FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

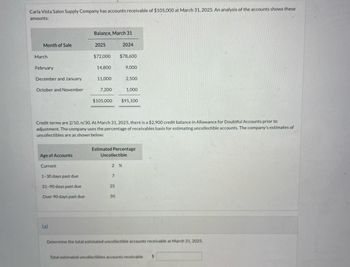

Transcribed Image Text:**Carla Vista Salon Supply Company Accounts Receivable Analysis (March 31, 2025)**

**Accounts Receivable Overview**:

Carla Vista Salon Supply Company reports accounts receivable amounting to $105,000 as of March 31, 2025. The analysis details the balances by the month of sale for both March 31, 2025, and March 31, 2024.

**Balance Analysis**:

| Month of Sale | Balance, March 31, 2025 | Balance, March 31, 2024 |

|----------------------|-------------------------|-------------------------|

| March | $72,000 | $78,600 |

| February | $14,800 | $9,000 |

| December and January | $11,000 | $2,500 |

| October and November | $7,200 | $1,000 |

| **Total** | **$105,000** | **$91,100** |

**Credit Terms**:

Credit terms are stipulated as 2/10, n/30. As of March 31, 2025, the company identifies a $2,900 credit balance in the Allowance for Doubtful Accounts before adjustment.

**Uncollectible Accounts Estimates**:

The company assesses the uncollectible accounts basis using the percentages of receivables:

- **Current accounts**: 2% uncollectible

- **1–30 days past due**: 7% uncollectible

- **31–90 days past due**: 25% uncollectible

- **Over 90 days past due**: 50% uncollectible

**(a) Uncollectible Accounts Receivable Calculation**:

The task is to determine the total estimated uncollectible accounts receivable as of March 31, 2025.

Total estimated uncollectibles accounts receivable:

| **Total Estimated Uncollectibles Accounts Receivable** | $__________________ |

*Note: To calculate this, please apply the respective percentages to the balances categorized by their age and sum the products to find the total estimated uncollectibles.*

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Marx Corporation has accounts receivable of $96,000 at March 31, 2018. An analysis of the accounts shows these amounts. Balance, March 31 Month of Sale 2018 2017 March (current) $65,900 $76,200 February (1 – 30 days past due) 12,900 7,900 December and January (31 – 90 days past due) 10,100 2,100 (over 90 days past due) 7,100 1,200 $96,000 $87,400 Credit terms are 2/10, n/30. At March 31, 2018, there is an unadjusted $2,300 credit balance in Allowance for Doubtful Accounts. The company uses the percentage of receivables by age category for estimating uncollectible accounts Marx’s estimates of bad debts are as shown below. Age of Accounts Estimated PercentageUncollectible Current 3% 1–30 days past due 6% 31–90 days past due 30% Over 90 days past due 50% Prepare the adjusting entry at March 31, 2018, to record bad debts expense.arrow_forwardTyla's bakery estimates the allowance for uncollectible accounts at 1% of the ending balance of accounts receivable. During 2024, Tyla's credit sales and collections were $117,000 and $141,000, respectively. What was the balance of accounts receivable on January 1, 2024, if $240 in accounts receivable were written off during 2024 and if the allowance account had a balance of $750 on December 31, 2024? A.) $41,000 B.) $480 C.) $99,240 D.) None of these answer choices are correct.arrow_forwardChez Fred Bakery estimates the allowance for uncollectible accounts at 3% of the ending balance of accounts receivable. During 2021, Chez Fred's credit sales and collections were $ 125,000 and $131,000, respectively. What was the balance of accounts receivable on January 1, 2021, if $180 in accounts receivable were written off during 2021 and if the allowance account had a balance of $750 on December 31, 2021? A) $5,820. B) $31,000. C) $31,180. D) None of these answer choices are correct.arrow_forward

- On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forwardProvide the answer is correct optionarrow_forwardAccounts Receivable Free Company gathered the following information from its accounting records for the year ended December 31, 2019: • Net Credit Sales for the year - P680,000 • Accounts Receivable at December 31 - 92,000 • Allowance for doubtful accounts at December 31 - 1,850arrow_forward

- Luna Company reported the following figures: 2020 2019 Net Credit Sales Account receivables at end of year $572,000 $38,700 $600,000 $46,100 Required: 1) Compute Luna's collection period of receivables for 2020. (Round to the nearest day) 2) Suppose Luna's normal credit terms for a sale on account are "2/10, n/30". How well does Luna's collection period compare to the company's credit terms? Is this good or bad for Luna Company?arrow_forwardDon't give answer in image formatarrow_forwardMillennial Manufacturing has net credit sales for 2018 in the amount of $1,453,630, beginning accounts receivable balance of $587,900, and an ending accounts receivable balance of $623,450. A. Compute the accounts receivable turnover ratio and the number of days' sales in receivables ratio for 2018. Round answers to two decimal places. Accounts receivable turnover ratio fill in the blank 1 times Sales in receivables ratio fill in the blank 2 days B. What do the outcomes tell a potential investor about Millennial Manufacturing if industry average is 2.6 times and number of day’s sales ratio is 180 days? a. Millennial Manufacturing collects its accounts more quickly than its competitors. b. A lender may favour Millennial Manufacturing over its competitors because of its faster collection period. c. Without prior years’ data it is hard to tell if Millennial Manufacturing is really more efficient than its competitors. d. All of the above statements may be correct.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education