FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Carla Vista Co. has had 4 years of record earnings. Due to this success, the market price of its 470,000 shares of $2 par value common

stock has increased from $15 per share to $54. During this period, paid-in capital remained the same at $2,820,000. Retained earnings

increased from $4,230,000 to $28,200,000. CEO Don Ames is considering either (1) a 15% stock dividend or (2) a 2-for-1 stock split.

He asks you to show the before-and-after effects of each option on (a) retained earnings, (b) total stockholders' equity, and (c) par

value per share.

(a)

1.

Your answer is partially correct.

2.

Stock dividend-retained earnings

$

2-for-1 stock split retained earnings $

24,393,000

28,200,000

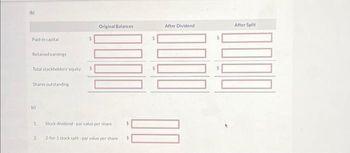

Transcribed Image Text:(b)

Paid-in capital

Retained earnings

Total stockholders' equity

Shares outstanding

(c)

1

2

$

Original Balances

Stock dividend par value per share

2-for-1 stock split-par value per share

$

$

After Dividend

After Split

000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Lohn Corporation is expected to pay the following dividends over the next four years: $14, $10, $9, and $4. Afterward, the company pledges to maintain a constant 3 percent growth rate in dividends forever. If the required return on the stock Is 12 percent, what is the current share price? Multiple Cholce $56.47 $58.51 $60.27 $65.40 $55.59arrow_forwardPanhandle Industries Inc. currently pays an annual common stock dividend of $3.20 per share. The company's dividend has grown steadily over the past 12 years from $1.60 to its present level; this growth trend is expected to continue. The company's present dividend payout ratio, also expected to continue, is 50 percent. In addition, the stock presently sells at 5 times current earnings (that is, its P/E multiple is 5). Panhandle Industries stock has a beta of 1.15, as computed by a leading investment service. The present risk-free rate is 4.0 percent, and the expected return on the stock market is 12.0 percent. Do not round intermediate calculations. Round your answers to the questions below to two decimal places. a. Suppose an individual investor feels that 11 percent is an appropriate required rate of return for the level of risk this investor perceives for Panhandle Industries. Using the dividend capitalization model and the Capital Asset Pricing Model approaches, determine whether…arrow_forwardXYC Corporation has 1,500,000 shares of common stock outstanding. The company directors declared a dividend of Php30,000,000 last year and the investor received Php20. What is the Php20 mentioned in the problem? a. coupon rate b. current yield c. dividend per share d. total dividendarrow_forward

- Balling Limited is a company listed on the NZX. Balling has announced it will make a dividend payment at the end of the year of $1.75 per share. The average annual growth rate in the company’s dividends over the past five years has been 5%. Balling’s shareholders have a required rate of return of 15%p.a. Balling’s shares have been trading very consistently around $20 per share for the past few months and analysts suggest this is likely to continue for the foreseeable future. How can you explain this price based on the constant growth dividend discount model?arrow_forwardAtlantic Northern Inc. just reported a net income of $5,000,000, and its current stock price is $25.75 per share. Atlantic Northern is forecasting an increase of 25% for its net income next year, but it also expects it will have to issue 1,500,000 new shares of stock (raising its shares outstanding from 5,500,000 shares to 7,000,000 shares). If Atlantic Northern's forecast turns out to be correct and its price-to-earnings (P/E) ratio does not change, what does management expect its stock price to be one year from now? $25.18 per share O $25.75 per share O$18.88 per share $31.48 per share One year later, Atlantic Northern Inc.'s stock is trading at $43.50, and the company reports its common equity value as $35,252,000. What is Atlantic Northern Inc.'s market-to-book (M/B) ratio? 8.63x Is it possible for a company to have a negative EPS and thus a negative P/E ratio? Yes varrow_forwardCullumber Company has had 4 years of record earnings. Due to this success, the market price of its 500,000 shares of $2 par value common stock has increased from $14 per share to $53. During this period, paid-in capital remained the same at $3,000,000. Retained earnings increased from $4,500,000 to $30,000,000. CEO Don Ames is considering either (1) a 15% stock dividend or (2) a 2-for-1 stock split. He asks you to show the before-and-after effects of each option on (a) retained earnings, (b) total stockholders' equity, and (c) par value per share. (a) 1. 2. (b) Paid-in capital Stock dividend - retained earnings Retained earnings 2-for-1 stock split - retained earnings (c) Total stockholders' equity $ Shares outstanding 1. 2. $ Stock dividend - par value per share $ Original Balances 2-for-1 stock split - par value per share $ $ $ $ After Dividend $ $ After Splitarrow_forward

- The Athletic Village has done very well the past year, and its stock price is now trading at $80 per share. Management is considering either a 100% stock dividend or a 2-for-1 stock split. Required: Complete the following table comparing the effects of a 100% stock dividend versus a 2-for-1 stock split on the stockholders’ equity accounts, shares outstanding, par value, and share price. (Round "Par value per share" to 3 decimal places.) Before After 100% Stock Dividend After 2-for-1 Stock Split Common stock, $0.01 par value $12 Additional paid-in capital 23,990 Total paid-in capital 24,002 Retained earnings 14,900 Total stockholders' equity $38,902 Shares outstanding 1,200 Par value per share $0.01 Share price $80arrow_forwardNoto Inc. just paid a dividend of $4.6 per share. Dividends are expected to grow at 6%, 5%, and 3% for the next three years respectively. After that the dividends are expected to grow at a constant rate of 2% indefinitely. Stockholders require a return of 9 percent to invest in Noto’s common stock. Compute the value of Noto’s common stock today.arrow_forwardDuring the first quarter of 2015, Plains All American Pipeline L.P. (PAA) stock cost $50 per share and was expected to yield 5% per year in dividends, while Total SA (TOT) stock cost $50 per share and was expected to yield 6% per year in dividends.† If you invested a total of $46,000 in these stocks and expected to earn $2,450 in dividends in a year, how many shares of each stock did you purchase?arrow_forward

- Kelsey Drums, Inc., is a well-established supplier of fine percussion instruments to orchestras all over the United States. The company's class A common stock has paid a dividend of $4.84 per share per year for the last 14 years. Management expects to continue to pay at that amount for the foreseeable future. Kim Arnold purchased 300 shares of Kelsey class A common 5 years ago at a time when the required rate of return for the stock was 8.3%. She wants to sell her shares today. The current required rate of return for the stock is 5.30%. How much total capital gain or loss will Kim have on her shares? 1. The value of the stock when Kim purchased it was $____per share. (Round to the nearest cent.) 2.The value of the stock if Kim sells her shares today is $_______ per share. (Round to the nearest cent.) 3. The total capital gain (or loss) Kim will have on her shares is $_______. (Round to the nearest dollar. Enter a positive number for a capital gain and a negative…arrow_forwardP/E AND STOCK PRICE Ferrell Inc. recently reported net income of $10 million. It has 420,000 shares of common stock, which currently trades at $51 a share. Ferrell continues to expand and anticipates that 1 year from now, its net income will be $14.5 million. Over the next year, it also anticipates issuing an additional 63,000 shares of stock so that 1 year from now it will have 483,000 shares of common stock. Assuming Ferrell's price/earnings ratio remains at its current level, what will be its stock price 1 year from now? Do not round intermediate calculations. Round your answer to the nearest centarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education