FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:CengageNOWv21Online teachin X

ilm/takeAssignment/takeAssignmentMain.do?invoker-assignments&takeAssignmentSessionLocator=assignment-take&inprogress-false

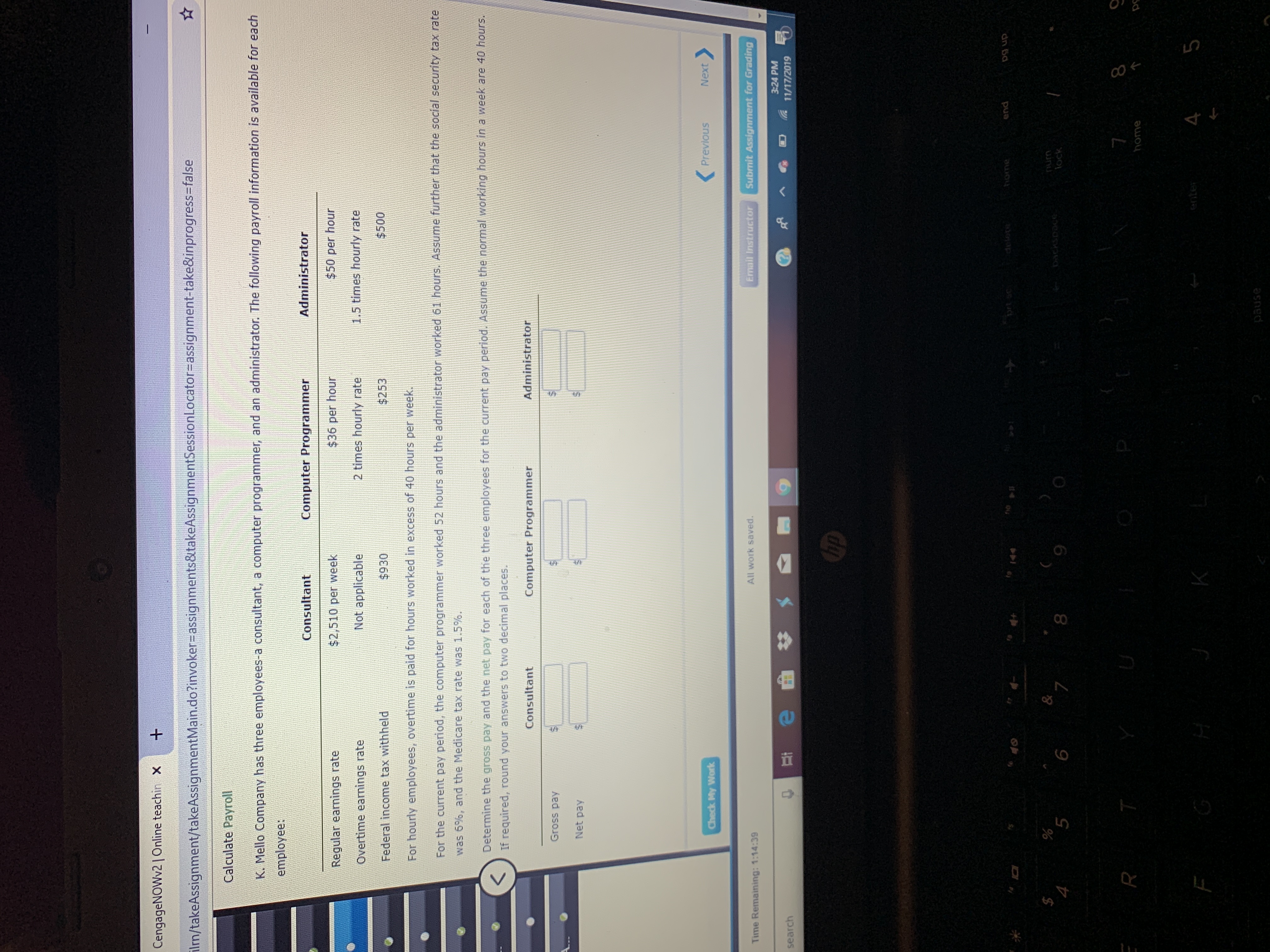

Calculate Payroll

K. Mello Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is available for each

employee:

Administrator

Computer Programmer

Consultant

$50 per hour

$36 per hour

$2,510 per week

Regular earnings rate

1.5 times hourly rate

2 times hourly rate

Not applicable

Overtime earnings rate

$500

$253

$930

Federal income tax withheld

For hourly employees, overtime is paid for hours worked in excess of 40 hours per week.

For the current pay period, the computer programmer worked 52 hours and the administrator worked 61 hours. Assume further that the social security tax rate

was 6%, and the Medicare tax rate was 1.5 %.

Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal working hours in a week are 40 hours.

If required, round your answers to two decimal places.

Administrator

Consultant

Computer Programmer

Gross pay

Net pay

Previous

Next

Check My Work

Email Instructor

Submit Assignment for Grading

All work saved.

Time Remaining: 1:14:39

3:24 PM

e

11/17/2019

search

hp

end

home

pr sc

to 144

dn 6a

o1ap

$

4

%

5

&

7

num

Dackspoce

9

6

lock

7

R T

home

enter

F

pause

tA

69

69

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Similar questions

- JOURNAL Page 43 DATE DESCRIPTION POST. REF. DEBIT CREDIT 20-- Nov. 6 Payroll Cash 12 12,296.97 Cash 11 12,296.97 6 Administrative Salaries 51 2,307.69 Office Salaries 52 4,677.85 Sales Salaries 53 3,600.00 Plant Wages 54 4,898.00 FICA Taxes Payable - OASDI 20.1 959.99 FICA Taxes Payable - HI 20.2 224.53 Employees FIT Payable 24 902.00 Employees SIT Payable 25 475.37 Employees SUTA Payable 25.1 9.27 Employees CIT Payable 26 599.41 Union Dues Payable 28 16.00 Payroll Cash 12 12,296.97 6 Payroll Taxes 56 1,362.30 FICA Taxes Payable - OASDI 20.1 959.98 FICA Taxes Payable - HI 20.2 224.51 SUTA Taxes Payable - Employer 22 177.81 13 Payroll Cash 12 1,570.27 Cash 11 1,570.27 1. What is the total gross…arrow_forwardK Pitt Accounting pays Peter Geller $97.290 per year Requirements 1. 2. What is the hourly cost to Pitt Accounting of employing Geller? Assume a 45-hour week and a 47-week year What direct labor cost would be assigned to Client 507 if Geller works 15 hours to prepare Client 507's financial statements? Requirement 1. What is the hourly cost to Pitt Accounting of employing Geller? Assume a 45-hour week and 47-week year Select the formula below that Pitt Accounting would use to calculate the hourly cost and complete the formula (Round the hourly cost to the nearest cent) Hourly cost Requirement 2. What direct labor cost would be assigned to Client 507 if Geller works 15 hours to prepare Client 507's financial statements? Select the fomula below that would be used to calculate the direct labor cost assigned to Client 507 and calculate that cost (Round the direct labor cost to the nearest cent). Direct labor costarrow_forwardCan you help me with this problem? I'm having trouble finding the values for the net pay. Thanks!arrow_forward

- es E2-3 (Algo) Analyzing Labor Time Tickets and Recording Labor Costs [LO 2-2, 2-4] A weekly time ticket for Joyce Caldwell follows: Labor Time Ticket Ticket Number: TT 338 Employee: Joyce Caldwell Date Monday, 8/12 Tuesday, 8/13 Wednesday, 8/14 Thursday, 8/15 Friday, 8/16 Time Started Job 271 Job 272 Job 273 7:00 AM 7:00 AM 7:00 AM 7:00 AM 12:00 PM 7:00 AM Dates: Monday 8/13 - Friday 8/17 Time Ended 3:00 PM 3:00 PM 3:00 PM 11:00 AM 4:00 PM 3:00 PM Weekly Totals Hourly Labor Rate Total Wages Earned Total Hours 8 hours 8 hours 8 hours 4 hours 4 hours 8 hours 40 hours × $21 $ 840 Job Number Job 271 Job 271 Job 272 Job 272 Maintenance Job 273 Required: 1. Determine how much of the $840 that Joyce earned during this week would be charged to Job 271, Job 272, andarrow_forwardCompute commission and gross payarrow_forwardAnalyze and review the following items and determine the appropriate journal entry. Record the journal entryarrow_forward

- engageNOWv2 | Online teachin X + _com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress.... A E At the end of April, Cavy Company had completed Jobs 765 and 766. The individual job cost sheets reveal the following information: Job Direct Materials Direct Labor Machine Hours Job No. 765 $8,400 30 $2,520 4,698 Job No. 766 14,877 87 Job 765 consisted of 180 units, and Job 766 consisted of 261 units. Assuming that the predetermined factory overhead rate is applied by using machine hours at a rate of $95 per hour. a. Determine the balance on the job cost sheets for each job. Job 765 Job 766 b. Determine the cost per unit at the end of April. Round your answers to the nearest cent. Job 765 Job 766 a 118 D -F10 Previous Next > Darrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease Complete all required and do not give images formatarrow_forward

- Hello, can you help me with this question? Amount to BeWithheld Employee FilingStatus No. of WithholdingAllowances Gross Wageor Salary PercentageMethod Wage-BracketMethod Lennon, A. MFJ N/A $675 weekly $fill in the blank 1 $fill in the blank 2 Starr, P. MFJ N/A 1,929 weekly fill in the blank 3 fill in the blank 4 McNeil, S. S N/A 1,775 biweekly fill in the blank 5 fill in the blank 6 Harrison, W. HH N/A 2,580 semimonthly fill in the blank 7 fill in the blank 8 Smythe, M. HH N/A 5,380 monthly fill in the blank 9 fill in the blank 10arrow_forwardA1arrow_forwardPlease complete the payrolll register. Note: this payroll register is partially done please complete the missing boxes with the right answers.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education