Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:at Peacier DC-bit

anac

Help

acte 11.po

cnapte 10 e e cise.

72.8%

O 57 64

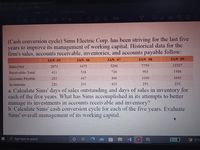

(Cash conversion cycle) Sims Electric Corp. has been striving for the last five

years to improve its management of working capital. Historical data for the

firm's sales, accounts receivable, inventories, and accounts payable follow:

JAN- 05

JAN- 06

JAN- 07

JAN- 08

JAN- 09

5296

7759

12327

Sales-Net

3475

2873

Receivable- Total

411

538

726

903

1486

Accounts Payable

283

447

466

1040

1643

Inventories

220

293

429

251

233

a. Calculate Sims' days of sales outstanding and days of sales in inventory for

each of the five years. What has Sims accomplished in its attempts to better

manage its investments in accounts receivable and inventory?

b. Calculate Sims' cash conversion cycle for each of the five years. Evaluate

Sims' overall management of its working eapital.

O Type here to search

82%

27°C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Operating cash flow. Find the operating cash flow for the year for Robinson and Sons if it had sales revenue of $78,200,000, cost of goods sold of $34,400,000, sales and administrative costs of $6,100,000, depreciation expense of $7,900,000,and a tax rate of 30%. The operating cash flow is $ (Round to the nearest dollar.)arrow_forwardFind the operating cash flow for the year for Marathon and Sons if it had sales revenue o\f $80,200,000, cost of goods sold of $35,700,000, sales and administrative costs of $6,800,000, depreciation expense of $4,000,000, and a tax rate of 30%.arrow_forwardNeed answer pleasearrow_forward

- You must type in both the answer and all of your work to receive credit. Use the financial statements and additional data provided by management to calculate the firm's Free Cash Flow for the projected year. • Tax rate = 25% • Plans for the projected year will require $500 of new machinery and equipment • Firm expects next year's dividend to be $260 Acme Products, Inc. Balance Sheets ASSETS Cash Receivables Inventory Property, plant & equipment Total assets LIABILITIES & EQUITY Accounts payables Accrued expenses Long-term debt Common stock Paid-in Capital Retained earnings Total liabilities and equity current yr 400 600 900 2,200 4,100 500 400 1,400 600 200 1,000 4,100 projected yr 500 750 1,125 2,750 Acme Products, Inc. Income Statement Operating expenses 5,125 Depreciation 5,125 Sales (all credit) Cost of Goods Sold Gross Profit Operating income Interest expense 625 Taxable income 500 Taxes (25%) 1,750 Net income 750 250 1,250 projected yr 7,000 4,000 3,000 1,400 400 1,200 100 1,100…arrow_forwardPlease solve parts A, B, AND C!arrow_forwardnku.9arrow_forward

- Computing Cash Conversion Cycle for Two YearsWinnebago Industries has the following metrics for 2015 and 2014. Amounts in days 2015 2014 Days sales outstanding 25.9 19.5 Days inventory outstanding 47.5 49.3 Days payable outstanding 13.9 13.3 Compute the cash conversion cycle for both years. Round answers to one decimal place. Cash conversion cycle 2015 Answer 2014 Answerarrow_forwardCalculate the cash operating cycle of Stone Limited for the year ended 30 April, 2018 and 2019.arrow_forwardQuestion Observe the following statement: STATEMENT OF CASH FLOW FOR "COUCH POTATO TECHNOLOGIES P/L" For the year ending June 30 2011 2010 2011 $000 $000 Receipts from customers (sales) Payments for purchases Payments to employees Purchase of assets 350 180 50 60 80 80 10 20 Payments for operating expenses 10 15 Additional Information: Industry Average Efficiency : 20% Net profit in 2010 : $21 000 a) Define the term working capital. b) Comment on the cash flow of Couch Potato Technologies P/L in 2010. c) Calculate and comment on the efficiency of Couch Potato Technologies P/L d) Calculate and comment on the net profit of Couch Potato Technologies P/L. e) Recommend TWO strategies that can be used to manage the working capital of Couch Potato Technologies P/L.arrow_forward

- To assist in approaching the bank about the loan, Paul has asked you to compute the following ratios for both this year and last year. The amount of working capital The current ratio The acid-test ratio The average collection period (The accounts receivable at the beginning of last year totaled $250,000) The average sales period (The inventory at the beginning of last year totaled $500,000) The operating cycle The total asset turnover. (The total assets at the beginning of last year were $2,420,000) The debt-to-equity ratio The times interest earned ratio The equity multiplier (The total stockholder’s equity at the beginning of last year totaled $1,420,000) Could you please help me answer 7-9?arrow_forwardThe following details are provided by a manufacturing company: Investment Useful life Estimated annual net cash inflows for first year Estimated annual net cash inflows for second year Estimated annual net cash inflows for next ten years Residual value Product line OA. 2.74 years OB. 6.36 years O c. 6.71 years OD. 2.24 years $1,030,000 12 years $460,000 $430,000 $190,000 $50,000 Depreciation method Straight-line 12% Required rate of return Calculate the payback period for the investment. (Round your answer to two decimal places.) ...arrow_forward7. A company that makes clutch disks had the cash flows shown below for one department with a MARR of 25%. Calculate the rate of return by using return on invested capital approach with a reinvestment rate of 15% per year. Should the company continue to make clutch disks? Year Cash Flow, $ Ft 1500 1 -1800 2 600 -570 3.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education