Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

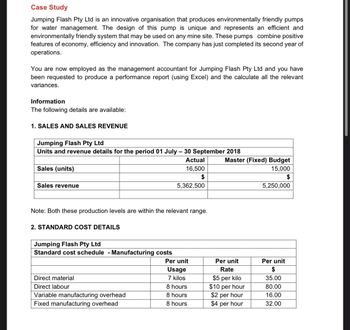

Transcribed Image Text:Case Study

Jumping Flash Pty Ltd is an innovative organisation that produces environmentally friendly pumps

for water management. The design of this pump is unique and represents an efficient and

environmentally friendly system that may be used on any mine site. These pumps combine positive

features of economy, efficiency and innovation. The company has just completed its second year of

operations.

You are now employed as the management accountant for Jumping Flash Pty Ltd and you have

been requested to produce a performance report (using Excel) and the calculate all the relevant

variances.

Information

The following details are available:

1. SALES AND SALES REVENUE

Jumping Flash Pty Ltd

Units and revenue details for the period 01 July - 30 September 2018

Sales (units)

Sales revenue

Actual

Master (Fixed) Budget

16,500

15,000

$

$

5,362,500

5,250,000

Note: Both these production levels are within the relevant range.

2. STANDARD COST DETAILS

Jumping Flash Pty Ltd

Standard cost schedule - Manufacturing costs

Per unit

Usage

Direct material

7 kilos

Per unit

Rate

$5 per kilo

Per unit

$

35.00

Direct labour

8 hours

$10 per hour

80.00

Variable manufacturing overhead

8 hours

$2 per hour

16.00

Fixed manufacturing overhead

8 hours

$4 per hour

32.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- Your manager has asked you to advise your client Kofi Gyato, owner and director of Kofi Gyato Limited, on the implications of the proposed transaction.Your client has identified an opportunity to develop his business by manufacturing the products which he sells. To do this he would need to buy a machine which will have an expected life of ten years. He has received this quotation for the machine.GHȼPrice of machine70,000Delivery and installation3,500Commissioning costs1,500Annual maintenance costs3,500Required:Prepare a report to your client. Your report should:(a) Explain the difference between capital and revenue expenditure, and how each type of expenditure affects the accounts of a business.(b) Indicate which of the costs of the machine should be considered as capital cost and which should be considered as revenue cost.(c) Define depreciation and explain how the accounting entries for depreciation affect each element of the accounting equation.(d) Indicate:(i) What the annual…arrow_forwardCurrent Designs faces a number of important decisions that require incremental analysis. Current Designs is always working to identify ways to increase efficiency while becoming more environmentally conscious. During a recent brainstorming session, one employee suggested to Diane Buswell, controller, that the company should consider replacing the current rotomold oven as a way to realize savings from reduced energy consumption. The oven operates on natural gas, using 17,000 therms of natural gas for an entire year. A new, energy-efficient rotomold oven would operate on 15,000 therms of natural gas for an entire year. After seeking out price quotes from a few suppliers, Diane determined that it would cost approximately $250,000 to purchase a new, energy-efficient rotomold oven. She determines that the expected useful life of the new oven would be 10 years, and it would have no salvage value at the end of its useful life. Current Designs would be able to sell the current oven today for…arrow_forwardAn industrial engineer proposed the purchaseof RFID Fixed-Asset Tracking System for the company’s warehouse and weave rooms. The engineerfelt that the purchase would provide a better systemof locating cartons in the warehouse by recording thelocations of the cartons and storing the data in thecomputer. The estimated investment, annual operating and maintenance costs, and expected annual savings are as follows.• Cost of equipment and installation: $85,500• Project life: 6 years• Expected salvage value: $5,000• Investment in working capital (fully recoverable atthe end of the project life): $15,000• Expected annual savings on labor and materials:$65,800• Expected annual expenses: $9,150• Depreciation method: five-year MACRSThe firm’s marginal tax rate is 35%.(a) Determine the net after-tax cash flows over theproject life.(b) Compute the IRR for this investment.(c) At MARR = 18%, is the project acceptable?arrow_forward

- A seminar was recently attended by the Managing Director of XYZ Manufacturing Company Limited located at Sheffield. The focus of the seminar was “optimising scarce resources utility in a manufacturing setting with particular reference to linear programming”. On his return to his base, he called for a meeting with the Management to share his experience from the seminar and the impact this will have on the decision by the Board to produce two major products in the years ahead. A group of external research experts had previously been commissioned and the following represents information from the research carried out by them The expected products are “Best” and “Smart” with expected costs statistics as follows: Best £ Smart £ Material costs (5kg@£50/kg) 250 (3kg@£50/kg) 150 Labour costs Machinery time (4 hours @£15/Hr) 60 (2hours @£15/Hr) 30 Other Processing Time (4 hours @£10/hr) 40 (5hours@£10/Hr) 50 The applicable pricing…arrow_forwardThe Chief Operations Officer (COO) of a manufacturing firm recommends one of the manufacturing sites to undergo a process improvement initiative. He claims that this project will enable the company to realize a net savings of at least $3.25 Mln. The Chief Financial Officer (CFO) of the company tasked you to conduct a financial analysis to verify the claims of the COO. After performing cost analysis, you estimated that the project will require an initial investment of $2 Mln today and $1 Mln in Year 1. Afterwards, the initiative will yield an annual cost savings of $850k from Year 2 to Year 10. You assume that these cost savings are realized at the end of each year. (a) Suppose that you use a discount rate of 5%. Will the resulting net savings support the claim of the COO? (b) Determine the Internal Rate of Return (IRR) of the process improvement initiative. (c) Show the NPV profile of the project.arrow_forwardVishunuarrow_forward

- Piscataway valves decided to pursue development of a new product line for natural gas pipelines. The development effort has been successful and Piscataway is preparing to begin manufacturing and marketing the new product line next year. Piscataway has learned that marketing to natural gas pipeline companies requires commercial skills and experience they do not have. Management has, as a consequence, decided to have a partner and are in serious discussions with two companies having the requisite marketing expertise: Fargo Pipeline Supplies (FPS) and Quantum International (QI) Note: For this question, all cash flows are incremental cash flows. Part A: FPS Proposal FPS would provide only marketing, sales, and distribution for natural gas pipeline valves. Piscataway would have to invest in faciliites to manufacture the valves, spending $7,465 in Year 0 Piscataway would have to invest in facilites to manufacture the valves, manufacture the valves themselves, and incur administrative…arrow_forwardAnalyze CSR initiatives at Green Manufacturing Green Manufacturing is a traditional manufacturing company located in the midwestern United States. The companys operations manager is developing a strategy to become more CSR-oriented. In an effort to evaluate possible areas where CSR initiatives can be implemented, the manager has gathered the following data regarding three potential CSR activities: The recycling activity would carry on indefinitely. The solar panels would have a useful life of 30 years. The replacement of assembly room light fixtures with natural light is assumed to have an 80-year effect. A. Identify which CSR activities Green Manufacturing should implement. B. For each CSR activity you recommend, identify an appropriate related performance metric.arrow_forwardssarrow_forward

- Denjararrow_forwardThe production department is proposing the purchase of an automatic insertion machine. It has identified three machines and has asked the accountant to analyze them to determine which one has the best average rate of return. Machine A Machine B Machine C Estimated average income $43,866.76 $73,406.10 $62,231.25 Average investment 313,334.00 244,687.00 414,875.00arrow_forwardThe production department is proposing the purchase of an automatic insertion machine. It has identified three machines and has asked the accountant to analyze them to determine which one has the best average rate of return. Machine A Machine B Machine C Estimated average income $48,288.80 $77,802.90 $72,428.85 Average investment 344,920.00 259,343.00 482,859.00 a. Machine B b. Machine C C. Machine A d. Machines B and C have the same preferred average rate of return.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College