Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

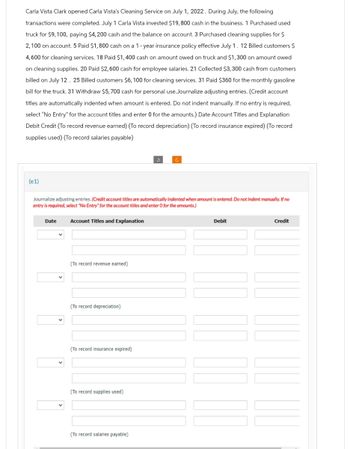

Do not give image format

Transcribed Image Text:Carla Vista Clark opened Carla Vista's Cleaning Service on July 1, 2022. During July, the following

transactions were completed. July 1 Carla Vista invested $19,800 cash in the business. 1 Purchased used

truck for $9, 100, paying $4,200 cash and the balance on account. 3 Purchased cleaning supplies for $

2,100 on account. 5 Paid $1,800 cash on a 1-year insurance policy effective July 1. 12 Billed customers $

4,600 for cleaning services. 18 Paid $1,400 cash on amount owed on truck and $1,300 on amount owed

on cleaning supplies. 20 Paid $2,600 cash for employee salaries. 21 Collected $3,300 cash from customers

billed on July 12. 25 Billed customers $6, 100 for cleaning services. 31 Paid $360 for the monthly gasoline

bill for the truck. 31 Withdraw $5, 700 cash for personal use.Journalize adjusting entries. (Credit account

titles are automatically indented when amount is entered. Do not indent manually. If no entry is required,

select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation

Debit Credit (To record revenue earned) (To record depreciation) (To record insurance expired) (To record

supplies used) (To record salaries payable)

(e1)

Journalize adjusting entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no

entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Date

Account Titles and Explanation

(To record revenue earned)

(To record depreciation)

(To record insurance expired)

(To record supplies used)

(To record salaries payable)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.arrow_forwardInner Resources Company started its business on April 1, 2019. The following transactions occurred during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $8,500 from their personal account to the business account. B. Paid rent $650 with check #101. C. Initiated a petty cash fund $550 check #102. D. Received $750 cash for services rendered. E. Purchased office supplies for $180 with check #103. F. Purchased computer equipment $8,500, paid $1,600 with check #104 and will pay the remainder in 30 days. G. Received $1,200 cash for services rendered. H. Paid wages $560, check #105. I. Petty cash reimbursement office supplies $200, Maintenance Expense $140, Miscellaneous Expense $65. Cash on Hand $93. Check #106. J. Increased Petty Cash by $100, check #107.arrow_forwardLavender Company started its business on April 1, 2019. The following are the transactions that happened during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $7,500 from their personal account to the business account. B. Paid rent $600 with check #101. C. Initiated a petty cash fund $250 check #102. D. Received $350 cash for services rendered. E. Purchased office supplies for $125 with check #103. F. Purchased computer equipment $1,500, paid $500 with check #104, and will pay the remainder in 30 days. G. Received $750 cash for services rendered. H. Paid wages $375, check #105. I. Petty cash reimbursement Office Supplies $50, Maintenance Expense $80, Miscellaneous Expense $60. Cash on hand $8. Check #106. J. Increased Petty Cash by $70, check #107.arrow_forward

- Collection of Amounts Previously Written Off Hannah purchased a laptop computer from Perry Corp. for $1,500. Hannahs receivable has been outstanding for over 180 days, and Perry determines that the total amount is uncollectible and writes off all of Hannahs debt. Hannah later receives a windfall and pays the amount of her balance to Perry Corp. Required: Make the appropriate journal entries (if any) to record the receipt of $450 by Perry Corp.arrow_forwardDomingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.arrow_forwardNatalie opened Natalie Washing co. on July 1, 2022. During July, the following transactions were completed. July 1 Owner invests $12,000 cash to start the business. July 3 Purchased used truck for $8,000, paying $2,000 cash and signing a 1-year, 10% note for the remainder. July 5 Purchased clening supplies for $900 on account. July10 Paid $1800 cash on a 1-year insurnace policy effective July 1 July 12 Billed customers $3700 fore cleaning services performed. July 15 Paid $500 on amount owed on cleaning supplies. July 16 Received $2500 for serviced to be performed evenly from July 16 through September 15. July 22 Paid $2000 for employee salaries. July 29 July 30 July 31 Collected $1600 cash from customers billed on July 12. Paid $290 for maintenance of the truck during month. Owner withdrew $600 from the business for personal expenses. Requirements: 1) Make a tabular analysis of the transactions on accounting equation. Use the following column headings: cash, Supplies, accounts…arrow_forward

- journal entryarrow_forwardMike Greenberg opened Cheyenne Window Washing Co. on July 1, 2020. During July, the following transactions were completed. July 1 Owner invested $9,800 cash in the company. 1 Purchased used truck for $6,560, paying $1,640 cash and the balance on account. 3 Purchased cleaning supplies for $740 on account. 5 Paid $1,440 cash on a 1-year insurance policy effective July 1. 12 Billed customers $3,030 for cleaning services performed. 18 Paid $820 cash on amount owed on truck and $410 on amount owed on cleaning supplies. 20 Paid $1,640 cash for employee salaries. 21 Collected $1,310 cash from customers billed on July 12. 25 Billed customers $2,050 for cleaning services performed. 31 Paid $240 for maintenance of the truck during month. 31 Owner withdrew $490 cash from the company. Date Account Titles and Explanation Debit Credit July 1July…arrow_forwardMike Greenberg opened Cheyenne Window Washing Co. on July 1, 2020. During July, the following transactions were completed. July 1 Owner invested $9,800 cash in the company. 1 Purchased used truck for $6,560, paying $1,640 cash and the balance on account. 3 Purchased cleaning supplies for $740 on account. 5 Paid $1,440 cash on a 1-year insurance policy effective July 1. 12 Billed customers $3,030 for cleaning services performed. 18 Paid $820 cash on amount owed on truck and $410 on amount owed on cleaning supplies. 20 Paid $1,640 cash for employee salaries. 21 Collected $1,310 cash from customers billed on July 12. 25 Billed customers $2,050 for cleaning services performed. 31 Paid $240 for maintenance of the truck during month. 31 Owner withdrew $490 cash from the company. List of accounts: Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accumulated…arrow_forward

- Mike Greenberg opened Novak Window Washing Co. on July 1, 2020. During July, the following transactions were completed. July 1 Owner invested $11,300 cash in the company. 1 Purchased used truck for $7,520, paying $1,880 cash and the balance on account. 3 Purchased cleaning supplies for $850 on account. 5 Paid $1,680 cash on a 1-year insurance policy effective July 1. 12 Billed customers $3,480 for cleaning services performed. 18 Paid $940 cash on amount owed on truck and $470 on amount owed on cleaning supplies. 20 Paid $1,880 cash for employee salaries. 21 Collected $1,500 cash from customers billed on July 12. 25 Billed customers $2,350 for cleaning services performed. 31 Paid $270 for maintenance of the truck during month. 31 Owner withdrew $560 cash from the company. Post to the Ledger Accounts. Cash date amount date amount balance Accounts…arrow_forwardMike Greenberg opened Blue Window Washing Co. on July 1, 2020. During July, the following transactions were completed. July Owner invested $ 9,100 cash in the company. 1 Purchased used truck for $ 6,080, paying $ 1,520 cash and the balance on 1 account. 3 Purchased cleaning supplies for $ 680 on account. Paid $ 1,320 cash on a 1-year insurance policy effective July 1. 12 Billed customers $ 2,810 for cleaning services performed. Paid $ 760 cash on amount owed on truck and $ 380 on amount owed on 18 cleaning supplies. 20 Paid $ 1,520 cash for employee salaries. 21 Collected $ 1,220 cash from customers billed on July 12. 25 Billed customers $ 1,900 for cleaning services performed. 31 Paid $ 220 for maintenance of the truck during month. 31 Owner withdrew $ 460 cash from the company.arrow_forwardOriole Clark opened Oriole’s Cleaning Service on July 1, 2020. During July, the following transactions were completed. July 1 Oriole invested $20,200 cash in the business. 1 Purchased used truck for $9,200, paying $4,000 cash and the balance on account. 3 Purchased cleaning supplies for $2,300 on account. 5 Paid $1,680 cash on 1-year insurance policy effective July 1. 12 Billed customers $4,400 for cleaning services. 18 Paid $1,400 cash on amount owed on truck and $1,400 on amount owed on cleaning supplies. 20 Paid $2,500 cash for employee salaries. 21 Collected $3,300 cash from customers billed on July 12. 25 Billed customers $5,900 for cleaning services. 31 Paid $350 for the monthly gasoline bill for the truck. 31 Withdraw $5,700 cash for personal use. Prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on the worksheet and complete the worksheet. (1) Unbilled and uncollected revenue for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning