FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:11:29 AM

oi o years and the estimated residual value is F000,000.

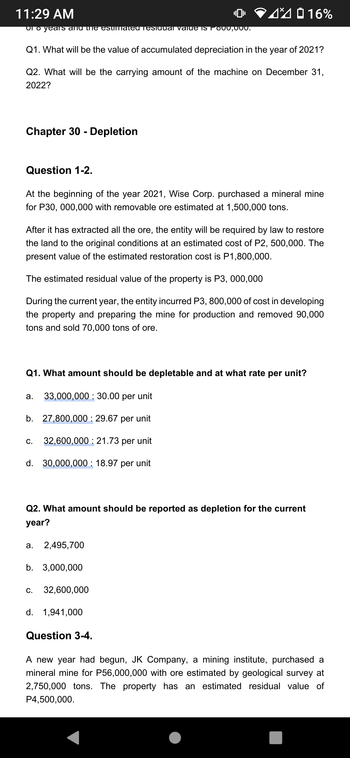

Q1. What will be the value of accumulated depreciation in the year of 2021?

Q2. What will be the carrying amount of the machine on December 31,

2022?

Chapter 30 - Depletion

Question 1-2.

At the beginning of the year 2021, Wise Corp. purchased a mineral mine

for P30,000,000 with removable ore estimated at 1,500,000 tons.

After it has extracted all the ore, the entity will be required by law to restore

the land to the original conditions at an estimated cost of P2, 500,000. The

present value of the estimated restoration cost is P1,800,000.

The estimated residual value of the property is P3,000,000

During the current year, the entity incurred P3, 800,000 of cost in developing

the property and preparing the mine for production and removed 90,000

tons and sold 70,000 tons of ore.

Q1. What amount should be depletable and at what rate per unit?

33,000,000 30.00 per unit

b. 27,800,000: 29.67 per unit

32,600,000: 21.73 per unit

d. 30,000,000: 18.97 per unit

a.

C.

Q2. What amount should be reported as depletion for the current

year?

a. 2,495,700

416%

b. 3,000,000

C.

32,600,000

d. 1,941,000

Question 3-4.

A new year had begun, JK Company, a mining institute, purchased a

mineral mine for P56,000,000 with ore estimated by geological survey at

2,750,000 tons. The property has an estimated residual value of

P4,500,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Natural Resources The Stein Company acquires a copper mine at the cost of $950,000 on January 1. Along with the purchase price Stein pays additional costs associated with development of $75,000. Stein expects the mine will have a salvage value of $125,000 once all the copper has been mined. Best estimates are that the mine contains 300,000 tons of ore. Required a. Prepare the entry to record the purchase of the copper mine. b. Prepare the December 31 year-end adjusting entry to record depletion is 40,000 tons of ore are mined and all the ore is sold. c. Prepare the December 31 year-end adjusting entry to record depletion if 40,000 tons of ore are mined but only 10,000 tons of the ore are sold. Description Debit Credit a. Purchase of Copper mine b. To record depletion on Copper mine. c. Copper inventory To record depletion on Copper mine.arrow_forwardMCQ3 Smitty Inc. wishes to use the revaluation model for this property: Before Revaluation • Building Gross Value 120,000 • Building Accumulated Depreciation 40,000 • Net carrying value 80,000 The fair value for the property is $150,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the Accumulated Depreciation account, if Smitty chooses to use the proportional method to record the revaluation?arrow_forward4 02:59:09 Perez Company acquires an ore mine at a cost of $2,240,000. It incurs additional costs of $627,200 to access the mine, which is estimated to hold 1,600,000 tons of ore. 210,000 tons of ore are mined and sold the first year. The estimated value of the land after the ore is removed is $320,000. Calculate the depletion expense from the information given. 1. & 2. Prepare the entry to record the cost of the ore mine and year-end adjusting entry. Complete this question by entering your answers in the tabs below. eBook Depletion Expense General Journal Calculate the depletion expense from the information given. Note: Round "Depletion per unit" to 3 decimal places. Cost Salvage Amount subject to depletion Total units of capacity Depletion per unit Units extracted and sold in period Depletion expense Help Save &arrow_forward

- VIEW PUncles Current Attempt in Progress On December 31, 2025, Vaughn Inc. has a machine with a book value of $1,222,000. The original cost and related accumulated depreciation at this date are as follows. Machine Less: Accumulated depreciation Book value (a) $1,690,000 Depreciation is computed at $78,000 per year on a straight-line basis. Presented below is a set of independent situations. For each independent situation, indicate the journal entry to be made to record the transaction. Make sure that depreciation entries are made to update the book value of the machine prior to its disposal. Date 468,000 Aug. 31, 2026 $1,222,000 A fire completely destroys the machine on August 31, 2026. An insurance settlement of $559,000 was received for this casualty. Assume the settlement was received immediately. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the…arrow_forwardplease answer question 19arrow_forwardNatural Resources The Hollister Company acquires a silver mine at the cost of $2,100,000 on January 1. Along with the purchase price Hollister pays additional costs associated with development of $50,000, Hollister expects the mine will have a salvage value of $300,000 once all the silver has been mined. Best estimates are that the mine contains 250,000 tons of ore. Required a: Prepare the entry to record the purchase of the silver mine. b. Prepare the December 31 year-end adjusting entry to record depletion is 60,000 tons of ore are mined and all the ore is sold, c. Prepare the December 31 year-end adjusting entry to record depletion is 60,000 tons of ore are mined but only 15,000 tons of the are are sold Description Credit 4 # Purchase of silver mine # = To record depletion on silver mine Siver inventory To record depletion on silver mine Debitarrow_forward

- Haresharrow_forwardProblem J: On January 1, 2021, the Reddick Company purchased a mining right for P30,000,000. The mine's recoverable ore reserves are estimated to be 4,000,000 tons. Following the extraction of all ore, the company will be obligated by law to return the land to its original state. The present value of the restoration cost is P2,000,000. The company estimated that the property may be sold for P5,000,000. At a cost of P6,000,000, roads were built and other development costs were invested to aid in the extraction and transportation of the mined ore in early 2021. 200,000 tons of ore were extracted and sold in 2021. A new study conducted by a new mining engineer on December 31, 2022, revealed that 5,000,000 tons of ore were available for mining. 225,000 tons of ore were mined and sold in 2022. How much depletion expense should be recognized in 2022?arrow_forwardQw.25.arrow_forward

- Required information [The following information applies to the questions displayed below.] Montego Production Company is considering an investment in new machinery for its factory. Various information about the proposed investment follows: Initial investment Useful life Salvage value Annual net income generated Montego's cost of capital Assume straight line depreciation method is used. Help Montego evaluate this project by calculating each of the following: $ 860,000 6 years Net Present Value $ 20,000 $ 66,000 11% Required: 4. Recalculate Montego's NPV assuming its cost of capital is 12 percent. (Future Value of $1, Present Value of $1. Future Value Annuity of $1, Present Value Annuity of $1.) Note: Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places.arrow_forwardPlease do not give solution in image format thankuarrow_forwardam. 105.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education