FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please don't give image format

Follow the format when answering the question. Thank you.

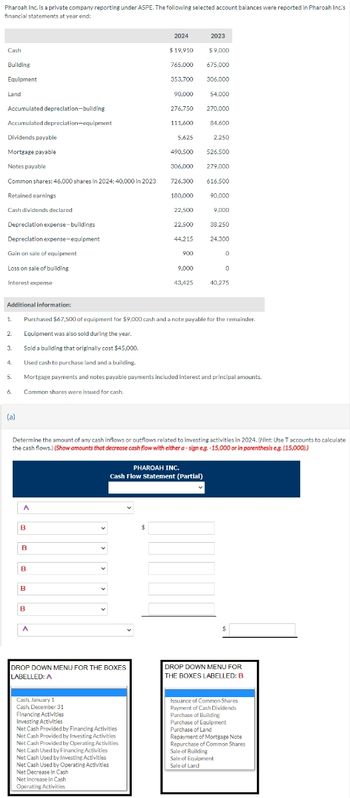

Transcribed Image Text:Pharoah Inc. is a private company reporting under ASPE. The following selected account balances were reported in Pharoah Inc.'s

financial statements at year end:

Cash

Building

Equipment

Land

Accumulated depreciation-building

Accumulated depreciation-equipment

Dividends payable

Mortgage payable

Notes payable

Common shares: 46,000 shares in 2024: 40,000 in 2023

Retained earnings

Cash dividends declared

Depreciation expense-buildings

Depreciation expense-equipment

Gain on sale of equipment

Loss on sale of building

Interest expense

Additional information:

1.

2.

3.

4.

5.

6.

(a)

A

B

B

B

B

B

A

V

Cash, January 1

Cash, December 31

DROP DOWN MENU FOR THE BOXES

LABELLED: A

2024

$ 19,910

Financing Activities

Investing Activities

Net Cash Provided by Financing Activities

Net Cash Provided by Investing Activities

Net Cash Provided by Operating Activities

Net Cash Used by Financing Activities

Net Cash Used by Investing Activities

Net Cash Used by Operating Activities

Net Decrease in Cash

Net Increase in Cash

Operating Activities

765,000

353,700

90,000

276,750

$

111,600

5,625

22,500

22,500

44,215

900

9,000

43,425

PHAROAH INC.

Cash Flow Statement (Partial)

2023

Purchased $67,500 of equipment for $9,000 cash and a note payable for the remainder.

Equipment was also sold during the year.

Sold a building that originally cost $45,000.

Used cash to purchase land and a building.

Mortgage payments and notes payable payments included interest and principal amounts.

Common shares were issued for cash.

$9,000

2,250

490,500

526,500

306,000 279,000

726,300

616,500

180,000

90,000

Determine the amount of any cash inflows or outflows related to investing activities in 2024. (Hint: Use T accounts to calculate

the cash flows.) (Show amounts that decrease cash flow with either a-sign e.g. -15,000 or in parenthesis eg. (15,000).)

675,000

306,000

54.000

270,000

84,600

9,000

38,250

24,300

0

0

40,275

S

DROP DOWN MENU FOR

THE BOXES LABELLED: B

Sale of Building

Sale of Equipment

Sale of Land

Issuance of Common Shares

Payment of Cash Dividends

Purchase of Building

Purchase of Equipment

Purchase of Land

Repayment of Mortgage Note

Repurchase of Common Shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Spicer Inc. showed the following alphabetized list of adjusted account balances at December 31, 2023. Assume that the preferred shares are non-cumulative. Accounts Payable Accounts Receivable Accumulated depreciation, Equipment Accumulated depreciation, Warehouse Cash Cash Dividends Common Shares Equipment Income Tax Expense Land Notes Payable, due in 2026 Operating Expenses Preferred Shares Retained Earnings Revenue Warehouse Current assets $ 26,760 40,200 11,140 22,280 9,400 20,600 Required: Prepare a classified balance sheet at December 31, 2023. (Enter all amounts as positive values.) Assets 122,000 79,400 41,600 127,600 34,600 110,200 40,200 28,720 282,100 138,800 SPICER INC. Balance Sheet December 31, 2023 Karrow_forwardThe balance sheets for Monitor World Corporation and additional information are provided below. MONITOR WORLD CORPORATION Balance Sheets December 31, 2024 and 2023 Assets Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional information for 2024: 1. Net income is $128,400. 2. Sales on account are $1,702,000. 3. Cost of goods sold is $1,276,500. Complete this question by entering your answers in the tabs below. a. Receivables turnover ratio b. Inventory turnover ratio c. Current ratio d. Acid-test ratio e. Debt to equity ratio 2024 times times $176,400 88,000 100,000 4,500 % Required: 1. Calculate the following risk ratios for 2024: 2. When we compare…arrow_forwardREQUIRED: In its statement of financial position, how much should be reported by WHITE as its total assets?arrow_forward

- Following are selected balance sheet accounts of Del Conte Corporation at December 31, 2024 and 2023, and the increases or decreases in each account from 2023 to 2024. Also presented is selected income statement information for the year ended December 31, 2024, and additional information. Selected Balance Sheet Accounts Assets Accounts receivable Property, plant, and equipment Accumulated depreciation Liabilities and Stockholders' Equity Bonds payable Dividends payable Common stock, $1 par Additional paid-in capital Retained earnings 2024 $ 42,000 285,000 (186,000) Selected Income Statement Information for the Year Ended December 31, 2024 Sales revenue 1. Cash collections from customers (direct method). 2. Payments for purchase of property, plant, and equipment. 61,000 10,000 30,000 3. Proceeds from sale of equipment. 4. Cash dividends paid. 5. Redemption of bonds payable. 11,000 112,000 $ 163,000 41,000 15,000 36,000 Amount 2023 $ 28,000 251,000 (171,000) 54,000 6,600 23,000 4,600…arrow_forwardThe balance sheet for Altoid Company is shown below. ALTOID COMPANY Balance Sheet December 31, 2024 Assets: Cash Short-term investments Accounts receivable (net) Inventory Property, plant, and equipment (net) Total assets Liabilities and shareholders' equity: Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and shareholders' equity $ 250 700 800 950 1,170 $ 3,870 $ 950 1,100 650 1,170 $ 3,870 Selected 2024 income statement information for Altoid Company includes: Net Sales Operating expenses $ 8,700 7,770 Income before interest and tax 930 130 Income tax expense 240 Net income $ 560 Interest expense Required: Compute Altoid Company's long-term debt to equity ratio for 2024 Note: Round your answer to 2 decimal places. Long-term debt to equityarrow_forwardBelow is the financial information for AXZ Corporation for fiscal year-ending June 30, 2020. (Amounts in millions $s) Cash flows from operations $2,908.3 Total revenues 14,892.2 Shareholders’ equity 4,482.3 Cash flows from financing (110.0) Total liabilities 7,034.4 Cash, ending year 2,575.7 Expenses 14,883.4 Noncash assets 8,941.0 Cash flows from investing (1,411.2) Net earnings 8.8 Cash, beginning year 1,188.6 Required: Using the information above, prepare the company’s: Balance sheet as of June 30, 2020. Income Statement for the fiscal year ended June 30, 2020. Cash Flow Statement for the fiscal year ending June 30, 2020.arrow_forward

- On January 1, 2025, Artic Inc. had the following balance sheet: Cash Total Debt investments (available-for-sale) 363,000 $434,000 Assets Interest revenue ARTIC INC. BALANCE SHEET AS OF JANUARY 1, 2025 ARTIC INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2025 $11,000 Gain on sale of investments Net income $71,000 Common stock (a) The accumulated other comprehensive income related to unrealized holding gains on available-for-sale debt securities. The fair value of Artic Inc.'s available-for-sale debt securities at December 31, 2025, was $310,000; its cost was $277,000. No debt securities were purchased during the year. Artic Inc.'s income statement for 2025 was as follows: (Ignore income taxes.) 28,000 $39,000 (Assume all transactions during the year were for cash.) Accumulated other comprehensive income Total Equity $389,000 Debit 45,000 $434,000 Prepare the journal entry to record the sale of the available-for-sale debt securities in 2025. (Credit account titles are…arrow_forwardPresented below is the balance sheet of Pina Corporation for the current year, 2020. PINA CORPORATIONBALANCE SHEETDECEMBER 31, 2020 Current assets $ 486,360 Current liabilities $ 381,360 Investments 641,360 Long-term liabilities 1,001,360 Property, plant, and equipment 1,721,360 Stockholders’ equity 1,771,360 Intangible assets 305,000 $3,154,080 $3,154,080 The following information is presented. 1. The current assets section includes cash $151,360, accounts receivable $171,360 less $11,360 for allowance for doubtful accounts, inventories $181,360, and unearned rent revenue $6,360. Inventory is stated on the lower-of-FIFO-cost-or-net realizable value. 2. The investments section includes the cash surrender value of a life insurance contract $41,360; investments in common stock, short-term $81,360 and long-term $271,360; and bond sinking fund $247,280. The cost and fair value of investments in common stock are the same.…arrow_forwardSarasota Corporation's balance sheet at the end of 2024 included the following items. Current assets (Cash $82,000) $236,480 Current liabilities $151,480 Land 31,100 Bonds payable 101,480 Buildings 121,480 Common stock 181,100 Equipment 91,100 Retained earnings 45,100 Accum. depr.-buildings (31,480) Total $479,160 Accum. depr.-equipment (11,000) Patents 41,480 Total $479,160 The following information is available for 2025. 1. Net income was $55,350. 2. Equipment (cost $21,480 and accumulated depreciation $9,480) was sold for $11,480. 3. Depreciation expense was $5,480 on the building and $10,480 on equipment. 4. Patent amortization was $2,500. 5. Current assets other than cash increased by $29,000. Current liabilities increased by $14,480. 6. An addition to the building was completed at a cost of $28,480. 7. A long-term investment in stock was purchased for $16,000. 8. Bonds payable of $51,100 were issued. 9. Cash dividends of $30,000 were declared and paid. 10. Treasury stock was…arrow_forward

- Create a Balance sheet for this information given:arrow_forwardNash's Trading Post, LLC issued 14800 shares of $1 par common stock for $40 per share during 2022. The company paid dividends of $36000 and issued long-term notes payable of $326000 during the year. What amount of cash flows from financing activities will be reported on the statement of cash flows?arrow_forwardYou are auditing the financial statements of Brin Inc. for the year 2020. The details of the unadjusted balances of its Accumulated Profit account are as follows: ACCUMULATED PROFIT Particulars Debit Credit Balance 500,000 540,000 740,000 670,000 690,000 660,000 580,000 150,000 730,000 640,000 Date Beginning Balance Gain on sale of treasury shares Net income for the year Payment of dividends declared in 2018 Paid in capital in excess of par Loss on sale of treasury shares Net loss for the year Net income for the year Payment of dividends declared in 2019 01.01.2018 08.31.2018 40,000 200,000 12.31.2018 02.28.2019 70,000 05.31.2019 20,000 07.31.2019 12.31.2019 12.31.2020 30,000 80,000 12.31.2020 90,000 Your examination disclosed the following: a. Omissions at the end of each year of the following: 2017 4,000 2018 2019 7,000 2020 Merchandise Inventory, end Accrued Expense 3,000 5,000 b. The cost of major repairs on the company's equipment on January 1, 2018 in the amount of P150,000 was…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education