Database System Concepts

7th Edition

ISBN: 9780078022159

Author: Abraham Silberschatz Professor, Henry F. Korth, S. Sudarshan

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

None

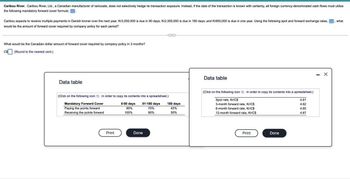

Transcribed Image Text:Caribou River. Caribou River, Ltd., a Canadian manufacturer of raincoats, does not selectively hedge its transaction exposure. Instead, if the date of the transaction is known with certainty, all foreign currency-denominated cash flows must utilize

the following mandatory forward cover formula:

Caribou expects to receive multiple payments in Danish kroner over the next year. Kr3,000,000 is due in 90 days; Kr2,300,000 is due in 180 days; and Kr950,000 is due in one year. Using the following spot and forward exchange rates,

would be the amount of forward cover required by company policy for each period?

what

What would be the Canadian dollar amount of forward cover required by company policy in 3 months?

C$ (Round to the nearest cent.)

Data table

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

(Click on the following icon in order to copy its contents into a spreadsheet.)

Spot rate, Kr/C$

4.61

Mandatory Forward Cover

Paying the points forward

Receiving the points forward

0-90 days

90%

100%

91-180 days

70%

180 days

45%

3-month forward rate, Kr/C$

4.62

90%

50%

6-month forward rate, Kr/C$

12-month forward rate, Kr/CS

4.65

4.67

Print

Done

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

Recommended textbooks for you

Database System ConceptsComputer ScienceISBN:9780078022159Author:Abraham Silberschatz Professor, Henry F. Korth, S. SudarshanPublisher:McGraw-Hill Education

Database System ConceptsComputer ScienceISBN:9780078022159Author:Abraham Silberschatz Professor, Henry F. Korth, S. SudarshanPublisher:McGraw-Hill Education Starting Out with Python (4th Edition)Computer ScienceISBN:9780134444321Author:Tony GaddisPublisher:PEARSON

Starting Out with Python (4th Edition)Computer ScienceISBN:9780134444321Author:Tony GaddisPublisher:PEARSON Digital Fundamentals (11th Edition)Computer ScienceISBN:9780132737968Author:Thomas L. FloydPublisher:PEARSON

Digital Fundamentals (11th Edition)Computer ScienceISBN:9780132737968Author:Thomas L. FloydPublisher:PEARSON C How to Program (8th Edition)Computer ScienceISBN:9780133976892Author:Paul J. Deitel, Harvey DeitelPublisher:PEARSON

C How to Program (8th Edition)Computer ScienceISBN:9780133976892Author:Paul J. Deitel, Harvey DeitelPublisher:PEARSON Database Systems: Design, Implementation, & Manag...Computer ScienceISBN:9781337627900Author:Carlos Coronel, Steven MorrisPublisher:Cengage Learning

Database Systems: Design, Implementation, & Manag...Computer ScienceISBN:9781337627900Author:Carlos Coronel, Steven MorrisPublisher:Cengage Learning Programmable Logic ControllersComputer ScienceISBN:9780073373843Author:Frank D. PetruzellaPublisher:McGraw-Hill Education

Programmable Logic ControllersComputer ScienceISBN:9780073373843Author:Frank D. PetruzellaPublisher:McGraw-Hill Education

Database System Concepts

Computer Science

ISBN:9780078022159

Author:Abraham Silberschatz Professor, Henry F. Korth, S. Sudarshan

Publisher:McGraw-Hill Education

Starting Out with Python (4th Edition)

Computer Science

ISBN:9780134444321

Author:Tony Gaddis

Publisher:PEARSON

Digital Fundamentals (11th Edition)

Computer Science

ISBN:9780132737968

Author:Thomas L. Floyd

Publisher:PEARSON

C How to Program (8th Edition)

Computer Science

ISBN:9780133976892

Author:Paul J. Deitel, Harvey Deitel

Publisher:PEARSON

Database Systems: Design, Implementation, & Manag...

Computer Science

ISBN:9781337627900

Author:Carlos Coronel, Steven Morris

Publisher:Cengage Learning

Programmable Logic Controllers

Computer Science

ISBN:9780073373843

Author:Frank D. Petruzella

Publisher:McGraw-Hill Education