FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:K

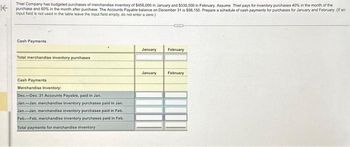

Thiel Company has budgeted purchases of merchandise inventory of $456,000 in January and $530,500 in February. Assume Thiel pays for inventory purchases 40% in the month of the

purchase and 60% in the month after purchase. The Accounts Payable balance on December 31 is $98,150. Prepare a schedule of cash payments for purchases for January and February. (If an

input field is not used in the table leave the input field empty, do not enter a zero.)

Cash Payments

Total merchandise inventory purchases

Cash Payments

Merchandise Inventory:

Dec-Dec. 31 Accounts Payable, paid in Jan.

Jan-Jan. merchandise inventory purchases paid in Jan.

Jan-Jan. merchandise inventory purchases paid in Feb.

Feb-Feb. merchandise inventory purchases paid in Feb.

Total payments for merchandise inventory

January

January

February

February

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please don't provide answer in image format thank youarrow_forwardNash Company's record of transactions concerning part X for the month of April was as follows. Purchases April 1 (balance on hand) 4 11 18 26 30 Sales 210 @ $5.20 510 @ 5.30 410 @ 5.50 April 5 27 5.60 28 310 @ 710 @ 5.80 310 @ 6.00 12 410 310 1,020 150 If the perpetual inventory record is kept in dollars, and costs are computed at the time of each withdrawal, what amount would be shown as ending inventory under (1) FIFO, (2) LIFO and (3) Average-cost? (Round average cost per unit to 4 decimal places, e.g. 2.7621 and final answers to 0 decimal places, e.g. 6,548.) Make a simple formula to find the FIFO, LIFO, & Average-Cost (nothing complicated)arrow_forward|| Cash Accounts receivable Allowance for doubtful accounts Merchandise inventory Aa $ 37,500 (dr) 126,000 (dr) 2,800 (cr) 26,250 (dr) Management has designated $37,500 as the firm's minimum monthly cash balance. Other information about the firm and its operations is as follows: a. Sales revenues of $350,000, $420,000, and $312,500 are expected for October, November, and December, respectively. All goods are sold on account. b. The collection pattern for accounts receivable is 60% in the month of sale, 39% in the month following the month of sale, and 1% uncollectible, which is set up as an allowance. c. Cost of goods sold is 60% of sales revenues. d. Management's target ending balance of merchandise inventory is 10% of the current month's budgeted cost of goods sold. e. All accounts payable for inventory are paid in the month of purchase. f. Other monthly expenses are $49,250, which includes $3,500 of depreciation and $2,000 of bad debt expense. g. In the event of a shortfall, the…arrow_forward

- Assume the perpetual inventory; system is used unless stated otherwise. Round all numbers to the nearest whole dollar unless stated otherwise. Journalizing sales transactions Journalize the following sales transactions for Antique Mall. Explanations are not required. The company estimates sales returns at the end of each month.arrow_forwardSkysong Company's record of transactions for the month of April was as follows. (b) Assuming that perpetual inventory records are kept in dollars, determine the inventory using (1) FIFO and (2) LIFO. Purchases Sales April 1 (balance on hand) 1,800 @ $5.60 April 3 1,500 @ $10.00 4 4,500 @ 5.70 9 4,200 @ 10.00 8 2,400 @ 6.00 11 1,800 @ 11.00 Inventory $ 13 3,600 @ 6.10 21 2,100 @ 6.20 27 22 23 3,600 @ 11.00 2,700 @ 12.00 eTextbook and Media 29 1,500 @ 6.40 13,800 Save for Later 15,900 (1) FIFO $ (2) LIFO 11790 Attempts: 0 of 3 used Submit Answarrow_forwardBaird Books buys books and magazines directly from publishers and distributes them to grocery stores. The wholesaler expects to purchase the following inventory: Required purchases (on account) April $ 120,000 Required A Required B Baird Books' accountant prepared the following schedule of cash payments for inventory purchases. Baird Books' suppliers require that 95 percent of purchases on account be paid in the month of purchase; the remaining 5 percent are paid in the month following the month of purchase. Required a. Complete the schedule of cash payments for inventory purchases by filling in the missing amounts. b. Determine the amount of accounts payable the company will report on its pro forma balance sheet at the end of the second quarter. Complete this question by entering your answers in the tabs below. Payment for current accounts payable Payment for previous accounts payable Total budgeted payments for inventory May $ 140,000 Complete the schedule of cash payments for…arrow_forward

- Stuart Books buys books and magazines directly from publishers and distributes them to grocery stores. The wholesaler expects to purchase the following inventory: Required purchases (on account) Stuart Books' accountant prepared the following schedule of cash payments for inventory purchases. Stuart Books' suppliers require that 95 percent of purchases on account be paid in the month of purchase; the remaining 5 percent are paid in the month following the month of purchase. Required a. Complete the schedule of cash payments for inventory purchases by filling in the missing amounts. b. Determine the amount of accounts payable the company will report on its pro forma balance sheet at the end of the second quarter. Required A Complete this question by entering your answers in the tabs below. Required B April $ 106,000 Payment for current accounts payable Payment for previous accounts payable Total budgeted payments for inventory $ Complete the schedule of cash payments for inventory…arrow_forwardRecording Sales Transactions Jeet Company and Reece Company use the perpetual inventory system. The following transactions occurred during the month of April: a. On April 1, Jeet purchased merchandise on account from Reece with credit terms of 2/10, n/30. The selling price of the merchandise was $3,100, and the cost of the merchandise sold was $2,225. b. On April 1, Jeet paid freight charges of $250 cash to have the goods delivered to its warehouse. c. On April 8, Jeet returned $800 of the merchandise. The cost of the merchandise returned was $500. d. On April 10, Jeet paid Reece the balance due. Required: Prepare the journal entries to record these transactions on the books of Reece Company. For a compound transaction, if those boxes in which no entry is required, leave the box blank. April 1 (Recorded sale on account) April 1 (Recorded cost of merchandise sold) April 8 (Record return of merchandise) April 8arrow_forwardPlease Do both questions Delphino’s has sales for the year of $127,300 and cost of goods sold of $86,700. The firm carries an average inventory of $14,300 and has an average accounts payable balance of $13,600. What is the inventory period? 81.36 days 60.20 days 58.68 days 89.02 days The Lumber Yard has projected sales for April through July of $152,400, $161,800, $189,700, and $196,400, respectively. The firm collects 52 percent of its sales in the month of sale, 46 percent in the month following the month of sale, and the remainder in the second month following the month of sale. What is the amount of the July collections? $181,508 $122,852 $189,819 $192,626arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education