FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

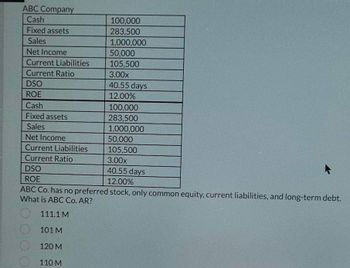

Transcribed Image Text:ABC Company

Cash

Fixed assets

Sales

Net Income

Current Liabilities

Current Ratio

DSO

ROE

Cash

Fixed assets

Sales

Net Income

Current Liabilities

Current Ratio

100,000

283,500

1,000,000

50,000

105,500

3.00x

40.55 days

12.00%

100,000

283,500

1,000,000

50,000

105,500

3.00x

DSO

40.55 days

12.00%

ROE

ABC Co. has no preferred stock, only common equity, current liabilities, and long-term debt.

What is ABC Co. AR?

111.1 M

101 M

120 M

110 M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Atlanta Company $ 820,000 490,000 Atlanta Company Spokane Company Total liabilities Total equity Compute the debt-to-equity ratio for each of the above companies. Choose Numerator: 100 Atlanta Company Spokane Company Spokane Company $ 298,900 1,786,000 Debt to equity ratio / Choose Denominator: mation Which company appears to have a riskier financing structure? Prev 4 of 5 = Debt-to-equity ratio II MacBook Air Next >arrow_forward1. A. the following data apply to Jacobs and Associates (millions of dollars): Cash and marketable securities $ 100.00 Net income%= $ 50.00 Fixed assets =$ 283.50 Sales =$1,000.00 Quick ratio =2.0 Current ratio= 3.0 DSO =40.55 days ROE =12% Jacobs has no preferred stock-only common equity, current liabilities, and long-term debt. Find Jacobs's A. Accounts receivable, B. Current liabilities, C. Current assets, D. Total assets, E. ROA, F. Common equity, and G. Long-term debt. 1B. in part A, you should have found Jacobs's accounts receivable = $111.1 million. If Jacobs could reduce its DSO from 40.55 days to 30.4 days while holding other things constant, how much cash would it generate? If this cash were used to buy back common stock (at book value), thus reducing the amount of common equity, how would this affect i. The ROE ii. The ROA iii. The ratio of total debt to total assets?arrow_forwardHewlard Pocket's market value balance sheet is given. Assets Liabilities and Shareholders' Equity A. Original balance sheet Cash $ 150,000 Debt Other assets 950,000 Equity 1,100,000 Value of firm $1,100,000 Value of firm $1,100,000 Shares outstanding Price per share 100,000 $1,100,000 / 100,000 = $11 %D Pocket needs to hold on to $76,000 of cash for a future investment. Nevertheless, it decides to pay a cash dividend of $1.90 per share and to replace cash as needed with a new issue of shares. After the dividend is paid and the new stock is issued: a. What will be the price per share? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What will be the total value of the company? (Enter your answers in whole dollars, not in millions.) c. What will be the total value of the stock held by new investors? (Enter your answers in whole dollars, not in millions. Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.) d.…arrow_forward

- DEBT TO CAPITAL RATIO Bartley Barstools has a market/book ratio equal to 1. Its stock price is $14 per share and it has 5 million shares outstanding. The firm’s total capital is $125 million and it finances with only debt and common equity. What is its debt-to-capital ratio?arrow_forwardvv. Subject Financearrow_forwardFinancial data for Joel de Paris, Incorporated, for last year follow: Joel de Paris, Incorporated Balance Sheet Assets Cash Accounts receivable Inventory Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity Joel de Paris, Incorporated Income Statement $ 386,000 978,000 1,192,000 Total liabilities and stockholders' equity $ 2,556,000 Sales Operating expenses Net operating income. Interest and taxes: Interest expense Tax expense Net income Beginning Balance. $ 112,000 197,000 $ 130,000 346,000 563,000 871,000 400,000 246,000 $ 2,556,000 $ 3,860,000 3,242,400 617,600 309,000 $ 308,600 $ Ending Balance $ 139,000 477,000 486,000 848,000 431,000 253,000 2,634,000 $ 341,000 978,000 1,315,000 $ 2,634,000 The company paid dividends of $185,600 last year. The "Investment in Buisson, S.A.," on the balance sheet represents an investment in the stock of another company. The…arrow_forward

- estions: Showing 1 5. Broward Manufacturing recently reported the following information: I Net income $615,000 ROA 10% Interest expense $202,950 Accounts payable and accruals $950,000 Broward's tax rate is 25%. Broward finances with only debt and common equity, so it has no preferred stock 40% of its total invested capital is debt, and 60% of its total invested capital is common equity. Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital (ROIC).arrow_forwardThe following data apply to Bright-Side Condos Ltd. (millions of dollars): Cash and Marketable Securities Fixed Assets Sales Net Income Quick Ratio Current Ratio Days Sales Outstanding Return On Equity $100 $283.50 $1,000.0 $50.00 2.0X 3.0X 40 days 12% Compute the company's (1) accounts receivable (2) current liabilities (3) current assets, (4) total assets, (5) Return On Assets, (6) common equity, and (7) long-term debt.arrow_forwardjituarrow_forward

- am. 11.arrow_forwardQuestion: Samuelson's has a debt-equity ratio of 45 percent, sales of $11,000, net income of $2,300, and total debt of $11,700. What is the return on equity? a. 4.50 percent. b. 20.91 percent. c. 8.85 percent. d. 19.66 percent. e. 6.10 percent.arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education