FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

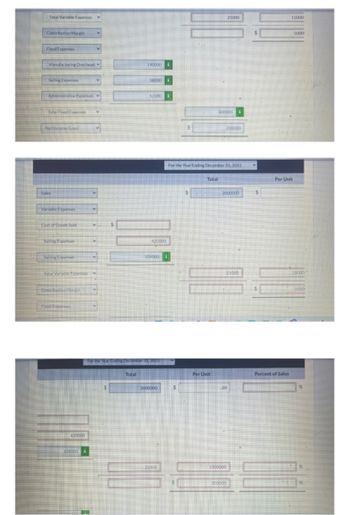

Transcribed Image Text:Total Variable Expenses

Contribution Margin

Fixed Expenses

Manufacturing Overhead

Selling Expenses

Administrative Expenses

Total Fixed Expenses

Net Income Los)

Sales

Variable Expenses

Cost of Goods Sold

Seting Expenses

Selling Expenses

Total Variable Expenses

Contribution Margin

Flied Expenses

420000

109000

Total

190000

50000

52000

420000

109000

31, 2022

2000000

21000

300000

Total

Per Unit

For the Year Ending December 31, 2022

200000

21000

2000000

21000

50

1500000

500000

15000

Per Unit

Percent of Sales

5000

15000

5000

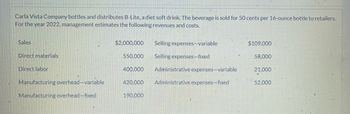

Transcribed Image Text:Carla Vista Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 50 cents per 16-ounce bottle to retailers.

For the year 2022, management estimates the following revenues and costs.

Sales

Direct materials

Direct labor

Manufacturing overhead-variable

Manufacturing overhead-fixed

$2,000,000

550,000

400,000

420,000

190.000

Selling expenses-variable

Selling expenses-fixed

Administrative expenses-variable

Administrative expenses-fixed

$109,000

58,000

21,000

52.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shaw Company produces and sells two packaged products—Z-Bikes and y Bikes. Revenue and cost information relating to the products follow: Product Z Bikes Y Bikes Selling price per unit $ 175.00 $ 200.00 Variable expenses per unit $ 85.00 $ 105.00 Traceable fixed expenses per year $ 200,000 $ 75.00 Common fixed expenses in the company total $110 annually. Last year the company produced and sold 50,000 units of Z Bikes and 30,000 units of Y Bikes. Required: Prepare a contribution format income statement segmented by product lines.arrow_forwardCompany Y produces and sells two packaged products Weedban and Greengrow Revenue and cost information related to the products follows: Weedban Greengrow SALES price per unit $9.00 $ 31.00 Variable expense per unit $2.90 $14.00 Traceable fixed expense per year $131,000 $44,000 Last year the company produced and sold 38,500 units of weed ban and 17,000 of Green grow. It's annual common fixed expenses are $106,000. Prepare a contribution format income statement segmented by-product lines ? Thank you,arrow_forwardPlease help me with show all calculation thankuarrow_forward

- Jorge Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 50 cents per 16-ounce bottle to retailers who charge customers 75 cents per bottle. For the year 2014, management estimates the following revenues and costs: Sales Direct materials Direct labor 1,800,000 425,500 356,300 Manufacturing overhead - variable 311,800 Manufacturing overhead - fixed 288,200 Selling expenses - variable 68,900 Selling expenses - fixed 67,500 Administrative expenses - variable 93,714 63,400 Administrative expenses - fixed Required: Prepare a CVP income statement for 2014 based on manage mental estimates.arrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education