FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please do not provide solution in image format thank you!

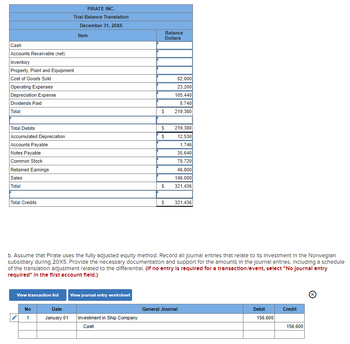

Transcribed Image Text:Cash

Accounts Receivable (net)

Inventory

Property, Plant and Equipment

Cost of Goods Sold

Operating Expenses

Depreciation Expense

Dividends Paid

Total

Total Debits

Accumulated Depreciation

Accounts Payable

Notes Payable

Common Stock

Retained Earnings

Sales

Total

Total Credits

View transaction list

PIRATE INC.

Trial Balance Translation

December 31, 20X5

No

1

Date

January 01

Item

View journal entry worksheet

Investment in Ship Company

Cash

Balance

Dollars

$

$

$

$

$

b. Assume that Pirate uses the fully adjusted equity method. Record all Journal entries that relate to its Investment in the Norwegian

subsidiary during 20X5. Provide the necessary documentation and support for the amounts in the journal entries, including a schedule

of the translation adjustment related to the differential. (If no entry is required for a transaction/event, select "No Journal entry

required" In the first account field.)

82,000

23,200

105,440

8,740

219,380

219,380

12,530

1,746

35,640

78,720

46,800

146,000

321,436

321,436

General Journal

Debit

156,600

Credit

156,600

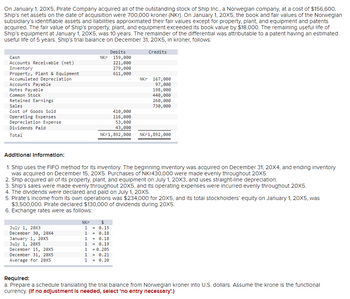

Transcribed Image Text:On January 1, 20X5, Pirate Company acquired all of the outstanding stock of Ship Inc., a Norwegian company, at a cost of $156,600.

Ship's net assets on the date of acquisition were 700,000 kroner (NKr). On January 1, 20X5, the book and fair values of the Norwegian

subsidiary's identifiable assets and liabilities approximated their fair values except for property, plant, and equipment and patents

acquired. The fair value of Ship's property, plant, and equipment exceeded Its book value by $18,000. The remaining useful life of

Ship's equipment at January 1, 20X5, was 10 years. The remainder of the differential was attributable to a patent having an estimated

useful life of 5 years. Ship's trial balance on December 31, 20X5, in kroner, follows:

Credits

Cash

Accounts Receivable (net)

Inventory

Property, Plant & Equipment

Accumulated Depreciation

Accounts Payable

Notes Payable

Common Stock

Retained Earnings

Sales

Cost of Goods Sold

Operating Expenses

Depreciation Expense

Dividends Paid

Total

Debits

NKr 159,000

221,000

279,000

611,000

410,000

116,000

53,000

43,000

NKr1,892,000

July 1, 20X3

December 30, 20X4

January 1, 20X5

July 1, 20X5

December 15, 20X5

December 31, 20X5

Average for 20X5

Additional Information:

1. Ship uses the FIFO method for its inventory. The beginning inventory was acquired on December 31, 20X4, and ending inventory

was acquired on December 15, 20X5. Purchases of NKr430,000 were made evenly throughout 20X5.

2. Ship acquired all of its property, plant, and equipment on July 1, 20X3, and uses straight-line depreciation.

3. Ship's sales were made evenly throughout 20X5, and its operating expenses were incurred evenly throughout 20X5.

4. The dividends were declared and paid on July 1, 20X5.

NKr 167,000

97,000

198,000

440,000

260,000

730,000

5. Pirate's income from its own operations was $234,000 for 20X5, and its total stockholders' equity on January 1, 20X5, was

$3,500,000. Pirate declared $130,000 of dividends during 20X5.

6. Exchange rates were as follows:

NKr

$

1 = 0.15

NKr1,892,000

1 = 0.18

1 = 0.18

1 = 0.19

1 = 0.205

1 = 0.21

1 = 0.20

Required:

a. Prepare a schedule translating the trial balance from Norwegian kroner into U.S. dollars. Assume the krone is the functional

currency. (If no adjustment is needed, select 'no entry necessary'.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is lossy compression? a MP3 is compressed music. b Reduce the size of files by taking out less important information. It drops nonessential information to decrease file size. Reduce the size of the file without losing any information and the original file can be reconstructed from a compressed version. d Joint Photographic Experts Group JPEG) is a compressed image. O O O Carrow_forwardWhat is Contiguous data?arrow_forwardInformation that is reported free from error ________.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education