Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ces

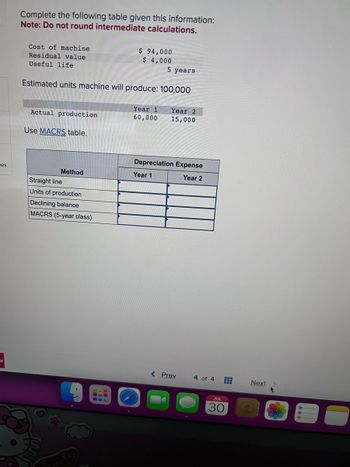

Complete the following table given this information:

Note: Do not round intermediate calculations.

Cost of machine

Residual value

Useful life

Actual production

Use MACRS table.

Estimated units machine will produce: 100,000

Method

$ 94,000

$ 4,000

Straight line

Units of production

Declining balance

MACRS (5-year class)

5 years

Year 1

60,000

Year 2

15,000

Depreciation Expense

Year 2

Year 1

< Prev

4 of 4

#

JUL

30

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Differential Analysis for Machine Replacement Proposal Franklin Printing Company is considering replacing a machine that has been used in its factory for four years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows: Old Machine Cost of machine, ten-year life $110,000 Annual depreciation (straight-line) 11,000 Annual manufacturing costs, excluding depreciation 39,100 Annual nonmanufacturing operating expenses 11,300 Annual revenue 94,600 Current estimated selling price of the machine 35,900 New Machine Cost of machine, six-year life $138,000 Annual depreciation (straight-line) 23,000 Estimated annual manufacturing costs, exclusive of depreciation 17,700 Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine. Required: 1. Prepare a differential analysis as of November 8 comparing…arrow_forwardComplete the following table given this information: Note: Do not round intermediate calculations. Cost of machine Residual value Useful life Actual production Estimated units machine will produce: 100,000 Use MACRS table. Method $ 101,800 $ 5,300 Straight line Units of production Declining balance MACRS (5-year class) 5 years Year 1 73,000 Year 2 22,000 Depreciation Expense Year 1 Year 2arrow_forwardA company uses a machine to manufacture its product. The operating results of the company for a quarter follows: Sales $2,000,000 Cost of sales 500,000 Operating expenses excluding depreciation 300,000 Depreciation of machine 260,000 1,060,000 Net income $940,000 The present operation can continue or the machine can be used to produce a new product that could produce P2,200,000 revenue per quarter. The cost to manufacture the new product plus operating expenses, exclusive of depreciation will be P800,000. Which alternative is better? Support your answer with computation.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education