FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Chapter 17 Homework

Concentrate

Water

Sugar

Bottles

Flavor changeover

Conversion cost

Total cost transferred to finished goods

Number of cases

Cola

Lemon-Lime

Root Beer

$

per case

per case

Orange

2,500 60,000

50,000

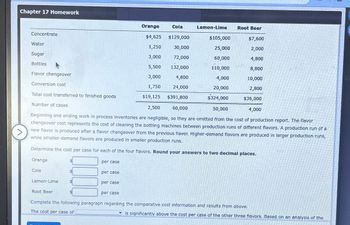

Beginning and ending work in process inventories are negligible, so they are omitted from the cost of production report. The flavor

changeover cost represents the cost of cleaning the bottling machines between production runs of different flavors. A production run of a

new flavor is produced after a flavor changeover from the previous flavor. Higher-demand flavors are produced in larger production runs,

while smaller-demand flavors are produced in smaller production runs.

>

Determine the cost per case for each of the four flavors. Round your answers to two decimal places.

Orange

per case

Cola

$4,625 $129,000

1,250

30,000

3,000

72,000

5,500

132,000

3,000

4,800

1,750

24,000

$19,125

$391,800

Lemon-Lime

$105,000

25,000

60,000

110,000

4,000

20,000

$324,000

Root Beer

$7,600

2,000

4,800

8,800

10,000

2,800

$36,000

4,000

per case

Complete the following paragraph regarding the comparative cost information and results from above.

The cost per case of

is significantly above the cost per case of the other three flavors. Based on an analysis of the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 5 part 1arrow_forwardChapter 6 question 8 Please help with part A-D Sheffield Construction Consultants performs cement core tests in its Greenville laboratory. The following standard costs for the tests have been developed by the company’s controller, Landon Sheffield, based on performing 2,100 core tests per month. Standard Price Standard Quantity Standard Cost Direct materials $0.50 per pound 5 pounds $2.50 Direct labor $10 per DLH 0.50 DLH 5.00 Variable overhead $9 per DLH 0.50 DLH 4.50 Fixed overhead $16 per DLH 0.50 DLH 8.00 Total standard cost per test $20.00 At the end of March, London reported the following operational results: ● The company actually performed 2,280 core tests during the month. ● 8,500 pounds of direct materials were purchased during the month at a total cost of $5,700. ● 6,200 pounds of direct materials were used to conduct the core tests. ●…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Indicator ' A 16 17 18 19 20 (1) $126,000 105,000 84,000 $200,000 D (2) $150,000 128,000 22,000 $138,000 E 1 2 Required: 3 Determine the missing amount for each separate situation involving work in process cost flows. 4 5 6 Total manufacturing costs 7 Work in process inventory, beginning 8 Work in process inventory, ending 9 Cost of goods manufactured 10 11 12 13 Students: The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work. 14 Nothing in this area will be graded, but it will be submitted with your assignment. 15 (3) $217,000 32,000 185,000 $237,000 F G H 1 Jarrow_forwardpe 20-3barrow_forwardProblem 20-5AA FIFO: Process cost summary; equivalent units; cost estimates LO C3, C4, P4 Skip to question [The following information applies to the questions displayed below.] Tamar Co. manufactures a single product in two departments. All direct materials are added at the beginning of the Forming process. Conversion costs are added evenly throughout the process. During May, the Forming department started 32,400 units, and transferred 34,200 units of product to the Assembly department. Its 5,400 units of beginning work in process consisted of $92,880 of direct materials and $768,708 of conversion costs. It has 3,600 units (100% complete with respect to direct materials and 80% complete with respect to conversion) in process at month-end. During the month, $784,080 of direct materials costs and $3,495,492 of conversion costs were charged to the Forming department. The following additional information is available for the Forming department. Beginning work in process consisted of…arrow_forward

- 5 part 2arrow_forwardAssignment Ch 4 еBook Print Item Activity-Based Costing and Product Cost Distortion Four Finger Appliance Company manufactures small kitchen appliances. The product line consists of blenders and toaster ovens. Four Finger Appliance presently uses the multiple production department factory overhead rate method. The factory overhead is as follows: Assembly Department $186,000 Test and Pack Department 120,000 Total $306,000 The direct labor information for the production of 7,500 units of each product is as follows: Assembly Department Test and Pack Department Blender 750 dlh 2,250 dlh Toaster oven 2,250 750 Total 3,000 dlh 3,000 dlh Four Finger Appliance used direct labor hours to allocate production department factory overhead to products. The management of Four Finger Appliance Company has asked you to use activity-based costing to allocate factory overhead costs to the two products. You have determined that $81,000 of factory overhead from each of the production departments can be…arrow_forwardQuestion z Answer saved Cost Formulas Marked out of 1.45 Material A Material B Material C Cutting labor Shaping labor Finishing labor Hag question $25/pound $100/gallon $45/hour $55/hour $60/ hour Saved to this PC Shorewood Manufacturing produces a single product requiring the following directmaterial and direct labor: Cost per Unit of Input Required Amount per Unit of Product $40 / pound 10 ounces Homework 6 8 ounces 0.3 gallon 30 minutes 15 minutes 45 minutes Variable Manufacturing overhead consists of indirect material, $0.60 per unit of product; indirect labor, $1,000 per month plus $0.70 per unit of product; factory maintenance, $14,000 per year plus $0.55 per unit of product; factory depreciation, $15,000 per year; and annual factory property taxes, $8,000. Selling and administrative expenses include the salaries of a sales manager, $30,000 per year; an office manager, $18,000 per year; and two salespersons, each of whom is paid a base salary of $11,000 per year and a commission…arrow_forward

- Unit 6 - Chapter 9 Assignment i 13 Part 13 of 15 10 points Required information Saved [The following information applies to the questions displayed below.] Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 6 pounds at $9.00 per pound Direct labor: 3 hours at $15 per hour 02:28:35 Variable overhead: 3 hours at $5 per hour Total standard variable cost per unit Print $ 54.00 45.00 15.00 $ 114.00 The company also established the following cost formulas for its selling expenses: Variable Fixed Cost per Cost per Unit Sold Advertising Sales salaries and commissions Shipping expenses Month $ 260,000 $ 220,000 $ 18.00 $ 9.00 The planning budget for March was based on producing and selling 20,000 units. However, during March the company actually produced and sold 25,000 units and incurred the following costs: a. Purchased 180,000 pounds of raw…arrow_forwardHow to do?arrow_forwardE 3 Mc Graw Hill connect® Problem 20-1A Weighted average: Cost per equivalent unit; costs assigned to products P1 Victory Company uses weighted average process costing. The company has two production processes. Conversion cost is added evenly throughout each process. Direct materials are added at the beginning of the first process. Additional information for the first process follows. Beginning work in process inventory Units started this period Units completed and transferred out Ending work in process inventory C $ Check (2) Conversion cost per equivalent unit, $4.50 4 Conversion Costs added this period Direct materials % Beginning work in process inventory Direct materials Conversion Total costs to account for 5 Required 1. Compute equivalent units of production for both direct materials and conversion. 2. Compute cost per equivalent unit of production for both direct materials and conversion. Unit Oll 60,000 820,000 700,000 180,000 A 6 Direct Materials Percent Complete $ 420,000…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education