FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

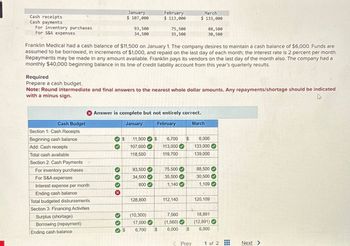

Transcribed Image Text:Cash receipts

Cash payments

For inventory purchases

For S&A expenses

January

$ 107,000

February

$113,000

March

$ 133,000

93,500

34,500

75,500

35,500

88,500

30,500

Franklin Medical had a cash balance of $11,500 on January 1. The company desires to maintain a cash balance of $6,000. Funds are

assumed to be borrowed, in increments of $1,000, and repaid on the last day of each month; the interest rate is 2 percent per month.

Repayments may be made in any amount available. Franklin pays its vendors on the last day of the month also. The company had a

monthly $40,000 beginning balance in its line of credit liability account from this year's quarterly results.

Required

Prepare a cash budget.

Note: Round intermediate and final answers to the nearest whole dollar amounts. Any repayments/shortage should be indicated

with a minus sign.

> Answer is complete but not entirely correct.

Cash Budget

Section 1: Cash Receipts

Beginning cash balance

January

February

March

$ 11,500 $ 6,700 $ 6,000

Add: Cash receipts

Total cash available

Section 2: Cash Payments

For inventory purchases

107,000

118,500

113,000

119,700

133,000

139,000

93,500

75,500

88,500

For S&A expenses

34,500

35,500

30,500

Interest expense per month

800

1,140

1,109

Ending cash balance

Total budgeted disbursements

128,800

112,140

120,109

Section 3: Financing Activities

Surplus (shortage)

(10,300)

Borrowing (repayment)

17,000

7,560

(1,560)

18,891

(12,891)

Ending cash balance

6,700 $

6,000 $

6,000

<Prev

1 of 2

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cash Over and Short Miller Enterprises deposits the cash received during each day at the end of the day. Miller deposited $48,287 on October 3 and $50,116 on October 4. Cash register records and other documents supporting the deposits are summarized as follows: 10/3 10/4 Cash sales $36,690 $40,310 Collections on account 10,875 9,813 Total receipts $47,565 $50,123 Required: 1. Calculate the amount of cash over or cash short for each day. Enter negative values as negative numbers. 2. Prepare the journal entry to record the receipt and deposit of cash on October 3. For those boxes in which no entry is required 3. Prepare the journal entry to record the receipt and deposit of cash on October 4. For those boxes in which no entry is required 4. CONCEPTUAL CONNECTION: If you were the manager with responsibility over the cash registers, how would you use this information?arrow_forwardRapid Delivery Services cash count at the end of the day totals $12,580 and the cash registertape shows $12,415. The amount of the change fund is $250. Rapid Delivery Services wouldrecord the revenue for the day as follows: a. Cash 12,580 Income from Services 12,580 b. Cash 12,430 Cash Short and Over 15 Income from Services 12,415 c. Cash 12,415 Income from Services 12,415 d. Cash 12,415Cash Short and Over 15Income from Services 12,430arrow_forwardMadison Company's cash ledger reports the following for the month ending March 31. Date Amount No. Date Amount Deposits: 3/4 $ 1,400 Checks: 541 3/2 $ 5,700 3/11 1,700 542 3/8 700 3/18 3,700 543 3/12 3,000 3/25 3,500 544 3/19 1,500 Cash receipts: 3/26-3/31 2,100 545 3/27 700 $ 12,400 546 3/28 800 547 3/30 1,200 Balance on March 1 $ 6,100 $ 13,600 Receipts 12,400 Disbursements (13,600 ) Balance on March 31 $ 4,900 Information from March's bank statement and company records reveal the following additional information: The ending cash balance recorded in the bank statement is $6,970. Cash receipts of $2,100 from 3/26–3/31 are outstanding. Checks 545 and 547 are outstanding. The deposit on 3/11 included a customer's check for $410 that did not clear the bank (NSF check). Check 543 was written…arrow_forward

- The accounts of Long Company provided the following 20X5 information at 31 December 20X5 (end of the annual period): Accounts receivable balance, 1 January 20X5 $51,000 Allowance for doubtful accounts balance, 1 January 20X5 3,000 Uncollectible account to be written off during 20X5 (ex-customer Slo) 1,000 Cash collected on accounts receivable during 20X5 170,000 Estimates for bad debt losses: Based on ending balance of accounts receivable, 8%. Based on aging schedule (excludes Slo’s account): Age Accounts Receivable Probability of Noncollection Less than 30 days $28,000 2% 31–90 days 7,000 10 91–120 days 3,000 30 More than 120 days 2,000 60 Required: Give the entry to write off customer Slo’s long-overdue account. Give all entries related to accounts receivable and the allowance account for the following two cases: Case A—Bad debt expense is based on the ending balance of accounts receivable Case B—Bad debt expense is based on aging Show how the results of applying each case above…arrow_forwardThe Morning Jolt Coffee Company has projected the following quarterly sales amounts for the coming year: QI $ 210 Sales 02 $ 270 Beginning receivables Sales Cash collections Ending receivables Q3 $ 330 a. Accounts receivable at the beginning of the year are $480. The company has a 45-day collection period. Calculate cash collections in each of the four quarters by completing the following: Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. Beginning receivables Sales Cash collections Ending receivables Q1 210 Q1 04 $480 210 Q2 Q2 270 b. Accounts receivable at the beginning of the year are $480. The company has a 60-day collection period. Calculate cash collections in each of the four quarters by completing the following: Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. 270 Q3 Q3 330 330 Drair Q4 Q4 480 480 21.10 Harrow_forwardc. Accounts receivable at the beginning of the year are $335. The company has a 30-day collection period. Calculate cash collections in each of the four quarters by completing the following: Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. Beginning receivables Sales Cash collections Ending receivables $ Q1 335 750 Q2 810 I Q3 890 Q4 980arrow_forward

- Keel Company's December 31 balances from the prior year related to accounts receivable follow. Accounts receivable (Dr.) Allowance for doubtful accounts (Cr.) $500,000 10,000 During the current year, $15,000 of accounts receivable is considered uncollectible, and no more effort to collect these accounts will be made. Total sales for the current year are $2,000,000, of which $400,000 are cash sales. A total of $1,500,000 cash was collected during the current year from sales that were originally made on account. Required a. Assuming that Keel applies the allowance method to estimate net accounts receivable and uses 10% of accounts receivable as its estimate of expected credit losses, prepare the disclosure on gross and net accounts receivable on the balance sheet at December 31 of the current year. • Note: Do not use negative signs in your answers. Balance Sheet, December 31 Accounts receivable Less: Allowance for doubtful accounts Accounts receivable, net 0arrow_forward000 Debit Cash $250; credit Accounts Payable $250. Havermill Co. establishes a $250 petty cash fund on September 1. On September 30, the fund is replenished. The accumulated receipts on that date represent $73 for Office Supplies, $137 for merchandise inventory, and $22 for miscellaneous expenses. The fund has a balance of $18. On October 1, the accountant determines that the fund should be increased by $50. The journal entry to record the establishment of the fund on September 1 is: Debit Petty Cash $250; credit Cash $250. Debit Petty Cash $250; credit Accounts Payable $250. Debit Cash $250; credit Petty Cash $250. Debit Miscellaneous Expense $250; credit Cash $250.arrow_forwardOn April 1, ABC has an Accounts Receivable balance of $190,000. During the month, credit sales total $210,000. As a result of collections efforts, the aging of Accounts Receivable is as follows for April 30: Current $100,000 (1% is estimated to be uncollectible) 0-30 Days Past Due $50,000 (5% is estimated to be uncollectible) 31-60 Days Past Due $ 20,000 (10% is estimated to be uncollectible) 31-90 Days Past Due $10,000 (20% is estimated to be uncollectible) > 90 Days Past Due $20,000 (50% is estimated to be uncollectible) Balance in Allowance for Doubtful Accounts (prior to any April 30 entry) $5,000 Credit If ABC is using the % of sales method of estimating its bad debts, what is the journal entry made at the end of the month if the estimated % of sales that are uncollectible is 4% ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education