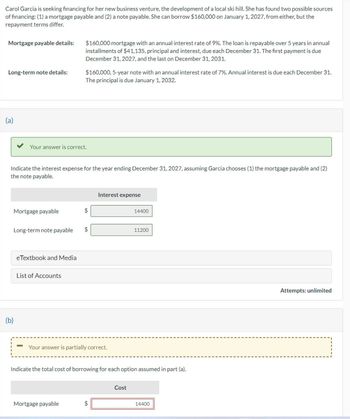

Carol Garcia is seeking financing for her new business venture, the development of a local ski hill. She has found two possible sources of financing: (1) a mortgage payable and (2) a note payable. She can borrow $160,000 on January 1,2027 , from either, but the repayment terms differ. Mortgage payable details: ,$160,000 mortgage with an annual interest rate of 9%. The loan is repayable over 5 years in annual installments of $41,135, principal and interest, due each December 31 . The first payment is due December 31, 2027, and the last on December 31, 2031. Long-term note details: ,$160,000,5-year note with an annual interest rate of 7%. Annual interest is due each December 31 . The principal is due January 1, 2032. (a) Your answer is correct. Indicate the interest expense for the year ending December 31, 2027, assuming Garcia chooses (1) the mortgage payable and (2) the note payable. eTextbook and Media List of Accounts (b) Your answer is partially correct. Indicate the total cost of borrowing for each option assumed in part (a).

Step by stepSolved in 3 steps

- Discount loan (interest and principal at maturity). Chuck Ponzi has talked an elderly woman into loaning him $10,000 for a new business venture. She has, however, successfully passed a finance class and requires Chuck to sign a binding contract on repayment of the $10,000 with an annual interest rate of 8% over the next 10 years. Determine the cash flow to the woman under a discount loan, in which Ponzi will have a lump-sum payment at the end of the contract. What is the amount of payment that the woman will receive at the end of years 1 through 9? $nothing (Round to the nearest cent.) What is the amount of payment that the woman will receive at the end of the loan in year 10? $nothing (Round to the nearest cent.)arrow_forwardKari is purchasing a home for $260,000. The down payment is 25% and the balance will be financed with a 15 year mortgage at 8% and 3 discount points. Kari made a deposit of $20,000 (applied to the down payment) when the sales contract was signed. Kari also has these expenses: credit report, $70; appraisal fee, $110; title insurance premium, 1% of amount financed; title search, $200; and attorney's fees, $500. Find the closing costs (arrow_forwardKatrina has the option of an 8-year nonsubsidized student loan of $31,000 at an annual interest rate of 2.5% or an 8-year subsidized loan of $31,000 at an annual interest rate of 4.5%. Determine for which loan Katrina will pay less interest over the term of the loan if she starts making payments 2 years after obtaining the loan. (Assume Katrina makes monthly payments for each loan. Round your answers to the nearest cent, as appropriate.) The total interest paid on the nonsubsidized loan is $ , and the total interest paid on the subsidized loan is $ . Therefore, Katrina will pay less interest on thearrow_forward

- Kari is purchasing a home for $220,000. The down payment is 25% and the balance will be financed with a 15 year mortgage at 8% and 3 discount points. Kari made a deposit of $30,000 (applied to the down payment) when the sales contract was signed. Kari also has these expenses: credit report, $70; appraisal fee, $120; title insurance premium, 1% of amount financed; title search, $200; and attorney's fees, $500. Find the closing costs (in $).arrow_forwardI need the answer of the question attached. Please provide all possible answers. Thank you!arrow_forwardDiscount loan (interest and principal at maturity). Chuck Ponzi has talked an elderly woman into loaning him $20,000 for a new business venture. She has, however, successfully passed a finance class and requires Chuck to sign a binding contract on repayment of the $20,000 with an annual interest rate of 11% over the next 5 years. Determine the cash flow to the woman under a discount loan, in which Ponzi will have a lump-sum payment at the end of the contract. What is the amount of payment that the woman will receive at the end of years 1 through 4? $ (Round to the nearest cent.)arrow_forward

- Kari is purchasing a home for $220,000. The down payment is 25% and the balance will be financed with a 15 year mortgage at 8% and 3 discount points. Kari made a deposit of $30,000 (applied to the down payment) when the sales contract was signed. Kari also has these expenses: credit report, $90; appraisal fee, $110; title insurance premium, 1% of amount financed; title search, $300; and attorney's fees, $500. Find the closing costs (in $).arrow_forwardDiscount loan (interest and principal at maturity). Chuck Ponzi has talked an elderly woman into loaning him $45,000 for a new business venture. She has, however, successfully passed a finance class and requires Chuck to sign a binding contract on repayment of the $45,000 with an annual interest rate of 11% over the next 5 years. Determine the cash flow to the woman under a discount loan, in which Ponzi will have a lump-sum payment at the end of the contract. What is the amount of payment that the woman will receive at the end of years 1 through 4? $nothing (Round to the nearest cent.)arrow_forwardKari is purchasing a home for $220,000. The down payment is 25% and the balance will be financed with a 15 year mortgage at 8% and 4 discount points. Kari made a deposit of $20,000 (applied to the down payment) when the sales contract was signed. Kari also has these expenses: credit report, $70; appraisal fee, $110; title insurance premium, 1% of amount financed; title search, $200; and attorney's fees, $500. Find the closing costs (in $). $ ____________________arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education