Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

What is the direct materials quantity variance on these general accounting question?

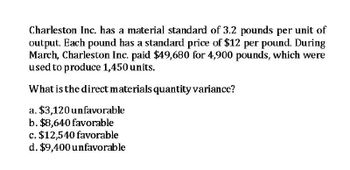

Transcribed Image Text:Charleston Inc. has a material standard of 3.2 pounds per unit of

output. Each pound has a standard price of $12 per pound. During

March, Charleston Inc. paid $49,680 for 4,900 pounds, which were

used to produce 1,450 units.

What is the direct materials quantity variance?

a. $3,120 unfavorable

b. $8,640 favorable

c. $12,540 favorable

d. $9,400 unfavorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forwardApril Industries employs a standard costing system in the manufacturing of its sole product, a park bench. They purchased 60,000 feet of raw material for $300,000, and it takes S feet of raw materials to produce one park bench. In August, the company produced 10,000 park benches. The standard cost for material output was $100,000, and there was an unfavorable direct materials quantity variance of $6,000. A. What is April Industries standard price for one unit of material? B. What was the total number of units of material used to produce the August output? C. What was the direct materials price variance for August?arrow_forwardKavallia Company set a standard cost for one item at 328,000; allowable deviation is 14,500. Actual costs for the past six months are as follows: Required: 1. Calculate the variance from standard for each month. Which months should be investigated? 2. What if the company uses a two-part rule for investigating variances? The allowable deviation is the lesser of 4 percent of the standard amount or 14,500. Now which months should be investigated?arrow_forward

- Eagle Inc. uses a standard cost system. During the most recent period, the company manufactured 115,000 units. The standard cost sheet indicates that the standard direct labor cost per unit is $1.50. The performance report for the period includes an unfavorable direct labor rate variance of $3,700 and a favorable direct labor time variance of $10,275. What was the total actual cost of direct labor incurred during the period?arrow_forwardDirect materials variances Bellingham Company produces a product that requires 2.5 standard pounds per unit. The standard price is 3.75 per pound. If 15,000 units used 36,000 pounds, which were purchased at 4.00 per pound, what is the direct materials (A) price variance, (B) quantity variance, and (C) cost variance?arrow_forwardRefer to Cornerstone Exercise 8.13. In March, Nashler Company produced 163,200 units and had the following actual costs: Required: 1. Prepare a performance report for Nashler Company comparing actual costs with the flexible budget for actual units produced. 2. What if Nashler Companys actual direct materials cost were 1,175,040? How would that affect the variance for direct materials? The total cost variance?arrow_forward

- Please provide correct answer ...arrow_forwardThe standard and actual prices per pound of raw material are $4.00 and $4.50,respectively. A total of 10,500 pounds of raw material was purchased and then usedto produce 5,000 units. The quantity standard allows two pounds of the raw materialper unit produced. What is the materials quantity variance?a. $5,000 unfavorableb. $5,000 favorablec. $2,000 favorabled. $2,000 unfavorablearrow_forwardNeed answerarrow_forward

- Primary Co. has a standard materials price of $4.00 per pound and a standard direct labor rate of $18.00 per hour. Primary's actual direct materials price was $4.10 per pound and paid direct labor of $17.50 per hour. Assume an actual materials usage of 26,000 pounds and actual labor totaling 8,000 hours. A. Calculate the direct materials price variance. Indicate whether the variance is favorable or unfavorable. B. Calculate the direct labor rate variance. Indicate whether the variance is favorable or unfavorable.arrow_forwardprovide correct answerarrow_forwardThe actual cost of direct materials is $55.75 per pound. The standard cost per pound is $60.50. During the current period, 6,100 pounds were used in production. The standard quantity for actual units produced is 5,700 pounds. How much is the direct materials price variance? A. $27,075 unfavorable B. $28,975 unfavorable C. $28,975 favorable D. $27,075 favorablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub