FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

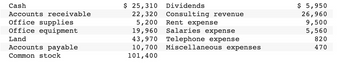

Transcribed Image Text:Cash

Accounts receivable

Office supplies

Office equipment

Land

Accounts payable

Common stock

$ 25,310

22,320

5,200

19,960

43,970

10,700

101,400

Dividends

Consulting revenue

Rent expense

Salaries expense

Telephone expense

Miscellaneous expenses

$ 5,950

26,960

9,500

5,560

820

470

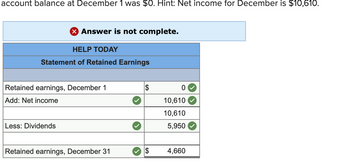

Transcribed Image Text:account balance at December 1 was $0. Hint: Net income for December is $10,610.

X Answer is not complete.

HELP TODAY

Statement of Retained Earnings

Retained earnings, December 1

Add: Net income

Less: Dividends

Retained earnings, December 31

$

0

10,610

10,610

5,950

4,660

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ergonomics Supply Inc., a wholesaler of office products, was organized on July 1 of the current year, with an authorization of 27,000 shares of preferred 2% stock, $100 par, and 600,000 shares of $10 par common stock. The following selected transactions were completed during the first year of operations: July 1. Issued 213,000 shares of common stock at par for cash. 1. Issued 400 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation. Aug. Issued 69,400 shares of common stock in exchange for land, buildings, and equipment with fair market 7. prices of $149,100, S505,120 and $164,700 respectively. Sept. 20. Issued 17,600 shares of preferred stock at $105 for cash. Required: Journalize the transactions. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a…arrow_forwardEntry for cash sales; cash short Instructions Chart of Accounts Journal Instructions The actual cash received from cash sales was $37,650, and the amount indicated by the cash register total was $37,653. Journalize the entry to record the cash receipts and cash sales. Refer to the Chart of Accounts for exact wording of account titles. T41 Merthandise nvemory 516 Cash Short and Over 145 Office Supplies Check My Workarrow_forwardhow do you do the IF formula?arrow_forward

- CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 114 Interest Receivable 115 Notes Receivable 116 Merchandise Inventory 117 Supplies 119 Prepaid Insurance 120 Land 123 Delivery Truck 124 Accumulated Depreciation-Delivery Truck 125 Equipment 126 Accumulated Depreciation-Equipment 130 Mineral Rights 131 Accumulated Depletion 132 Goodwill 133 Patents LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends REVENUE 410 Sales 610 Interest Revenue 620 Gain on Sale of Delivery Truck 621 Gain on Sale of Equipment EXPENSES 510 Cost of Merchandise Sold 520 Salaries Expense 521 Advertising Expense 522 Depreciation Expense-Delivery Truck 523 Delivery Expense 524 Repairs and Maintenance Expense 529 Selling…arrow_forwardCould you please explain to me how the cash balances are calculated???? Pro Forma Cash Flow Cash Received Cash from Operations Cash Sales $24,198 $100,099 $122,460 Cash from Receivables $46,108 $217,218 $342,905 Subtotal Cash from Operations $70,306 $317,317 $465,366 Additional Cash Received Sales Tax, VAT, HST/GST Received $0 $0 $0 New Current Borrowing $0 $0 $0 New Other Liabilities (interest-free) $0 $0 $0 New Long-term Liabilities $0 $40,000 $0 Sales of Other Current Assets $0 $0 $0 Sales of Long-term Assets $0 $0 $0 New Investment Received $0 $0 $0 Subtotal Cash Received $70,306 $357,317 $465,366 Expenditures Year 1 Year 2 Year 3 Expenditures from Operations Cash Spending $167,000 $225,200 $229,200 Bill Payments $75,294 $124,114 $152,785 Subtotal Spent on Operations $242,294 $349,314 $381,985 Additional Cash Spent Sales Tax, VAT, HST/GST Paid Out $0 $0 $0…arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.]The August bank statement and cash T-account for Martha Company follow: BANK STATEMENT Date Checks Deposits Other Balance August 1 $ 13,600 August 2 $ 120 13,480 August 3 $ 9,300 22,780 August 4 220 22,560 August 5 160 22,400 August 9 530 21,870 August 10 130 21,740 August 15 3,100 24,840 August 21 220 24,620 August 24 15,500 9,120 August 25 5,650 14,770 August 30 620 14,150 August 30 Interest earned $ 20 14,170 August 31 Service charge 10 14,160 Cash (A) Debit Credit August 1 Balance 13,600 Deposits Checks written August 2 9,300 120 August 1 August 12 3,100 220 August 2 August 24 5,650 160 August 3 August 31 4,100 130 August 4 530 August 5 200 August 15 280 August 17 620 August 18 220 August 19…arrow_forward

- J. P. Robard Mfg., Inc. Balance Sheet ($000) Cash $470 Accounts receivable 2,100 Inventories 940 Current assets $3,510 Net fixed assets 4,590 Total assets $8,100 Accounts payable $1,120 Accrued expenses 580 Short-term notes payable 280 Current liabilities $1,980 Long-term debt 2,040 Owners' equity 4,080 Total liabilities and owners' equity $8,100 (Click on the icon in order to copy its contents into a spreadsheet.) J. P. Robard Mfg., Inc. Income Statement ($000) Net sales (all credit) $8,010 Cost of goods sold (3,300) Gross profit $4,710 Operating expenses (includes $500 depreciation) (3,090) Net operating income $1,620 Interest expense (360) Earnings before taxes $1,260 Income taxes (35%) (441) Net income $819arrow_forward1. Prepare a bank reconciliation for Summer Corp. Balance per Summer Company books $500,000 Balance per Citi bank $510,000 Reconciling items Outstanding Checks $40,000 Nonsufficient funds Check $10,000 Deposits in transit $19,000 Bank Fees $1,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education