Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Ratio Analysis -Solvency and Leverage Ratios

a. Debit Ratio

b. Equity Ratio

| A. Debt Ratio | Total Liabilities/ Total Assets | |||||

| B. Equity Ratio | Total Equity/Total Assets |

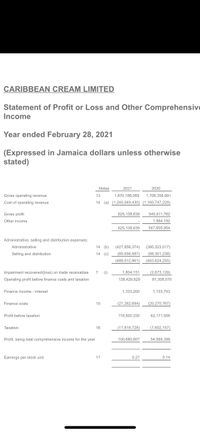

Transcribed Image Text:CARIBBEAN CREAM LIMITED

Statement of Profit or Loss and Other Comprehensive

Income

Year ended February 28, 2021

(Expressed in Jamaica dollars unless otherwise

stated)

Notes

2021

2020

Gross operating revenue

13

1,870,188,069

1,706,358,991

Cost of operating revenue

14 (a) (1,245,049,430) (1,160,747,229)

Gross profit

625,138,639

545,611,762

Other income

1,994,192

625,138,639

547,605,954

Administrative, selling and distribution expenses:

Administrative

14 (b)

(427,856,374)

(395,323,017)

Selling and distribution

14 (c)

(60,656,587)

(68,301,238)

(488,512,961)

(463,624,255)

Impairment recovered/(loss) on trade receivables

7

(i)

1,804,151

(2,673,129)

Operating profit before finance costs and taxation

138,429,829

81,308,570

Finance income - interest

1,333,200

1,133,753

Finance costs

15

(21,262,694)

(20,270,767)

Profit before taxation

118,500,335

62,171,556

Taxation

16

(17,819,728)

(7,602,157)

Profit, being total comprehensive income for the year

100,680,607

54,569,399

Earnings per stock unit

17

0.27

0.14

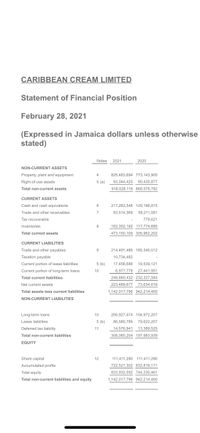

Transcribed Image Text:CARIBBEAN CREAM LIMITED

Statement of Financial Position

February 28, 2021

(Expressed in Jamaica dollars unless otherwise

stated)

Notes

2021

2020

NON-CURRENT ASSETS

Property, plant and equipment

4

825,483,694 773,143,905

Right-of-use assets

5 (a)

93,044,425

95,435,877

Total non-current assets

918,528,119 868,579,782

CURRENT ASSETS

Cash and cash equivalents

6

217,283,548 129,196,815

Trade and other receivables

7

93,514,369

58,211,081

Tax recoverable

779,621

Inventories

162,352,192 117,774,685

Total current assets

473,150,109 305,962,202

CURRENT LIABILITIES

Trade and other payables

214,491,486 185,346,512

Taxation payable

10,734,482

Current portion of lease liabilities

5 (b)

17,456,686

19,539,121

Current portion of long-term loans

10

6,977,778

27,441,951

Total current liabilities

249,660,432 232,327,584

Net current assets

223,489,677

73,634,618

Total assets less current liabilities

1,142,017,796 942,214,400

NON-CURRENT LIABILITIES

Long-term loans

10

206,927,474 104,972,207

Lease liabilities

5 (b)

86,580,789

79,622,207

Deferred tax liability

11

14,576,941

13,389,525

Total non-current liabilities

308,085,204 197,983,939

EQUITY

Share capital

12

111,411,290 111,411,290

Accumulated profits

722,521,302 632,819,171

Total equity

833,932,592 744,230,461

Total non-current liabilities and equity

1,142,017,796 942,214,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Return on equity (ROE) using the traditional DuPont formula equals to A. (net profit margin) (interest component) (solvency ratio) B. (net profit margin) (interest component) (liquidity ratio) C. (net profit margin) (total asset turnover) (quick ratio) D. (net profit margin) (total asset turnover) (solvency ratio)arrow_forward1. Which of the following is referred to as the Accounting Equation? Assets Liabilities + Equity Equity Liabilities + Assets Liabilities Assets + Equity Assets = Liabilities - Equity = 2. Which of the following make up the Finance Equation? (select all that apply) Revenues = Price x Volume Costs = Fixed + Variable Profit Revenues-Costs Income Sales - COGSarrow_forwardWhich of the following is a solvency ratio? a. Times interest earned. b. Inventory turnover ratio. c. Profit margin. d. Price-earnings ratio.arrow_forward

- 12. Which two ratios multiplied by each other equal Return on Total Assets? (A) Profit Margin (B) Return on Equity (C) Current Ratio (D) Price Earnings Ratio (E) Total Asset Turnoverarrow_forwardAccounting: type question:,,,,,, While calculating purchase price, the following values of assets are considered A. Book value B. New values fixed C. Averagevalues D. Market valuesarrow_forward_______ ratios are used to measure the speed in which various assets are converted into sales or cash. A Debt (aka Leverage) B Efficiency (aka working capital) C Profitability C Coveragearrow_forward

- Question: What is the formula for calculating the current ratio? a. Current Assets / Current Liabilitiesb. Current Liabilities / Current Assetsc. Total Assets / Total Liabilitiesd. Total Liabilities / Total Assetsarrow_forwardCurrent assets DIVIDED BY current liabilities is the Current Ratio Net Worth Ratio Working Capitalarrow_forwardWhich of the ratios listed helps to indicate whether current liabilities could be paid without having to sell the inventory? a.Current ratio b.Profit margin c.Quick ratio d.Debt to equityarrow_forward

- Which of the following should be used when calculating the weights for a company's capital structure? OA. Historic accounting values OB.Book values OC. Current market values OD. Par and face valuesarrow_forwardWhich of the following is an asset management ratio? a) Times interest earned b) Leverage c) Inventory turnover d) Current ratioarrow_forwardDefine each of the following terms: a. Liquid asset b. Liquidity ratios: current ratio; quick ratio c. Asset management ratios: inventory turnover ratio d. Debt management ratios: total debt to total capital; times-interest-earned (TIE) ratio e. Profitability ratios: profit margin; return on total assets (ROA); return on common equity (ROE); return on invested capital (ROIC); basic earning power (BEP) ratio f. Market value ratios: price/earnings (P/E) ratio; market/book (M/B) ratio; enterprise value/EBITDA ratioarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education