, compounded monthly. What is the biggest loan Jim can get?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education