Case 12-7 Accounting for Income Taxes: Different Approaches

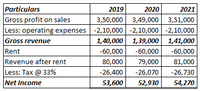

Mark or Make is a bourbon distillery. Sales have been steady for the past three years, and operating costs have remained unchanged. On January 1, 2019, Mark or Make took advantage of a special deal to prepay its rent for three years at a substantial savings. The amount of the prepayment was $60,000. The income statement items (excluding the rent) are shown here.

| 2019 | 2020 | 2021 | |

| Gross profit on sales | 350,000 | 349,000 | 351,000 |

| Operating expense | 210,000 | 210,000 | 210,000 |

Assume that the rental is deducted on the corporate tax purposes in 2019 and that there are no other temporary differences between taxable income and pretax accounting income. In addition, there are no permanent differences between taxable income and pretax accounting income. The corporate tax rate for all three years is 30%.

Required:

- For years 2019 and 2020, Mark or Make reported net income applying the concept of comprehensive interperiod income tax allocation. During 2020, Congress passed a new tax law that will increase the corporate tax rate from 30 to 33%. Reconstruct the income statements for 2020 and 2019 under the following assumptions:

- Mark or Make uses the deferred method to account for interperiod income tax allocation.

- Mark or Make uses the asset–liability approach to account for interperiod income tax allocation.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- 6. During 2019, Reed Corporation sold merchandise for a total of $900,000. The cost of merchandise to Reed was $675,000. Reed offers credit terms of 1/10, n/30 to encourage early payment. At year-end, there are $22,500 of sales still eligible for the 1% discount. Reed believes that all of the companies will pay within the discount period to receive the 1% discount. Assume Reed's fiscal year is December 31. Reed's adjusting journal entry will include: A) A debit to Sales Discounts for $225 B) A credit to Allowance for Sales Discounts for $2,250 C) A debit to Sales Discounts for $2,050 D) A credit to Sales Discounts for $225 E) No adjusting journal entry is required. Discount will be recognized when payment is received.arrow_forwardProblems 1). Record the journal entries for the following current liabilities for Company Z A). Company Z is required by law to collect and remit sales taxes to the state. If $78,000 of cash sales are subject to a 6% sales tax B). Company Z faces a probalble loss on a pending lawsuit where the amount of the loss is estimated to be $500,000. C). Employees earn vacation pay at the rate of one day per month. During the month, 25 employees quality for one vacation day each. Their average daily wage is $100 per day. D). Z company estimates thatt warranty expense will be 4% of sales. The company's sales for the current period are $185,000.. E). Z Company receives $48, 000 cash in advance ticket sales for 12 home games. Record the advance ticket sales on April :30. Record the revenue earned for the first home game played on August 14. "V B. C. D. E.arrow_forwardA-One Mechanics Limited files GST returns monthly, and the GST rate is 5%. The figures in the following table represent the store's GST taxable sales and purchases for which GST is paid for the indicated months of the year. As part of a year-to-date review, determine A-One Mechanics Limited's net GST remittance and if they owe the government money or are entitled to a refund. The GST remittance is a(n) refund (Round to the nearest cent as needed.) of $ Month January February March April May Purchases Sales $ 158,114 $374,089 494,764 775,165 107,357 317,760 56,475 246,957 300,302 586,444arrow_forward

- i need the answer quicklyarrow_forwardAt the end of 2022, the following information is available for Great Adventures. Additional interest for five months needs to be accrued on the $32,200, 6% loan obtained on August 1, 2021. Recall that annual interest is paid each July 31. Assume that $12,200 of the $32,200 loan discussed above is due next year. By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $27,200 during the year and recorded those as Deferred Revenue. Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes the likelihood of payment occurring is probable, and the estimated amount to be paid is $14,200. For sales of MU watches, Great Adventures offers a warranty against defect for one year. At the end of the year, the company estimates future warranty costs to be $6,200. No Date General Journal Debit Credit 1 Dec 31 Interest Expense 805 Interest Payable 805…arrow_forwardValley Spa purchased $11,200 in plumbing components from Tubman Co. Valley Spa Studios signed a 90-day, 7% promissory note for $11,200. If the note is dishonored, what is the amount due on the note? (Use 360 days a year.)arrow_forward

- 3....new. //// Metlock Inc. was incorporated in 2019 to operate as a computer software service firm, with an accounting fiscal year ending August 31. Metlock’s primary product is a sophisticated online inventory-control system; its customers pay a fixed fee plus a usage charge for using the system.Metlock has leased a large, Alpha-3 computer system from the manufacturer. The lease calls for a monthly rental of $44,000 for the 144 months (12 years) of the lease term. The estimated useful life of the computer is 15 years.All rentals are payable on the first day of the month beginning with August 1, 2020, the date the computer was installed and the lease agreement was signed. The lease is non-cancelable for its 12-year term, and it is secured only by the manufacturer’s chattel lien on the Alpha-3 system.This lease is to be accounted for as a finance lease by Metlock, and it will be amortized by the straight-line method. Borrowed funds for this type of transaction would cost…arrow_forward7,please answer the following question, thanksarrow_forwardPlease explain proper steps by Step and Do Not Give Solution In Image Format ? And Fast Answering Please ?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education