FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

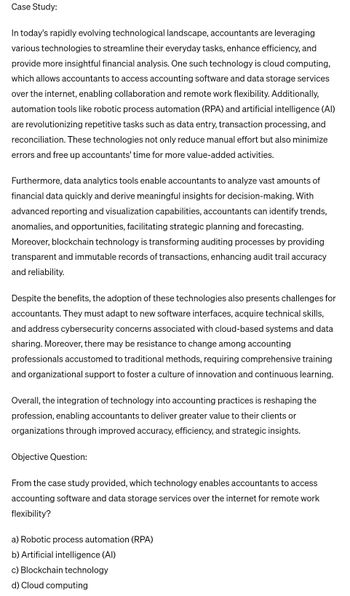

Transcribed Image Text:Case Study:

In today's rapidly evolving technological landscape, accountants are leveraging

various technologies to streamline their everyday tasks, enhance efficiency, and

provide more insightful financial analysis. One such technology is cloud computing,

which allows accountants to access accounting software and data storage services

over the internet, enabling collaboration and remote work flexibility. Additionally,

automation tools like robotic process automation (RPA) and artificial intelligence (AI)

are revolutionizing repetitive tasks such as data entry, transaction processing, and

reconciliation. These technologies not only reduce manual effort but also minimize

errors and free up accountants' time for more value-added activities.

Furthermore, data analytics tools enable accountants to analyze vast amounts of

financial data quickly and derive meaningful insights for decision-making. With

advanced reporting and visualization capabilities, accountants can identify trends,

anomalies, and opportunities, facilitating strategic planning and forecasting.

Moreover, blockchain technology is transforming auditing processes by providing

transparent and immutable records of transactions, enhancing audit trail accuracy

and reliability.

Despite the benefits, the adoption of these technologies also presents challenges for

accountants. They must adapt to new software interfaces, acquire technical skills,

and address cybersecurity concerns associated with cloud-based systems and data

sharing. Moreover, there may be resistance to change among accounting

professionals accustomed to traditional methods, requiring comprehensive training

and organizational support to foster a culture of innovation and continuous learning.

Overall, the integration of technology into accounting practices is reshaping the

profession, enabling accountants to deliver greater value to their clients or

organizations through improved accuracy, efficiency, and strategic insights.

Objective Question:

From the case study provided, which technology enables accountants to access

accounting software and data storage services over the internet for remote work

flexibility?

a) Robotic process automation (RPA)

b) Artificial intelligence (AI)

c) Blockchain technology

d) Cloud computing

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Prompt: Accounting information systems became more and more sophisticated and eventually evolved into enterprise resource planning systems. At the same time this was happening, computers were replacing many of the repetitive tasks formerly accomplished by accountants. The accounting profession changed dramatically from one dominated by transaction recording and external financial statement preparation to one where accountants were full decision-making and decision-support team members. Has the profession kept up with these changes? Are the expectations of students entering the profession different than they were before this change? Response Parametersarrow_forwardAccountants play an important role within an organization. Without the proper tools and resources, they would not be as efficient or effective in their jobs. Discuss the value that an AIS system brings to an organization. In what ways do accounting information systems enable companies to not only become more productive but also provide the ability to compete with others on a global scale?\\nProvide 2-3 ways in which you have experienced the value of AIS from a professional or personal level.arrow_forwardi. Briefly inform these stakeholders of the benefits of automation on the current business processes within the organization, specifically referencing the benefits of using a spreadsheet solution and how easy it was to process data to derive the information presented in the report. ii. Give a brief analysis of the data found in the chartarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education