Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

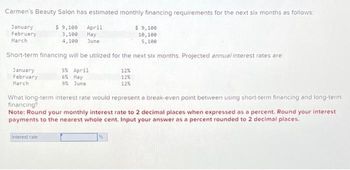

Transcribed Image Text:Carmen's Beauty Salon has estimated monthly financing requirements for the next six months as follows:

$ 9,100 April

January

February

3,100

May

March

4,100 June

$9,100

10,100

5,100

Short-term financing will be utilized for the next six months. Projected annual interest rates are:

January

5% April

12%

6% May

12%

February

March

9% June

12%

What long-term interest rate would represent a break-even point between using short-term financing and long-term

financing?

Note: Round your monthly interest rate to 2 decimal places when expressed as a percent. Round your interest

payments to the nearest whole cent. Input your answer as a percent rounded to 2 decimal places.

Interest rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Nikularrow_forwardYou are considering an investment in a Third World bank account that pays a nominal annual rate of 18%, compounded monthly. If you invest $5,200 at the beginning of each month, how many months would it take for your account to grow to $500,000? Round fractional months up. a. 38 months b. 60 months c. 46 months d. 17 months e. 27 monthsarrow_forward(Loan Amortization Problem) Your company is planning to borrow $2,500,000. This will be a six-year, 2 percent per year, annual payment, fully amortized term loan. The first payment will be made one year from today. What fraction of the total annual payment made at the end of year three will represent repayment of principal? [Hint: you need only complete the first three rows of the amortization schedule to answer this question.] Step By Step please, as if writing down the solution on a sheet of paper.arrow_forward

- You are looking to purchase a Tesla Model X sport utility vehicle. The price of the vehicle is $93,500. You negotiate a six-year loan, with no payments during the first year. After the first year, you will pay $1,300 per month for the following five years, with a ballon payment at the principal on the loan. The APR on the loan with monthly compounding is 5 percent. What will be the amount of the balloon payment six years from now?arrow_forwardBoatler Used Cadillac Co. requires $800,000 in financing over the next two years. The firm can borrow the funds for two years at 9 per cent interest per year. Mr Boatler decides to do forecasting and predicts that if he utilizes short-term financing instead, he will pay 6.75 per cent interest in the first year and 10.55 per cent interest in the second year. a. Determine the total two-year interest cost under each planarrow_forwardA new furniture set costs $ 2700. If you make a down payment of $ 300 and finance the rest at a rate of 7.6% for 18 months, find the monthly payments on your loan. How much will you have paid in interest over the course of the loan? Repayment amount = Interest paid =arrow_forward

- The total purchase price of a new home entertainment system is $14,260. If the down payment is $2300band the balance is to be financed over 72 months at 6% add-on intrest, what is the monthy payment?arrow_forwardPls show complete workings.arrow_forwardScheduled payments of $800 due two months ago and $1200 due in one month are to be repaid by a payment of $1000 today and the balance in three months. What is the amount of the final payment if the simple interest rate is 7.75% p.a and the focal date is one month from now?arrow_forward

- Present value with periodic rates. Cooley Landscaping needs to borrow $25,000 for a new front-end dirt loader. The bank is willing to loan the money at 8% interest for the next 6 years with annual, semiannual, quarterly, or monthly payments. What are the different payments that Cooley Landscaping could choose for these different payment plans? C What is Cooley's payment for the loan at 8% interest for the next 6 years with annual payments? $ (Round to the nearest cent.)arrow_forwardYou would like to take out a $500,000, 3% APR loan. You would like your constant monthly payment not to exceed $2,000, with the first payment one month from now. What should be the minimum length of the loan?" 244 months 393 months forever 458 months 250 monthsarrow_forwardHelp me get the through this problem im stuckarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education