Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ces

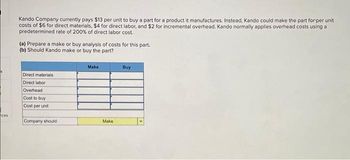

Kando Company currently pays $13 per unit to buy a part for a product it manufactures. Instead, Kando could make the part forper unit

costs of $6 for direct materials, $4 for direct labor, and $2 for incremental overhead. Kando normally applies overhead costs using a

predetermined rate of 200% of direct labor cost.

(a) Prepare a make or buy analysis of costs for this part.

(b) Should Kando make or buy the part?

Direct materials

Direct labor

Overhead

Cost to buy

Cost per unit

Company should:

Make

Make

Buy

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardKando Company currently pays $14 per unit to buy a part for a product it manufactures. Instead, Kando could make the part for per unit costs of $6 for direct materials, $4 for direct labor, and $2 for incremental overhead. Kando normally applies overhead costs using a predetermined rate of 200% of direct labor cost. (a) Prepare a make or buy analysis of costs for this part. (b) Should Kando make or buy the part? Make Buy Direct materials Direct labor Overhead Cost to buy Cost per unit Company should:arrow_forwardPlease help me. Thankyou.arrow_forward

- Xia Co. currently buys a component part for $9 per unit. Xia believes that making the part would require $6.40 per unit of direct materials and $1.05 per unit of direct labor. Xia allocates overhead using a predetermined overhead rate of 205% of direct labor cost. Xia estimates an incremental overhead rate of $0.55 per unit to make the part. 1-a. What are the relevant costs for Xia to make or buy the part? (Round your answers to 2 decimal places.) Make Buy Per Unit 1-b. Should Xia make or buy the part? O Make O Buyarrow_forwardHaver Company currently pays an outside supplier $19 per unit for a part for one of its products. Haver is considering two alternative methods of making the part. Method 1 for making the part would require direct materials of $7 per unit, direct labor of $10 per unit, and incremental overhead of $3 per unit. Method 2 for making the part would require direct materials of $7 per unit, direct labor of $4 per unit, and incremental overhead of $7 per unit. Compute the cost per unit for each alternative method of making the partarrow_forwardGelb Company currently makes a key part for its main product. Making this part incurs per unit variable costs of $1.30 for direct materials and $0.85 for direct labor. Incremental overhead to make this part is $1.44 per unit. The company can buy the part for $3.76 per unit. (a) Prepare a make or buy analysis of costs for this part. (Enter your answers rounded to 2 decimal places.) (b) Should Gelb make or buy the part? (a) Make or Buy Analysis Direct materials Direct labor Overhead Cost to buy Cost per unit Cost difference (b) Company should: Make Buyarrow_forward

- Haver Company currently pays an outside supplier $15 per unit for a part for one of its products. Haver is considering two alternative methods of making the part. Method 1 for making the part would require direct materials of $5 per unit, direct labor of $8 per unit, and ncremental overhead of $3 per unit. Method 2 for making the part would require direct materials of $5 per unit, direct labor of $2 per unit, and incremental overhead of $7 per unit. Required: 1. Compute the cost per unit for each alternative method of making the part. 2. Should Haver make or buy the part? If Haver makes the part, which production method should it use? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the cost per unit for each alternative method of making the part. Make with Method Make with 1 Method 2 Cost per unit Cost per unit Required t Buy Required 2 >arrow_forwardGelb Company currently makes a key part for its main product. Making this part incurs per unit variable costs of $1.45 for direct materials and $1.00 for direct labor. Incremental overhead to make this part is $1.50 per unit. The company can buy the part for $4.15 per unit. (a) Prepare a make or buy analysis of costs for this part. (Enter your answers rounded to 2 decimal places.) (b) Should Gelb make or buy the part? (a) Make or Buy Analysis Direct materials Direct labor Overhead Cost to buy Cost per unit Make Buy Cost difference (b) Company should:arrow_forwardHaver Company currently pays an outside supplier $33 per unit for a part for one of its products. Haver is considering two alternative methods of making the part. Method 1 for making the part would require direct materials of $14 per unit, direct labor of $17 per unit, and incremental overhead of $3 per unit. Method 2 for making the part would require direct materials of $14 per unit, direct labor of $11 per unit, and incremental overhead of $7 per unit. Required: 1. Compute the cost per unit for each alternative method of making the part. 2. Should Haver make or buy the part? If Haver makes the part, which production method should it use? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the cost per unit for each alternative method of making the part. Cost per unit Make with Method 1 Make with Method 2 Cost per unit $ 0 Required 1 $ 0 $ Buy Required 2 >arrow_forward

- Gelb Company currently makes a key part for its main product. Making this part incurs per unit variable costs of $1.40 for direct materials and $0.95 for direct labor. Incremental overhead to make this part is $1.48 per unit. The company can buy the part for $4.02 per unit. (a) Prepare a make or buy analysis of costs for this part. Note: Enter your answers rounded to 2 decimal places. (b) Should Gelb make or buy the part? (a) Make or Buy Analysis Direct materials Direct labor Overhead Cost to buy Cost per unit Cost difference (b) Company should: Make Buyarrow_forwardPaxton Company can produce a component of its product that incurs the following costs per unit: please need answer the general accounting questionarrow_forwardA company currently pays $5 per unit to buy a key part for a product it manufactures. It can make the part for $1.50 per unit for direct materials and $2.50 per unit for direct labor. The company normally allocates overhead costs at the rate of 50% of direct labor. Incremental overhead costs to make this part are $0.75 per unit. Should the company make or buy the part?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College