FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

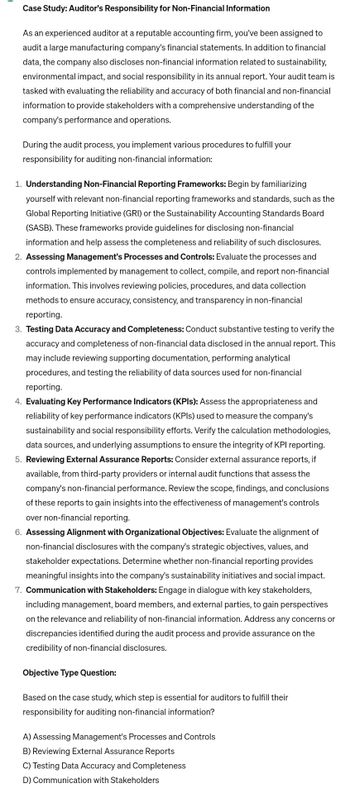

Transcribed Image Text:Case Study: Auditor's Responsibility for Non-Financial Information

As an experienced auditor at a reputable accounting firm, you've been assigned to

audit a large manufacturing company's financial statements. In addition to financial

data, the company also discloses non-financial information related to sustainability,

environmental impact, and social responsibility in its annual report. Your audit team is

tasked with evaluating the reliability and accuracy of both financial and non-financial

information to provide stakeholders with a comprehensive understanding of the

company's performance and operations.

During the audit process, you implement various procedures to fulfill your

responsibility for auditing non-financial information:

1. Understanding Non-Financial Reporting Frameworks: Begin by familiarizing

yourself with relevant non-financial reporting frameworks and standards, such as the

Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board

(SASB). These frameworks provide guidelines for disclosing non-financial

information and help assess the completeness and reliability of such disclosures.

2. Assessing Management's Processes and Controls: Evaluate the processes and

controls implemented by management to collect, compile, and report non-financial

information. This involves reviewing policies, procedures, and data collection

methods to ensure accuracy, consistency, and transparency in non-financial

reporting.

3. Testing Data Accuracy and Completeness: Conduct substantive testing to verify the

accuracy and completeness of non-financial data disclosed in the annual report. This

may include reviewing supporting documentation, performing analytical

procedures, and testing the reliability of data sources used for non-financial

reporting.

4. Evaluating Key Performance Indicators (KPIs): Assess the appropriateness and

reliability of key performance indicators (KPIs) used to measure the company's

sustainability and social responsibility efforts. Verify the calculation methodologies,

data sources, and underlying assumptions to ensure the integrity of KPI reporting.

5. Reviewing External Assurance Reports: Consider external assurance reports, if

available, from third-party providers or internal audit functions that assess the

company's non-financial performance. Review the scope, findings, and conclusions

of these reports to gain insights into the effectiveness of management's controls

over non-financial reporting.

6. Assessing Alignment with Organizational Objectives: Evaluate the alignment of

non-financial disclosures with the company's strategic objectives, values, and

stakeholder expectations. Determine whether non-financial reporting provides

meaningful insights into the company's sustainability initiatives and social impact.

7. Communication with Stakeholders: Engage in dialogue with key stakeholders,

including management, board members, and external parties, to gain perspectives

on the relevance and reliability of non-financial information. Address any concerns or

discrepancies identified during the audit process and provide assurance on the

credibility of non-financial disclosures.

Objective Type Question:

Based on the case study, which step is essential for auditors to fulfill their

responsibility for auditing non-financial information?

A) Assessing Management's Processes and Controls

B) Reviewing External Assurance Reports

C) Testing Data Accuracy and Completeness

D) Communication with Stakeholders

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The CPA's role in performing audits is important to our society because: O an audit of financial statements helps investors and others know that they can rely on the information presented in the financial statements. O auditors have the primary responsibility for the information contained in the financial statements. auditors issue reports on the accuracy of each financial transaction. auditors provide direct financial advice to potential investors.arrow_forwardAshavinarrow_forwardSteve Ankenbrandt, president of Beeb Corporation, has been discussing the company’s internal operations with the presidents of several other multidivision companies. Ankenbrandt discovered that most of them have an internal audit staff. The activities of the staffs at other companies include financial audits, operational audits, and sometimes compliance audits. Required: Describe the meaning of the following terms as they relate to the internal auditing function: a. Financial auditing. b. Operational auditing. c. Compliance auditing.arrow_forward

- Management should address written representations about a firm's annual audit to the: 1. Shareholders 2. Auditor 3. Board of directors. 4. Firm's attorneys. O 1 O 2 O 3 4.arrow_forwardHow can an auditor use the following topic in his future work? Evaluate financial decision-making to ensure compliance with accounting standards, rules, and regulations. Apply Generally Accepted Accounting Principles (GAAP) to record financial information. Analyze financial statements to inform current business decision-making and draw conclusions about the financial health of a company. Recommend budget planning strategies based on the financial performance of a company.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education