FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

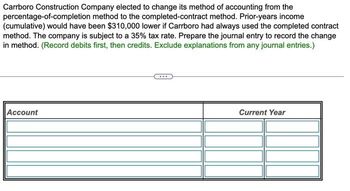

Transcribed Image Text:Carrboro Construction Company elected to change its method of accounting from the

percentage-of-completion method to the completed-contract method. Prior-years income

(cumulative) would have been $310,000 lower if Carrboro had always used the completed contract

method. The company is subject to a 35% tax rate. Prepare the journal entry to record the change

in method. (Record debits first, then credits. Exclude explanations from any journal entries.)

Account

Current Year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the beginning of 2021, Pitman Co. had pretax financial income of $1,200,000. Additionally, there was a timing difference of $300,000 due to an accounts receivable that will not be collected until the following year. The tax rate us 30%. A. Calculate the total taxable income for 2021. B. Calculate Income tax expense, income tax payable, and the deferred amount for 2021, and create the journal entry.arrow_forwardPierce Corp. has a December 31 year end. It received its property tax invoice of $33,000 for the calendar year on April 30. The invoice is payable on June 30. Prepare the journal entries to record the property tax on (a) April 30, (b) June 30, and (c) December 31, assuming the company adjusts its accounts annually. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Round answers to O decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit eTextbook and Mediaarrow_forwardLewes Company appropriately uses the installment sales method for tax purposes and the accrual method for revenue recognition for accounting purposes. Pertinent data at December 31, 2016, the close of the first year of operations, are as follows: Revenue Recognized Revenue Recognized Customer for Accounting Purposes for Tax Purposes Lowe's Builders $200,000 $100,000 Top Down Plumbing 500,000 350,000 Glass Plus Windows 600,000 350,000 Lewes's tax rate is 30%. What amount should be included in the deferred tax account at December 31, 2016 for these installment sales?arrow_forward

- ABD Company pays a weekly payroll of $285,000 that includes federal taxes withheld of $38,100, FICA taxes withheld of $23,670, and 401(k) withholdings of $27,000. (Although not required, preparing journal entries may help you answer questions 1A- What is the effect of assets from the transaction(s)? TWO ANSWERS REQUIRED - (Increase or decrease and $ how much) 1B- What is the effect of liabilities from the transaction(s)? TWO ANSWERS REQUIRED - (Increase or decrease and $ how much)arrow_forward! Required information [The following information applies to the questions displayed below.] At year-end December 31, Chan Company estimates its bad debts as 0.30% of its annual credit sales of $812,000. Chan records its bad debts expense for that estimate. On the following February 1, Chan decides that the $406 account of P. Park is uncollectible and writes it off as a bad debt. On June 5, Park unexpectedly pays the amount previously written off. Determine the impact of the December 31, February 1, and June 5 transactions on the accounting equation. For each transaction, indicate whether there would be an increase, decrease, or no effect, for Assets, Liabilities, and Equity. Note: Leave no cells blank. December 31 February 1 June 5 Assets Liabilities Equityarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- On March 1, the Applewood Corporation wanted to purchase a $475,000 piece of equipment, but Applewood was only able to furnish $161,500 of its own cash to purchase the equipment. Applewood borrowed the remainder of the $475,000 from the People’s National Bank on a 2-year, 5.5% note. Required: If the company keeps its records on a calendar year, what adjusting entry should Applewood make on December 31? If an amount box does not require an entry, leave it blank. When required, round your answers to the nearest dollar. Dec. 31 fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 (Record accrued interest expense)arrow_forwardCurrent Attempt in Progress Swifty Wholesalers Ltd. has a December 31 year end. The company incurred the following transactions related to current liabilities: 1. Swifty's cash register showed the following totals at the end of the day on March 17: pre-tax sales $55,000, GST $2,750, and PST $3,850. 2. 3. Swifty remitted $49,000 of sales taxes owing from March to the government on April 30. Swifty paid its employees for the week of August 15 on August 20. The gross pay was $80,000. The company deducted $4,240 for CPP, $1,264 for El, $6,400 for pension, and $16,020 for income tax from the employees' pay. 4. Swifty recorded the employer portions of CPP and El for the week of August 15 on August 20 for $4,240 and $1,770, respectively. 5. On September 15, all amounts owing for employee income taxes, CPP, and El pertaining to the payroll transactions above were paid. 6. On December 31, Swifty's legal counsel believes that the company will have to pay damages of $62,000 next year to a local…arrow_forwardIn December of 2019, a company received consulting services of $100,000. No entry was recorded for these service in 2019. The invoice for the services was received in January 2020 and recorded by debiting consulting expense and crediting accounts payable. This error was discovered in 2020 and was determined to be a material error. What is the impact of the error on the net income of 2019 and 2020? Provide the proper correcting journal enntry assuming a 30% tax rate.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education