FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

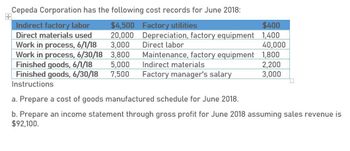

Transcribed Image Text:Cepeda Corporation has the following cost records for June 2018:

+

Indirect factory labor

$4,500

Factory utilities

$400

Direct materials used

20,000

Depreciation, factory equipment 1,400

Work in process, 6/1/18

3,000

Direct labor

40,000

Work in process, 6/30/18

3,800

Maintenance, factory equipment 1,800

Finished goods, 6/1/18

5,000

Indirect materials

2,200

Finished goods, 6/30/18

7,500

Factory manager's salary

3,000

Instructions

a. Prepare a cost of goods manufactured schedule for June 2018.

b. Prepare an income statement through gross profit for June 2018 assuming sales revenue is

$92,100.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following cost data relate to the manufacturing activities of Newberry Company during the just completed year: Total actual manufacturing OH costs incurred (including 15,000 of indirect materials) 353,000 Purchases of raw materials (both direct and Indirect) 250,000 Direct labor cost 135,000 Raw Materials, beg 10,000 Raw Materials, end 15,000 Work in Process, beg 20,000 Work in process, end 35,000 The company uses a predetermined overhead rate to apply manufacturing overhead cost to production. The predetermined overhead rate for the year was $15 per machine-hour. A total of 23,000 machine-hours were recorded for the year. Required: Compute the amount of underapplied or overapplied manufacturing overhead cost for the year.arrow_forwardMonty Corporation has the following cost records for June 2022. Indirect factory labor $4,500 Factory utilities $390 Direct materials used 19,600 Depreciation, factory equipment 1,370 Work in process, 6/1/22 2,940 Direct labor 39,200 Work in process, 6/30/22 3,720 Maintenance, factory equipment 1,760 Finished goods, 6/1/22 Finished goods, 6/30/22 4,900 Indirect materials 2,250 7,350 Factory manager's salary 2,940 (a) Prepare a cost of goods manufactured schedule for June 2022. MONTY CORPORATION Cost of Goods Manufactured Schedule For the Month Ended June 30, 2022 > > > $ $ $ $arrow_forwardWhat is the total manufacturing cost charged to work in process during 2018 Calculate the cost of finished goods manufactured during 2018 Calculate cost of goods sold for 2018arrow_forward

- Carla Vista Manufacturing Inc. provides you with the following data for the month of June:Prime costs were $ 196,000, conversion costs were $140, 500, andtotal manufacturing costs incurred were $265,500. Beginning and ending work in process inventories were equal. Selling and administrative costs were $ 262,100. (a)What were the total costs of direct materials used, direct labour, and manufacturing overhead? Direct material costs$Direct labour costsManufacturing overhead costsarrow_forwardThe following is the data for Lauren Enterprises: Selling and administrative expenses $75,000 Direct materials used 265,000 Direct labor (25,000 hours) 300,000 Factory overhead application rate $16 per DLH Inventories Beginning Ending Direct materials $50,000 $45,000 Work in process 75,000 90,000 Finished goods 40,000 25,000 Refer to Figure 2-14. What is the cost of goods manufactured? Inventories Beginning Ending Direct materials $50,000 $45,000 Work in process 90,000 75,000 40,000 25,000 Finished goods Refer to Figure 2-14. What is the cost of goods manufactured? $1,115,000 $965,000 $955,000 $950,000arrow_forwardCepeda Corporation has the following cost records for June 2018: + Indirect factory labor $4,500 Factory utilities $400 Direct materials used 20,000 Depreciation, factory equipment 1,400 Work in process, 6/1/18 3,000 Direct labor 40,000 Work in process, 6/30/18 3,800 Maintenance, factory equipment 1,800 Finished goods, 6/1/18 5,000 Indirect materials 2,200 Finished goods, 6/30/18 7,500 Factory manager's salary 3,000 Instructions a. Prepare a cost of goods manufactured schedule for June 2018. b. Prepare an income statement through gross profit for June 2018 assuming sales revenue is $92,100.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education