FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

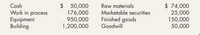

On December 31, Pitts Manufacturing Company reports the following assets: what is the total amount of Pitts’ inventory at year-end?

Transcribed Image Text:Cash

Work in process

Equipment

Building

$ 50,000

176,000

950,000

1,200,000

$ 74,000

25,000

150,000

50,000

Raw materials

Marketable securities

Finished goods

Goodwill

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Scrappers Supplies tracks the number of units purchased and sold throughout each accounting perlod but applies Its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Transactions Units Unit Cost Beginning inventory, January 1 Transactions during the year: a. Purchase on account, March 2 b. Cash sale, April 1 ($48 each) c. Purchase on account, June 30 d. Cash sale, August 1 ($48 each) 170 $ 32 330 34 (410) 220 38 (80) Required: 1-a. Calculate the Cost of Goods Sold and Ending Inventory for Scrappers Supplies assuming it applies the LIFO cost method perpetually at the time of each sale. TIP: The sale of 410 units on April 1 is assumed, under LIFO, to consist of the 330 units purchased March 2 and 80 units from beginning inventory. 1-b. Does the use of a perpetual inventory system result in a higher or lower Cost of Goods…arrow_forwardBased on the following data for the current year, what is the inventory turnover (rounded to one decimal place)? Sales on account during year $469,274 Cost of merchandise sold during year 179,305 Accounts receivable, beginning of year 42,159 Accounts receivable, end of year 52,598 Merchandise inventory, beginning of year 32,886 Merchandise inventory, end of year 40,548 Oa. 17.7 Ob. 12.8 Oc. 3.9 Od. 4.9arrow_forwardThe Westmoreland Corporation uses a periodic system for its inventory. The company starts the current year with inventory costing $177,000. During the year, an additional $387,000 is paid for inventory purchases and $17,000 for transportation costs to get those items. A physical count at the end of the year finds $145,000 of ending inventory. How was each of these numbers derived? What is the company’s cost of goods sold?arrow_forward

- Orion Iron Corporation tracks the number of units purchased and sold throughout each year but applies its inventory costing method at the end of the year, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Transactions Units Unit Cost a. Inventory, Beginning 300 $ 13 For the year: b. Purchase, April 11 900 11 c. Purchase, June 1 800 14 d. Sale, May 1 (sold for $41 per unit) 300 e. Sale, July 3 (sold for $41 per unit) 620 f. Operating expenses (excluding income tax expense), $18,100 Required: 1. Calculate the number and cost of goods available for sale. 2. Calculate the number of units in ending inventory. 3. Compute the cost of ending inventory and cost of goods sold under (a) FIFO, (b) LIFO, and (c) weighted average cost. 4. Prepare an income statement that shows under the FIFO method, LIFO method and weighted average method. 6. Which…arrow_forwardGladstone Limited tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Transactions Beginning inventory, January 1 Transactions during the year: a. Purchase, January 30 b. Sale, March 14 ($12 each) c. Purchase, May 1 d. Sale, August 31 ($12 each) Required: Units 1,900 Unit Cost $ 4.00 2,500 6.00 (1,700) 1,200 (1,900) 8.00 1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31, under each of the following inventory costing methods. For Specific identification, assuming that the March 14, sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the sale of August 31, was selected from the remainder of the beginning…arrow_forwardOrion Iron Corporation tracks the number of units purchased and sold throughout each year but applies its Inventory costing method at the end of the year, as if it uses a periodic Inventory system. Assume its accounting records provided the following Information at the end of the annual accounting period, December 31. Transactions a. Inventory, Beginning For the year: b. Purchase, April 11 c. Purchase, June 1 d. Sale, May 1 (sold for $40 per unit) e. Sale, July 3 (sold for $40 per unit) f. Operating expenses (excluding income tax expense), $18,500 Required: 1. Calculate the number and cost of goods available for sale. 2. Calculate the number of units in ending Inventory. Units 200 Unit Cost $ 12 950 9 850 13 200 700 3. Compute the cost of ending Inventory and cost of goods sold under (a) FIFO, (b) LIFO, and (c) weighted average cost. 4. Prepare an Income statement that shows under the FIFO method, LIFO method and weighted average method. 6. Which Inventory costing method minimizes…arrow_forward

- Orion Iron Corporation tracks the number of units purchased and sold throughout each year but applies its inventory costing method at the end of the year, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Transactions a. Inventory, Beginning For the year: b. Purchase, April 11 c. Purchase, June 1 d. Sale, May 1 (sold for $40 per unit) e. Sale, July 3 (sold for $40 per unit) f. Operating expenses (excluding income tax expense), $18,600 Required: 1. Calculate the number and cost of goods available for sale. 2. Calculate the number of units in ending inventory. Units 400 Unit Cost $ 12 850 10 750 14 400 670 3. Compute the cost of ending inventory and cost of goods sold under (a) FIFO, (b) LIFO, and (c) weighted average cost. 4. Prepare an income statement that shows under the FIFO method, LIFO method and weighted average method. 6. Which inventory costing method minimizes…arrow_forwardCraig Ferguson Company had the following account balances at year-end: cost of goods sold $70,000; inventory $17,300: operating expenses $33,000; sales revenue $121,000; sales discounts $1,400; and sales returns and allowances $1,950. A physical count of inventory determines that merchandise inventory on hand is $16,250. (a) Prepare the adjusting entry necessary as a result of the physical count. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Account Titles and Explanation Debit Creditarrow_forward[The following information applies to the questions displayed below.] At the end of January of the current year, the records of Donner Company showed the following for a particular item that sold at $17.80 per unit: Transactions Units Amount Inventory, January 1 700 $ 2,450 Purchase, January 12 670 3,685 Purchase, January 26 230 1,725 Sale (560) Sale (200) 3. Between FIFO or LIFO, which method would result in the lower income tax expense? Assume a 30 percent average tax rate. (Round your answer to 2 decimal places.)arrow_forward

- A company uses a periodic inventory system. The beginning inventory was $20,000, purchases amounted to $110,000, sales totaled $215,000, and the year-end inventory was $25,000. The cost of goods sold must have been: a $100,000. b $105,000 c $110,000. d some other amount.arrow_forwardInventory at the beginning of the year cost $13,900. During the year, the company purchased (on account) inventory costing $86,500. Inventory that had cost $82,500 was sold on account for $97,000. Required: a. Calculate the amount of ending inventory. b. What was the amount of gross profit? c. Prepare journal entry to record sale of inventory assuming a perpetual system is used. Debit Credit Accountarrow_forwardOrion Iron Corporation tracks the number of units purchased and sold throughout each year but applies its inventory costing method at the end of the year, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Transactions a. Inventory, Beginning For the year: Units 350 Unit Cost $ 12 b. Purchase, April 11 c. Purchase, June 1 d. Sale, May 1 (sold for $40 per unit) e. Sale, July 3 (sold for $40 per unit) f. Operating expenses (excluding income tax expense), $18,300 Required: 1. Calculate the number and cost of goods available for sale. 2. Calculate the number of units in ending inventory. 3. Compute the cost of ending inventory and cost of goods sold under (a) FIFO, (b) LIFO, and (c) weighted average cost. 4. Prepare an income statement that shows under the FIFO method, LIFO method and weighted average method. 6. Which inventory costing method minimizes income taxes? 800 850 350…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education